Luis de Guindos, of @ecb, calls for standardised mandatory disclosure to address the problems of greenwashing in ESG products.

https://twitter.com/FrankElderson/status/1397851391922692099

and second, calls for states to promote green finance - but nothing on penalising dirty assets.

Nice to see regulators adopting carbon financiers' favourite narrative, that decarbonisation should be a profit opportunity.

Nice to see regulators adopting carbon financiers' favourite narrative, that decarbonisation should be a profit opportunity.

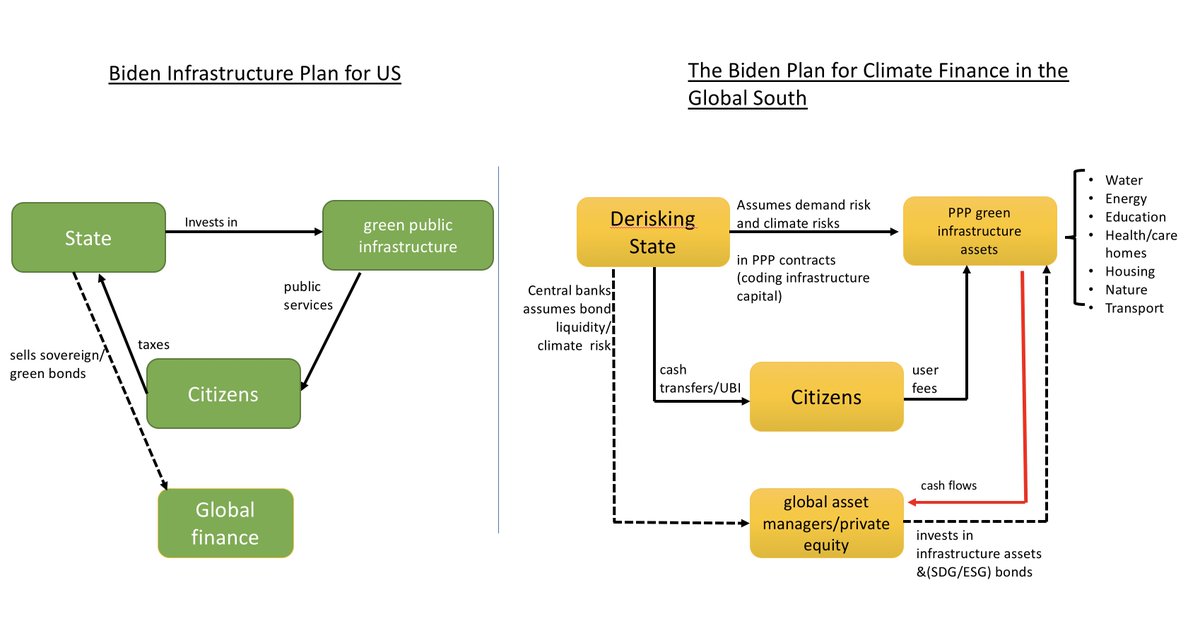

as I argued in the OddLots podcast, we are entering a green macrofinance regime that can be dominated either by private finance, or by the state.

until we see central banks introduce penalties on dirty lending, we remain in Big Finance regime

until we see central banks introduce penalties on dirty lending, we remain in Big Finance regime

https://twitter.com/notjustwilliam/status/1397830154425180160?s=20

fascinating @FrankElderson of ECB notes Big Oil got a serious climate hammering yesterday -

time now for the ECB to follow suit and stop subsidising it via its haircut framework

time now for the ECB to follow suit and stop subsidising it via its haircut framework

https://twitter.com/FinancialTimes/status/1378564814679764994?s=20

MEP @spietikainen feeds my fears that EU Sustainable Finance taxonomy derailed by

a) Member States that want to extend green to dirty activities

b) lack of political will to develop 'dirty taxonomy' - now a no go area though European Council mandated Commission to do so

a) Member States that want to extend green to dirty activities

b) lack of political will to develop 'dirty taxonomy' - now a no go area though European Council mandated Commission to do so

'transition risks' is a Trojan horse for carbon financiers in Big Finance regime -

it frames rules on dirty lending as a 'risk' to finance, often in systemic terms, and thus scares central banks into a toothless emphasis on disclosure of better defined climate risks

it frames rules on dirty lending as a 'risk' to finance, often in systemic terms, and thus scares central banks into a toothless emphasis on disclosure of better defined climate risks

As @FabioTamburrini reminds me, @ecb has been asking a dirty taxonomy, and at this point, should probably be put in charge of developing it so we avoid the pitfalls of the Sustainable one

https://twitter.com/DanielaGabor/status/1270981248077398016?s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh