1/ my friends and family in Turkey 🇹🇷 saw their savings drop 15% last week.

inflation may be an abstract concept in the states, but it is painfully real for people in other parts of the world.

thread below 👇 (trigger warning for MMT peeps 😬)

inflation may be an abstract concept in the states, but it is painfully real for people in other parts of the world.

thread below 👇 (trigger warning for MMT peeps 😬)

2/ inflation isn't just a rise in the cost of goods and services. It is the money you worked hard for becoming less valuable.

it is going to be more expensive for Turks to buy bread tomorrow. more importantly, it's going to be more difficult for them to retire.

it is going to be more expensive for Turks to buy bread tomorrow. more importantly, it's going to be more difficult for them to retire.

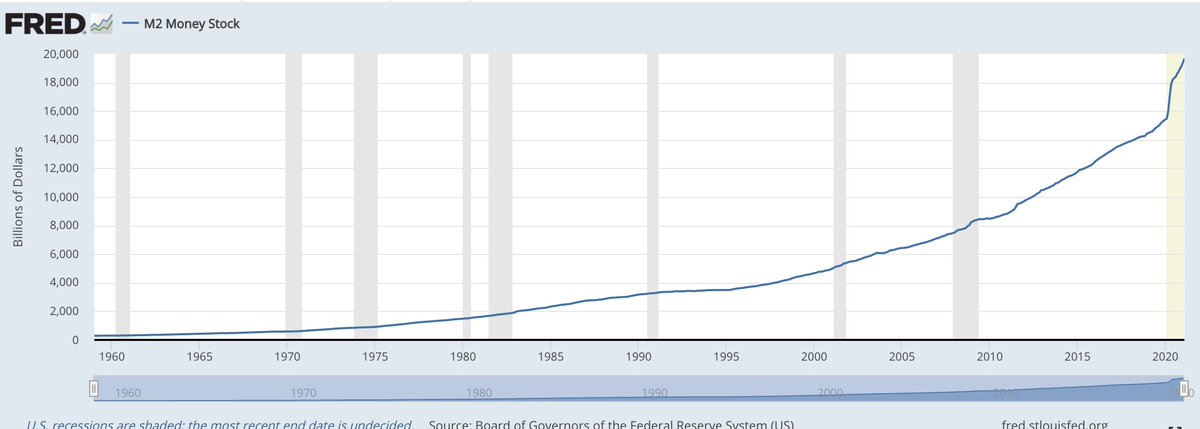

3/ and while it may feel like outside the realm of possibility in the US, the Fed is printing money at historic rates.

before the most recent $1.9 trillion stimulus, M2 money supply had already increased by more than 25%.

but sure, inflation is only 1.4%.

before the most recent $1.9 trillion stimulus, M2 money supply had already increased by more than 25%.

but sure, inflation is only 1.4%.

4/ now the Biden administration is pushing another $3 trillion economic package and Fed Chair Powell said he wants to RAISE inflation ""moderately above"" 2%.

and the "experts" have no idea the impact this is going to have on your savings.

wsj.com/articles/biden…"

and the "experts" have no idea the impact this is going to have on your savings.

wsj.com/articles/biden…"

5/ while there is no way of knowing how many more trillions of dollars The Fed will print over the next several decades, there will never be more than 21,000,000 #bitcoin.

6/ i am passionate about helping build infrastructure that empowers people to choose how they plan for their future.

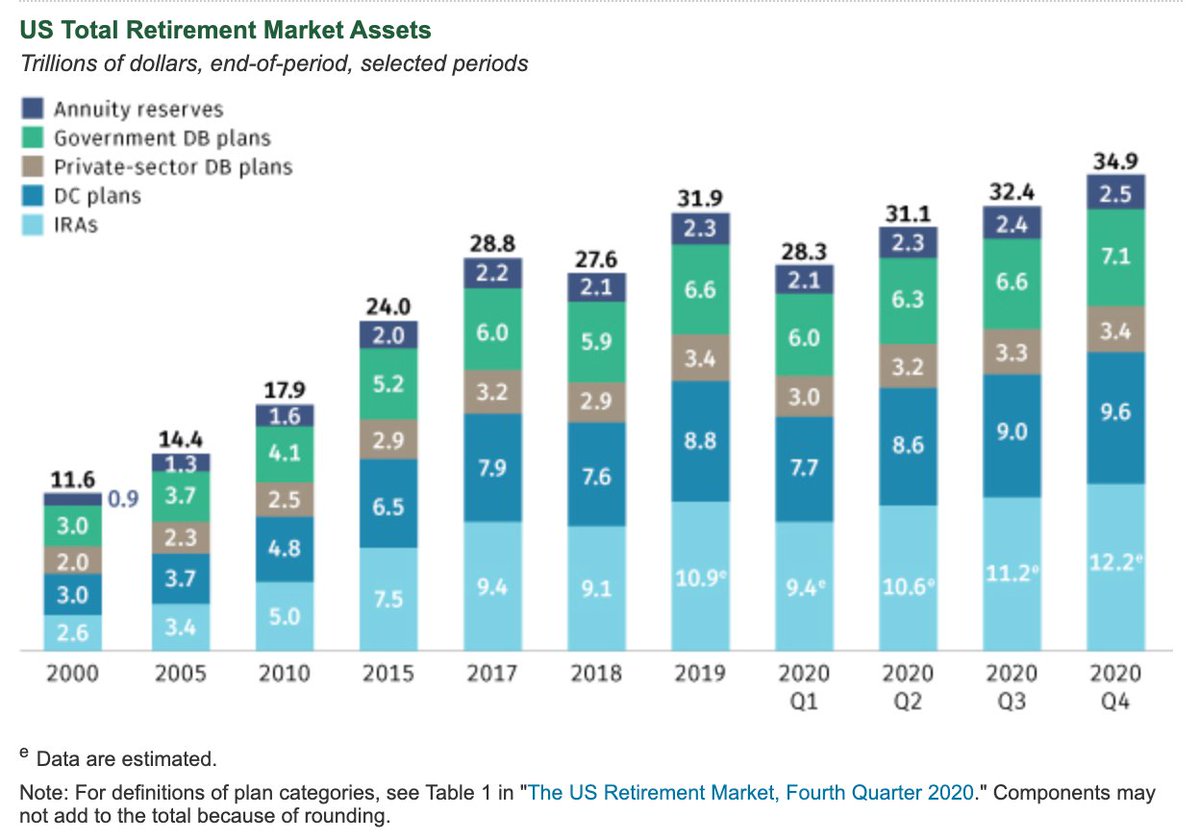

retirement accounts are hold the life savings of millions of people. the $35T in US retirement accounts shouldn't be limited to ETFs or money market funds.

retirement accounts are hold the life savings of millions of people. the $35T in US retirement accounts shouldn't be limited to ETFs or money market funds.

7/ @choicebykt is building a product that makes it easy for everyone to choose how they plan for their future.

you can buy #bitcoin, other crypto, and alternative assets in the same account as legacy assets (stocks, bonds, ETFs, etc.)

you can buy #bitcoin, other crypto, and alternative assets in the same account as legacy assets (stocks, bonds, ETFs, etc.)

8/ while firms like Goldman Sachs are working on offering bitcoin to only their wealthiest clients, Choice is democratizing access for EVERYONE.

they are empowering people from Alabama to Alaska, with balances big or small, to own bitcoin in a tax-advantaged way.

they are empowering people from Alabama to Alaska, with balances big or small, to own bitcoin in a tax-advantaged way.

9/ which is why i'm joining @RyanRadloff & @FitchC as a Kingdom Services Holding Board member to help @choicebykt grow.

follow along and watch us slay zombie retirement accounts and build our generation's Charles Schwab 🧟♀️

retirewithchoice.com/?utm_medium=so…

follow along and watch us slay zombie retirement accounts and build our generation's Charles Schwab 🧟♀️

retirewithchoice.com/?utm_medium=so…

10/ to summarize:

a) inflation is real, despite what the CPI says.

b) there is no knowing how many more trillions of dollars The Fed will print, but only 21M bitcoin

c) bitcoin is for EVERYONE

d) @choicebykt is building the future of retirement accounts

a) inflation is real, despite what the CPI says.

b) there is no knowing how many more trillions of dollars The Fed will print, but only 21M bitcoin

c) bitcoin is for EVERYONE

d) @choicebykt is building the future of retirement accounts

• • •

Missing some Tweet in this thread? You can try to

force a refresh