1/ "at @CoinSharesCo, we use data to inform our perspective of the #bitcoin market"

thanks to @CNBC for having me and @jillruthcarlson on. let me just drop some facts here so we can stop talking about elon & other trivial BS and focus on FACTS

📹👇🏾

cnbc.com/video/2021/05/…

thanks to @CNBC for having me and @jillruthcarlson on. let me just drop some facts here so we can stop talking about elon & other trivial BS and focus on FACTS

📹👇🏾

cnbc.com/video/2021/05/…

2/ over the last few weeks, BTC option skew was relatively bearish.

in #bitcoin, the tail (ie futures / options) wags the dog. this past week, we saw BTC spot prices drift lower, which proved options skews to be right.

TL;DR - traders were bearish

h/t @GenesisVol for data

in #bitcoin, the tail (ie futures / options) wags the dog. this past week, we saw BTC spot prices drift lower, which proved options skews to be right.

TL;DR - traders were bearish

h/t @GenesisVol for data

3/ let's zoom out

in the last five months, bitcoin more than tripled its prior 2017 all time high of 20k, hitting 65k at one point.

ethereum has yet to triple its 2018 all time high of 1400, and is currently trading around 3400

traders are positioned to capture $ETH upside!

in the last five months, bitcoin more than tripled its prior 2017 all time high of 20k, hitting 65k at one point.

ethereum has yet to triple its 2018 all time high of 1400, and is currently trading around 3400

traders are positioned to capture $ETH upside!

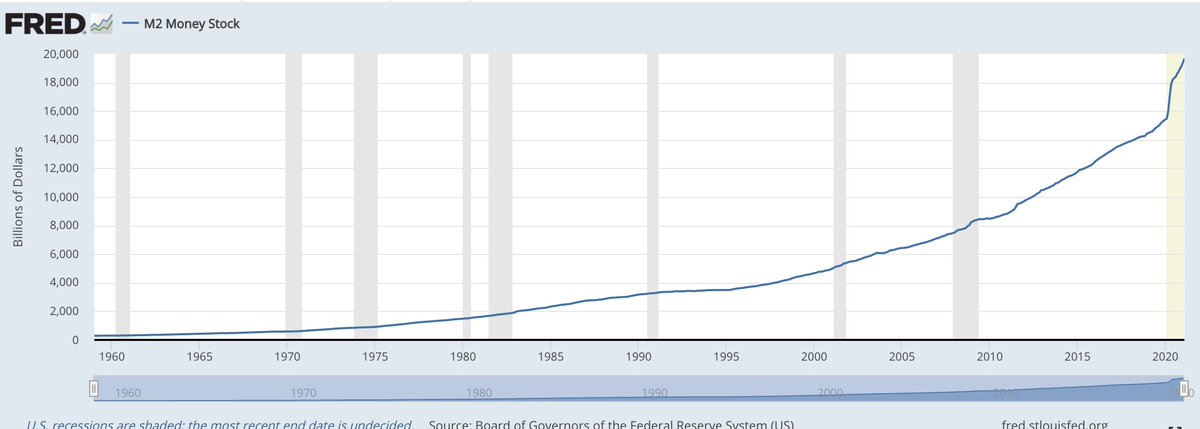

4/ last week's dip had little to do with elon

in equities, scaled back stimulus + latest inflation data caused a brief equities sell-off that likely contributed to crypto's sea of red

with tax day on monday, we always see some selling across markets

in equities, scaled back stimulus + latest inflation data caused a brief equities sell-off that likely contributed to crypto's sea of red

with tax day on monday, we always see some selling across markets

5/ from @CoinSharesCo Fund Flows Report, investors pulled ~$50M from crypto ETPs last week, the redemptions this year

May is the first month ether products traded > volume than bitcoin. Ether ETPs traded $4.1B for the week, versus BTC ETP's at $3.1B

medium.com/coinshares/dig…

May is the first month ether products traded > volume than bitcoin. Ether ETPs traded $4.1B for the week, versus BTC ETP's at $3.1B

medium.com/coinshares/dig…

6/ so who's actually selling? PAPER 🧻 HANDS 👐🏾

h/t @glassnode, as of Monday, 23% of on-chain entities (unique, separate wallets) are holding BTC at a loss

newer market entrants are panic selling and realizing losses

long term term HODLers are stepping in to buy the dip

h/t @glassnode, as of Monday, 23% of on-chain entities (unique, separate wallets) are holding BTC at a loss

newer market entrants are panic selling and realizing losses

long term term HODLers are stepping in to buy the dip

7/ changes in market structure also make retail sell-offs sharper!

remember that retail can now trade crypto and tech stocks on the same platform – @Robinhood @sofi @eToro etc – unlike 2017.

whenever there is a sea of red in equities, fear takes over, people move to “safety”

remember that retail can now trade crypto and tech stocks on the same platform – @Robinhood @sofi @eToro etc – unlike 2017.

whenever there is a sea of red in equities, fear takes over, people move to “safety”

8/ see @binance v @coinbase here, again from @glassnode

binance is the preferred venue for retailand has seen the lions share of trading flow

flows are driven by new market entrants (panic selling) and capital rotation into other crypto-asset (further out on risk spectrum)

binance is the preferred venue for retailand has seen the lions share of trading flow

flows are driven by new market entrants (panic selling) and capital rotation into other crypto-asset (further out on risk spectrum)

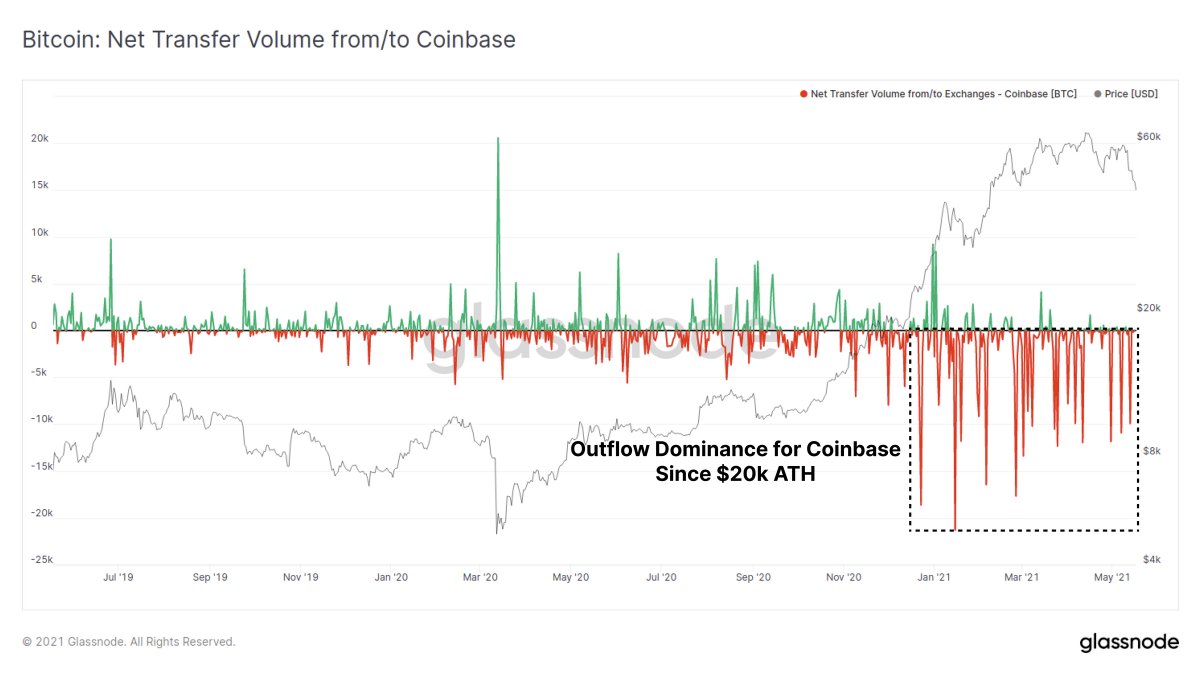

9/ in contrast, @coinbase is the preferred venue for US institutional accumulation

"Coinbase has seen almost entirely net outflows of BTC since breaking $20k ATH, a trend that continued this week"

to understand the market, follow the DATA.

"Coinbase has seen almost entirely net outflows of BTC since breaking $20k ATH, a trend that continued this week"

to understand the market, follow the DATA.

10/ so what's next?

demand for leverage has been low and trader sentiment weak with the fear/greed index hitting a yearly low.

we saw aggressive 40k put buying towards late last week on @DeribitExchange, and funding flipped negative (shorts pay)

but we're about done

demand for leverage has been low and trader sentiment weak with the fear/greed index hitting a yearly low.

we saw aggressive 40k put buying towards late last week on @DeribitExchange, and funding flipped negative (shorts pay)

but we're about done

11/ demand for ETH is somewhat higher on the leverage side, suggesting traders are slightly more bullish with upcoming deflationary upgrades in ETH and emerging narrative that insitutional players looking more closely at DeFi

remember, traders look for VOLATILITY, not direction!

remember, traders look for VOLATILITY, not direction!

12/ alts are getting more attention. from our CoinShares perspective, it feel like it’s @solana summer, and we expect to see the broader SOL ecosystem get a boost.

we'll be judging the upcoming hackathon, excited to share more on our Solana thesis!

solana.com/hackathon

we'll be judging the upcoming hackathon, excited to share more on our Solana thesis!

solana.com/hackathon

• • •

Missing some Tweet in this thread? You can try to

force a refresh