We see some incredible opportunities in the gold mining sector in the years ahead.

Our newly published 2021 In Gold We Trust report devotes a chapter – Golden Opportunities in Mining – to this topic: bit.ly/3fpQEeT

This thread summarizes some of its key insights.👇

Our newly published 2021 In Gold We Trust report devotes a chapter – Golden Opportunities in Mining – to this topic: bit.ly/3fpQEeT

This thread summarizes some of its key insights.👇

1/ 2020 saw a great improvement in the financial position of gold and silver miners.

In 2020, producers had their most profitable year ever.

The average gold spot price increased to USD 1,770/oz., but average industry AISC – representing the cost of mining – remained flat.👇

In 2020, producers had their most profitable year ever.

The average gold spot price increased to USD 1,770/oz., but average industry AISC – representing the cost of mining – remained flat.👇

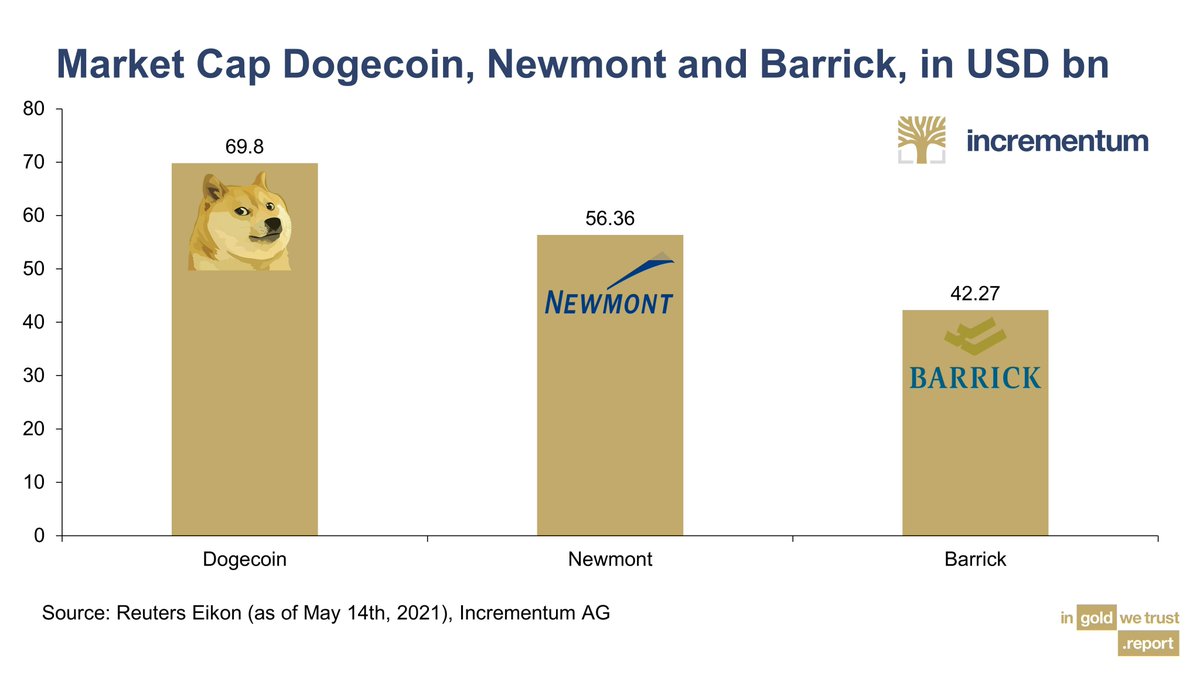

2/ Undervaluations went largely unnoticed as investors focussed on cryptocurrencies, SPACS, Reddit-induced squeezes and FAANG stocks.

We can see this lack of focus in the fact that Dogecoin – a satirical homage to Bitcoin – has a higher mkt cap than some major mining companies.

We can see this lack of focus in the fact that Dogecoin – a satirical homage to Bitcoin – has a higher mkt cap than some major mining companies.

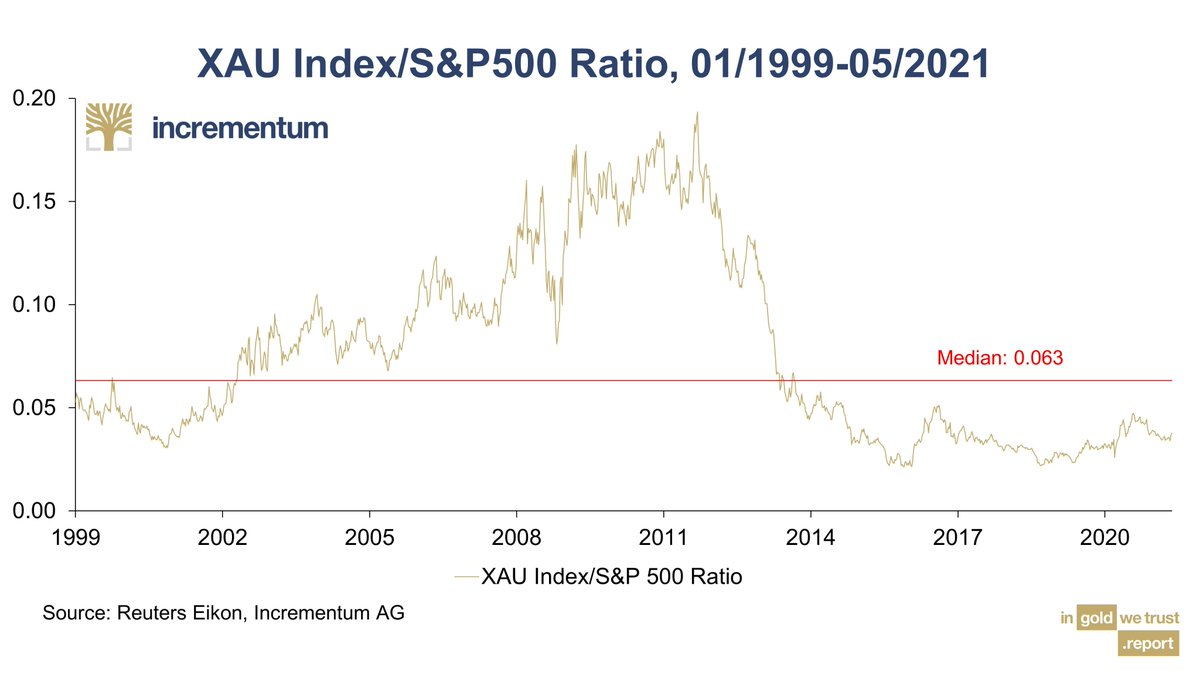

3/ To us, it is clear: the gold and silver mining industry is in the best shape it has been in in a long time.

The chart depicts the performance of mining stocks (the XAU Index) relative to equity markets (S&P 500), illustrating clearly how cheap mining stocks are.

The chart depicts the performance of mining stocks (the XAU Index) relative to equity markets (S&P 500), illustrating clearly how cheap mining stocks are.

4/ From a valuation perspective, the gold mining industry has never been better regarding what you get versus what you pay.

Capitalight Research provides a metric for comparing the S&P and gold mining stocks.

It shows that mining stocks have been undervalued since late 2019.

Capitalight Research provides a metric for comparing the S&P and gold mining stocks.

It shows that mining stocks have been undervalued since late 2019.

5/ Our analysis clearly shows that companies included in the HUI Gold Bugs Index are trading at the lowest Price-to-Cash Flow and Price-to-Earnings ratio multiples in more than 20 years.

The chart below shows the HUI Price-to-Earnings ratio over time.

The chart below shows the HUI Price-to-Earnings ratio over time.

6/ Finally, the HUI to gold ratio indicates that gold stocks are trading one standard deviation below the historical mean: yet another indication that gold mining stocks are undervalued.

7/ No matter how one looks at it, using every valuation tool in the toolbox, it is difficult to argue that gold stocks are not inexpensive.

To find out more, check out the full chapter here: bit.ly/3fpQEeT

Thanks for reading— @RonStoeferle & @MarkValek

To find out more, check out the full chapter here: bit.ly/3fpQEeT

Thanks for reading— @RonStoeferle & @MarkValek

• • •

Missing some Tweet in this thread? You can try to

force a refresh