1/n To understand if $35k #Bitcoin makes any sense, you need to 'zoom out' first. First of all, we've never had $500 million+ buy orders executed in a couple of days. Not to mention an S&P500 company using it as reserves. Grayscale GBTC captured huge inflows, while gold ETF bled

2/n Keep in mind, USD fiat had bottomed vs global currencies (DXY) to a 3y low. However, as vaccination grew and companies such as $NFLX reported subpar numbers as life returned to normal, there was less reason to bet on some catastrophic event

3/n By April S&P had fully recovered, breaking 4.000 and real estate prices boomed as well. Just as BTC reached $60k, Janet Yellen and Chistine Lagarde both started citing the need for crypto regulation due to illegal activities. Kraken CEO alerted the "crackdown" on April 12

4/n Just 2 days later, Coinbase went public. Somehow ppl were expecting a $120bn+ valuation, and it traded at $70bn even as BTC reached $65k. To make things worse, the Gamestop effect spilled to crypto at exact date, as XRP peaked @ $1.97 and DOGE @ $0.45

5/n The 'perfect storm' for altcoins was formed as the leader BTC signaled weakness down to $50k. Meanwhile DeFi TVL surpassed $100 billion as institutional players understood that they could finally 'dominate' some crypto-sector. However, 2 risks were ignored due to the euphoria

6/n Firstly, Tether-NYAG May-19 deadline to present detailed reserves, and more importantly, SEC's chair Gensler first public hearing on May 6 recommending Congress to regulate crypto exchanges. That was exactly what short sellers needed to make a kill.

7/n All-out-war declared by governments & a fixed-date that could trigger some catastrophic event... Tether deadline. The 27% futures basis (premium) indicated excessive leverage from buyers. All they had to do was spread some FUD and coordinate an attack to liquidate longs.

8/n The April-15 hashrate's 23% drop due to the coal mine accident in China created room for the whole energy discussion that happened to trigger... Elon Musk/Tesla. A Binance investigation FUD was also planted on May-13. The final strike involved China, twice....

9/n China financial institutions 'ban' FUD on May-18, followed by the mining 'crackdown' FUD on May-21. No real 'news', no real 'action'... just plain FUD. Mining stuff came out Friday @ 1am on China, some minutes from a Financial Stability Committee. No doubt a coordinated FUD.

10/n Levered longs got wipped out completely, and Bitcoin tanked twice below $35k. Heavy volume traded, and 'coincidently' almost every exchange had large bids @ $30k marking the bottom. If you compare with ANY other similar situation, a 4% - 8% price difference was expected.

11/n This screams 'coordinated move'. However, assuming smart money bought the dip is not enough. Were they previously short? Well, someone shorted 10k BTC at Bitfinex on May-17. However, some other large players such as Alameda bought it, and will likely HODL.

12/n Most likely, the spot mkt sellers were hedge funds that bought all the way from $40k to $65k. They were not used, or not really expecting such volatility. Those guys build $100million+ positions, and selling those during a -10% day causes cascading liquidations

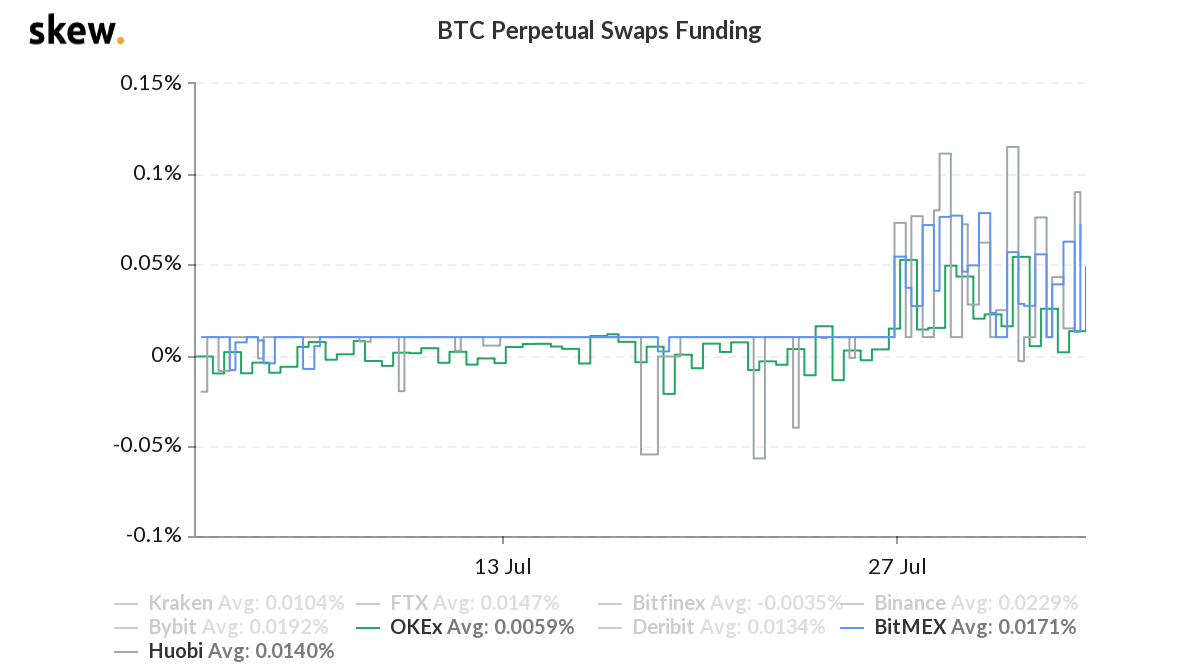

13/n The negative perpetual (inverse swap) funding rate is a clear sign that the correction has 'exhausted' itself. Bulls are in pain, but in time they will regain confidence. Whales accumulated enough sub-$35k and will 'defend' such level.

14/n Unfort, no one can predict how long we gonna drift between $35k and $45k. However, once bulls regain trust, nothing can stop them. No one wants to 'short' below $50k or $55k, not after such a huge 'flush' that liquidated almost every leveraged long.

15/n Having said that, build positions slowly from $35k to $38k. Leave bids at $32k just in case. #Bitcoin survived this stress test very well. It's just FUD, nothing concrete. Who cares about exchanges' regulation? Let them burn in hell. Regulation might bring the U.S. ETF.

16/n Stop being so afraid. We revised prices from 3 or 4 months ago. So what? Inflation in under way. They have nowhere to hide. S&P, real estate, commodities at all-time high. Fixed income paying negative interest. They'll eventually have to seek protection.

17/17 There's NOTHING out there like #Bitcoin. They'll learn #Ethereum and #BCash problems the hard way. Let them burn themselves. They'll end up paying $100k+ for $BTC. Just stack sats. We're good.

• • •

Missing some Tweet in this thread? You can try to

force a refresh