1/ USD stablecoins will soon hit $100B in market cap, and make up 4% of the crypto market

let's take a closer look

despite making up only 64% of the stablecoin market, tether dominates daily trading volume, with >90% of daily traded volume

let's take a closer look

despite making up only 64% of the stablecoin market, tether dominates daily trading volume, with >90% of daily traded volume

2/ this chart tells a very clear story.

rumors of tether's demise are overstated. it is *the* dominant trade pair, which drives its staggering daily turnover.

bUSD is the only close competitor, b/c its @binance's preferred trade pair that they push to millions of traders.

rumors of tether's demise are overstated. it is *the* dominant trade pair, which drives its staggering daily turnover.

bUSD is the only close competitor, b/c its @binance's preferred trade pair that they push to millions of traders.

3/ while market cap is an impressive number, its a poor measure of adoption.

the number that we should be focused on is daily traded volume and velocity, which is driven by the integration of stables into market structure via trade pairs.

this is *utility*

the number that we should be focused on is daily traded volume and velocity, which is driven by the integration of stables into market structure via trade pairs.

this is *utility*

4/ for USDC, UST (missed in my chart sorry), and LUSD, the metric is probably TVL - total value locked - since these stables are primarily used to provide liquidity and yield farm.

but according to @defipulse, even here, USDT still dominates, with 48% of stablecoin TVL

👀👀👀

but according to @defipulse, even here, USDT still dominates, with 48% of stablecoin TVL

👀👀👀

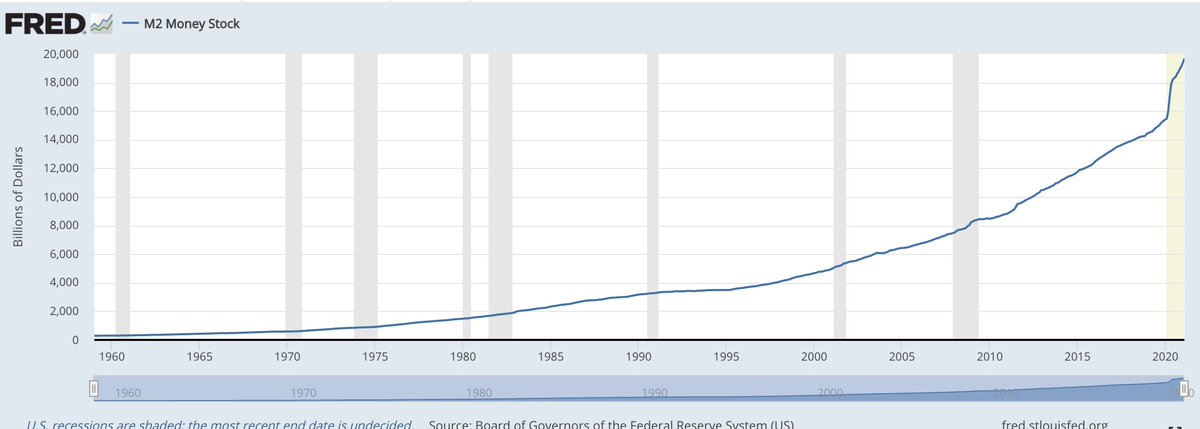

5/ the stables story is fascinating to me, because a whole-ass banking system is being built on-chain and it's pretty amazing to see the numbers.

tether has more deposits than all but the top 5% of US banks.

that's f*ing crazy.

tether has more deposits than all but the top 5% of US banks.

that's f*ing crazy.

6/ disclosure: i'm an investor in @LiquityProtocol which issues LUSD.

sources: i used @coingecko and @MessariCrypto for data, and only looked at stables in the top 100. i missed UST because not enough coffee, mi scusi.

sources: i used @coingecko and @MessariCrypto for data, and only looked at stables in the top 100. i missed UST because not enough coffee, mi scusi.

• • •

Missing some Tweet in this thread? You can try to

force a refresh