Our #IGWT 2021 report is out today!

Chapter One gives an overview of #gold in the context of the economic status quo.

How has gold performed? How has it been affected by macroeconomic trends? What are our forecasts?

This thread provides a summary👇

bit.ly/3fpQEeT

Chapter One gives an overview of #gold in the context of the economic status quo.

How has gold performed? How has it been affected by macroeconomic trends? What are our forecasts?

This thread provides a summary👇

bit.ly/3fpQEeT

1/ Over the past 12 months, #gold has reached new all-time highs in almost all currencies.

With a gain of 24.6%, gold’s performance in 2020 was stellar in US dollar terms.

It was weaker in euro terms at 14.3%, but still well into double digits.

With a gain of 24.6%, gold’s performance in 2020 was stellar in US dollar terms.

It was weaker in euro terms at 14.3%, but still well into double digits.

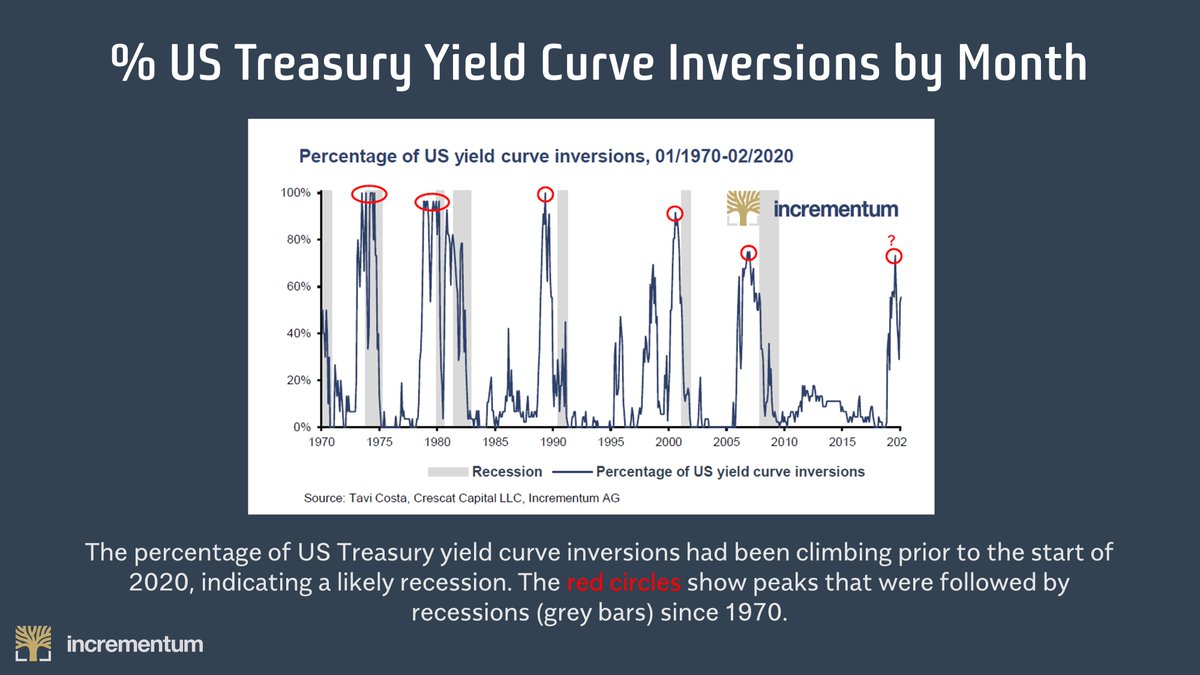

2/ At the same time the global macroeconomic situation has worsened.

The Covid-19 pandemic added about $24trn to the global debt mountain last year.

It has now reached a record level of $281trn, and the global debt-to-GDP ratio now exceeds 355%.

The Covid-19 pandemic added about $24trn to the global debt mountain last year.

It has now reached a record level of $281trn, and the global debt-to-GDP ratio now exceeds 355%.

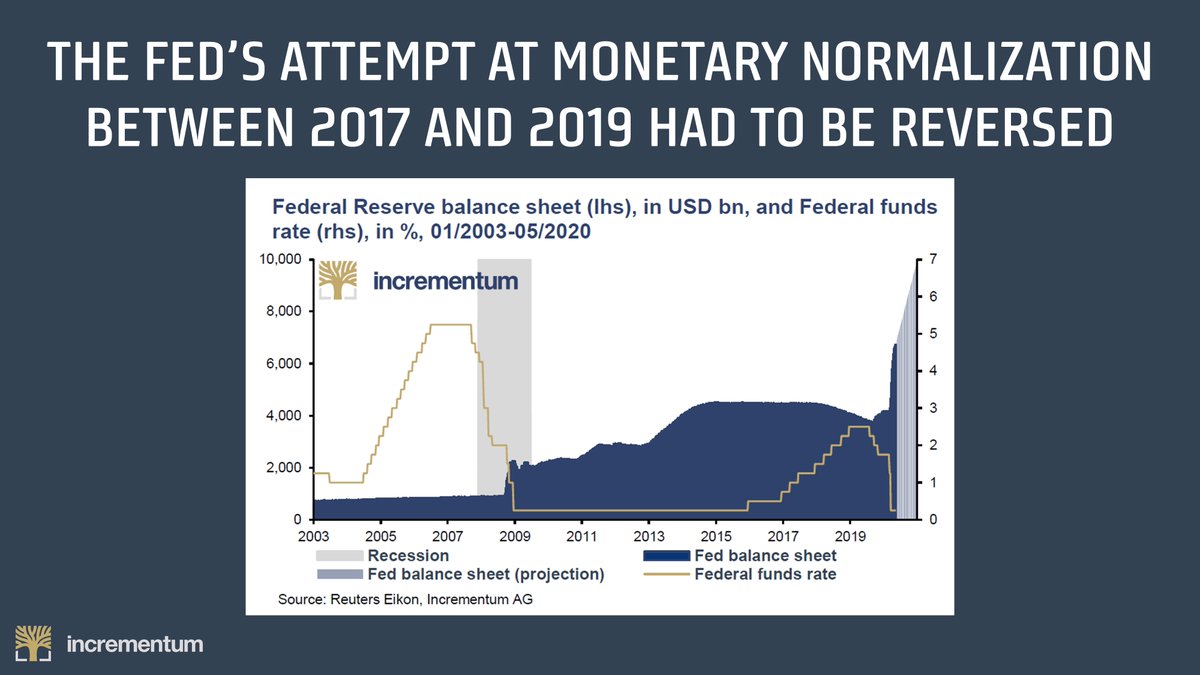

3/ Over the past decade, the actions of central banks have pushed yields on $12.2trn of government bonds into negative territory: an amount approaching the GDP of the entire Eurozone.

For bondholders, inflation is likely to be the pain trade of the decade ahead.

For bondholders, inflation is likely to be the pain trade of the decade ahead.

4/ Fiscal dominance is accelerating the merging of monetary and fiscal policy.

Emblematic of this is the appointment of former Federal Reserve chair Janet Yellen as US Treasury secretary and former ECB President Mario Draghi as Italian prime minister.

Emblematic of this is the appointment of former Federal Reserve chair Janet Yellen as US Treasury secretary and former ECB President Mario Draghi as Italian prime minister.

5/ The political independence of central banks has always been the institutional guarantor of confidence in the stability of the currency.

The closer this liaison between monetary and fiscal policy grows, the greater the likelihood of a loss of confidence.

The closer this liaison between monetary and fiscal policy grows, the greater the likelihood of a loss of confidence.

6/ Over the past year it seems as if the excitement around “digital assets” is being exploited to market central bank digital currencies.

In our view, CBDCs are a wolf in sheep’s clothing, allowing for more authoritarian control over money.

In our view, CBDCs are a wolf in sheep’s clothing, allowing for more authoritarian control over money.

https://twitter.com/IGWTreport/status/1372657142335946756?s=20

7/ Demand for #gold EFTs proved robust last year, despite a period of weakness in Q4.

ETFs recorded record inflows of 877 tonnes, equivalent to a quarter of annual gold production.

As of year-end 2020, ETFs closed at a new record high of 3,751.5 tonnes.

ETFs recorded record inflows of 877 tonnes, equivalent to a quarter of annual gold production.

As of year-end 2020, ETFs closed at a new record high of 3,751.5 tonnes.

8/ We reaffirm our 2020 #IGWT report USD price forecast for #gold at the end of the decade, based on our proprietary price model.

The conservative base scenario, i.e. without any extraordinary inflationary tendencies, results in a price target of $4,800 for gold.

The conservative base scenario, i.e. without any extraordinary inflationary tendencies, results in a price target of $4,800 for gold.

Thank you for reading.

This thread summarizes some insights from our 2021 #IGWT report by @RonStoeferle and @MarkValek.

The report is packed full of insights on developments related to #gold, #silver, #Bitcoin and the macroeconomy.

Check it out here: bit.ly/3fpQEeT

This thread summarizes some insights from our 2021 #IGWT report by @RonStoeferle and @MarkValek.

The report is packed full of insights on developments related to #gold, #silver, #Bitcoin and the macroeconomy.

Check it out here: bit.ly/3fpQEeT

• • •

Missing some Tweet in this thread? You can try to

force a refresh