#Garware #HiTechFilms Search this company on twitter, all you see is news of @LuckyInvest_AK Ashish sir investing in it. This thread adds some fundamental research about this company, to demystify it. If you like the thread, please retweet so max investors can gain the knowledge

Primary business of GHTF is manufacturing polyester (PET) films. These are transparent plastic films used for a variety of purposes. Packaging of items. The tint you see on windows (not in India, but abroad) is a PET film. The tint you see on buildings (yes, in India); PET Film.

Not all polyester films were made equal though. The basic PET film is a commodity. Primary use is packaging. There are 11 manufacturers in India. Most PET manufacturers are thus commodity producers. Not GHTF though.

76% (& increasing) of GHTF’s business is into value-added PET films. It is the largest exporter of PET films in India. GHTF’s products find applications in auto, real estate, electronics and FMCG industries.

They also claim to be the only fully vertically integrated producer of PET films in the world. RM is crude oil derivatives for them, not PET, coz they make their own PET (Polyethylene Terephthalate).

Company has 2 main segments: Industrial Product Division (end use: insulation of electrical equipment is one example, packaging is another), Consumer Product Division (window tint, paint protection film). All of CPD is value-added, some of IPD is value-added.

As an aside, you might be thinking, this company is an ESG investor’s nightmare with all that plastic (Carbon) it produces. That is not the case. They consume more carbon than they produce, net carbon negative.

The IPD segment is the uninteresting one because it is not growing that fast, has some commodity elements and the company has a large market share already in some sub-segments. Eg: Shrink films, used in electronics & FMCG, company has 80-90% market share.

The CPD segment.

Sun Window films is the traditional product they made. The tint we see in our car glasses is this. People install this to protect against UV rays and to reduce the amount of light inside cars. Only banned in India and 2 other countries.

Sun Window films is the traditional product they made. The tint we see in our car glasses is this. People install this to protect against UV rays and to reduce the amount of light inside cars. Only banned in India and 2 other countries.

It is mandatory in some countries. Global Market is 4500cr. In this FY on annual run rate basis the company did roughly 500cr. Only manufacturer in India. Only 2 manufacturers in world. Sells under 3 brands: Global (In US, Europe), Garware (In India), Sun control films.

Huge potential to acquire market share. 3rd largest brand in the USA and Europe. Have 70% market share in India (small market).

Global has grown from 31cr in 2011 to 195cr in 2020. US and Europe are also high margin markets for them. It is small transformations like these that are underlying co’s 10 yr journey of no topline growth but margin improvements.

Other reasons:

Co has consciously focussed on margin improvement, stopped loss making products, loss making markets. Reduced commodity as % of revenues. Window films were banned in India in 2012 by SC. Was a 75cr biz. In FY20, took a 45 day shutdown to upgrade 2 of 5 lines.

Co has consciously focussed on margin improvement, stopped loss making products, loss making markets. Reduced commodity as % of revenues. Window films were banned in India in 2012 by SC. Was a 75cr biz. In FY20, took a 45 day shutdown to upgrade 2 of 5 lines.

Back to CPD. The 2nd exciting division is: Paint Protection Films. Only manufacturer in India. Entire car is covered with a transparent film. Protects cars against bugs, small rocks,scratch, dirt. Film is self healing.

Through complete in-house R&D co made this completely independently. 4500cr market. 0 sales today. Co targeting 300cr revenues in FY23. 30% margins. Already done 60cr capex, will do 60 more in FY22. Co doesn’t give credit to distributors. Look at the (unit economics) ROCE. Wow

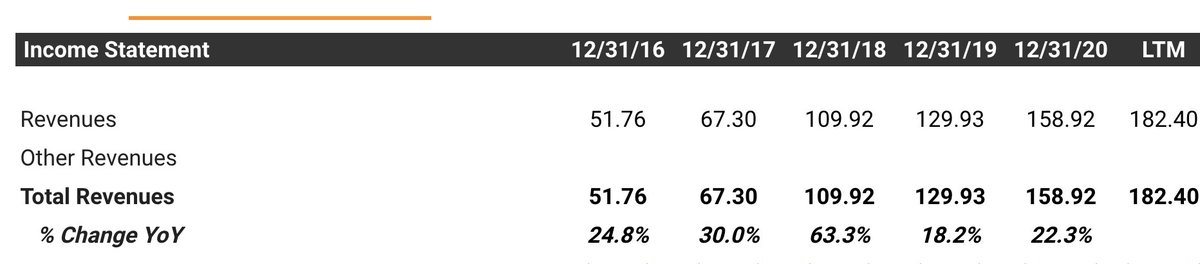

Having covered the business. Let’s cover the financials. As I alluded to before, co has not grown topline in the last 10 or so years. However, what has grown are the co’s margins (both gross and operating).

This is due to better product mix (remember the pic about increasing contribution of value-added) and better market mix (focus on US and Europe where margins are higher). After a decade of no top line growth, co has now started doing concalls and guided for 1500cr revenue in FY23

There is profitability guidance too but they have already exceeded that. Will provide new guidance in Q4 results. Co has planned 120cr capex for the PPF line. Will do additional capex over and above to achieve 1500cr revenue guidance.

Let’s look at unit economics (ROCE).

Optically it will seem low. This is because co has a huge land bank in Maharashtra. Estimates range from 400cr to 1000 cr about the current market value of the land.

Optically it will seem low. This is because co has a huge land bank in Maharashtra. Estimates range from 400cr to 1000 cr about the current market value of the land.

Many analysts have requested management to dispose of the land and do share buybacks. Management has said they would consider it.

Management had re-evaluated this land in FY17 due to IND-AS requirements. 650cr was added. If we subtract this from fixed assets, we get 630cr.

Management had re-evaluated this land in FY17 due to IND-AS requirements. 650cr was added. If we subtract this from fixed assets, we get 630cr.

The Working Capital is 70cr. Works out to Capital Deployed of 700cr. TTM EBIT is 198cr. Let’s also exclude the other income of 12cr to get operating EBIT of 186cr. This works out to ROCE of 26%. Not bad at all.

Let’s talk about industry tailwinds. Most dangerous competitor for GHTF is XPEL. XPEL product revenues grew by 89% in Q1CY21. PPF revenues grew by 81%. Very positive commentary from management for Q2 and 2021. This is due to pent up demand for cars in US.

So there are definitely short-term tailwinds for GHTF. Longer term, they would have to gain market share to grow.

Lets talk about competitive advantages.

GHTF has invested in R&D through which they have developed technology enabling them to manufacture Sun films and PPF. Competitors did not. See the pic for how they make Sun films and tell me its a commodity producer.

GHTF has invested in R&D through which they have developed technology enabling them to manufacture Sun films and PPF. Competitors did not. See the pic for how they make Sun films and tell me its a commodity producer.

They also plan to ramp up R&D spends. Currently do not disclose how much they spend. Many new products in the pipeline. This is a company which is looking to add value.

Lets talk about corporate governance.

Many companies meet with analysts privately. But how many post minutes of the meeting to BSE? I have not seen any. This one did. bseindia.com/xml-data/corpf…

Many companies meet with analysts privately. But how many post minutes of the meeting to BSE? I have not seen any. This one did. bseindia.com/xml-data/corpf…

One line in specific from this filing really reinforced this corporate governance standard for me: In response to a question about maintenance capex

“Mr. Mehta replied that the company hasn’t publicly disclosed the number”.

“Mr. Mehta replied that the company hasn’t publicly disclosed the number”.

Valuations:

Land, valued at 400-1000cr. Some of it might or might not get unlocked. TTM p/e of 17 with improving margins and guidance of sales growth. Almost Monopoly Market share in the domestic market and growing market share in exports

Land, valued at 400-1000cr. Some of it might or might not get unlocked. TTM p/e of 17 with improving margins and guidance of sales growth. Almost Monopoly Market share in the domestic market and growing market share in exports

@CapitalSapling since you are very interested in smallcap dominance, do check out this thread and this company: Garware Hi-tech films.

Have stated the the facts about the valuations. Growth guidance, optional value unlocking, high and improving unit economics and margins. Now everyone must make their own judgement on valuations.

Risks (Most important thing IMO):

1. XPEL has completely changed the game. Is gaining market share very fast. Changed distribution dynamics by making tinters work for it directly (cut off distributors). Building a brand. Can GHTF grow in the face of XPEL?

1. XPEL has completely changed the game. Is gaining market share very fast. Changed distribution dynamics by making tinters work for it directly (cut off distributors). Building a brand. Can GHTF grow in the face of XPEL?

2. It is possible that current price discounts all future business improvements. Everyone must make their own judgement calls about valuations.

4. Current Quarter and year high growth are unlikely to sustain (pent up demand). End user Market is not growing that fast. Can result in derating, unless GHTF can maintain growth momentum.

As a bonus, here are the financials for a few Indian peers of GHTF. Look at how secular the improvement in GHTF gross margins has been, compared to peers. Even XPEL does not have such high gross margins (Xpel's is 34%).

Tagging a new people who might be interested

@soicfinance @AvadhMaheshwar2 @safiranand @SwarnashishC @CapitalSapling

@soicfinance @AvadhMaheshwar2 @safiranand @SwarnashishC @CapitalSapling

Disclaimer: I am invested and positively biased. This is not a buy or sell recommendation, only an attempt to share knowledge with the reader. everyone must make their own buy/sell decisions.

Films similar to sun window films are also used to protect and reduce sun in buildings. Here are few key projects Garware has supplied their films to:

Some big names in there. Shows us the quality of their films.

Some big names in there. Shows us the quality of their films.

• • •

Missing some Tweet in this thread? You can try to

force a refresh