#PNBHousing #PNB

1/N

Today's announcement abt proposed Caryle led 4K cr investment in the co is against minority shareholders

As a background PNB and Carlyle both owns ~1/3 of the co. and ~10% by GA. (~25% by rest of the public)

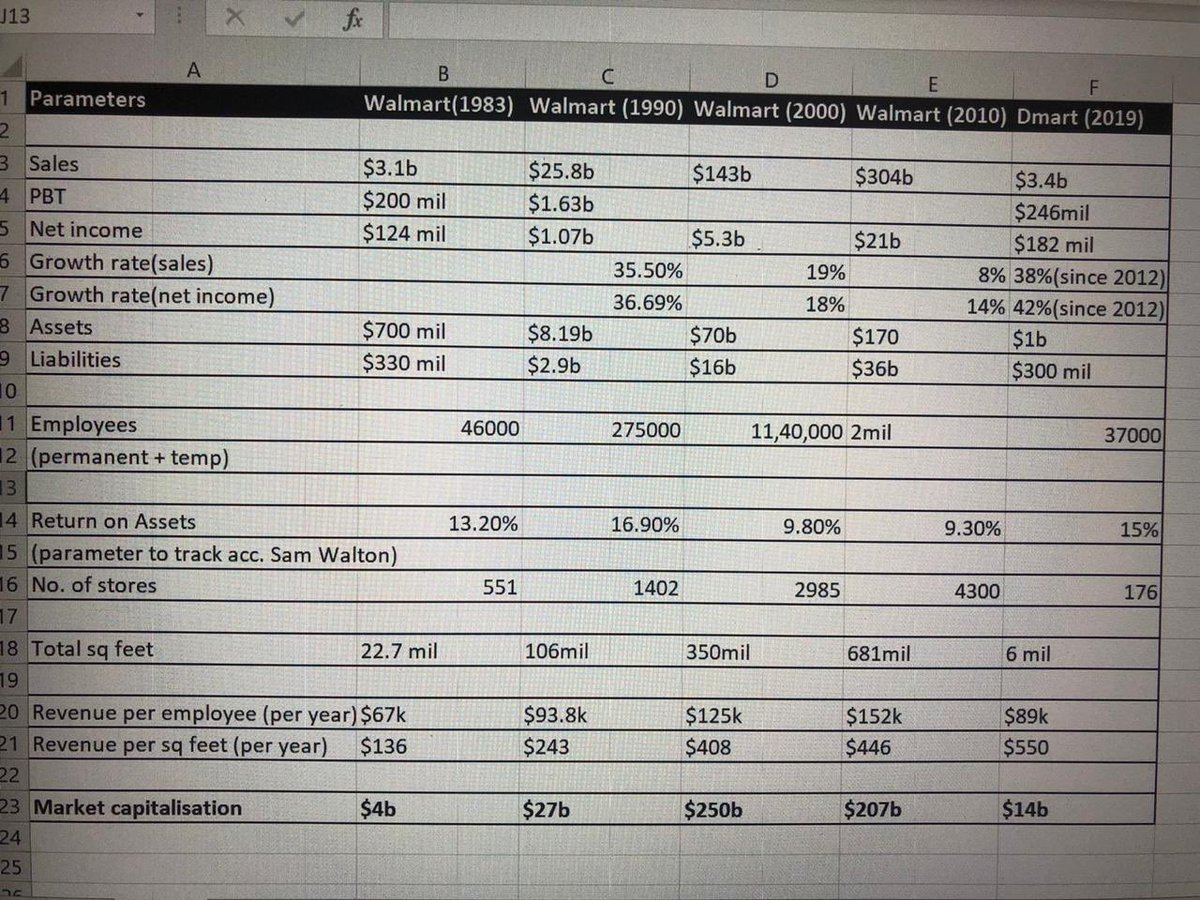

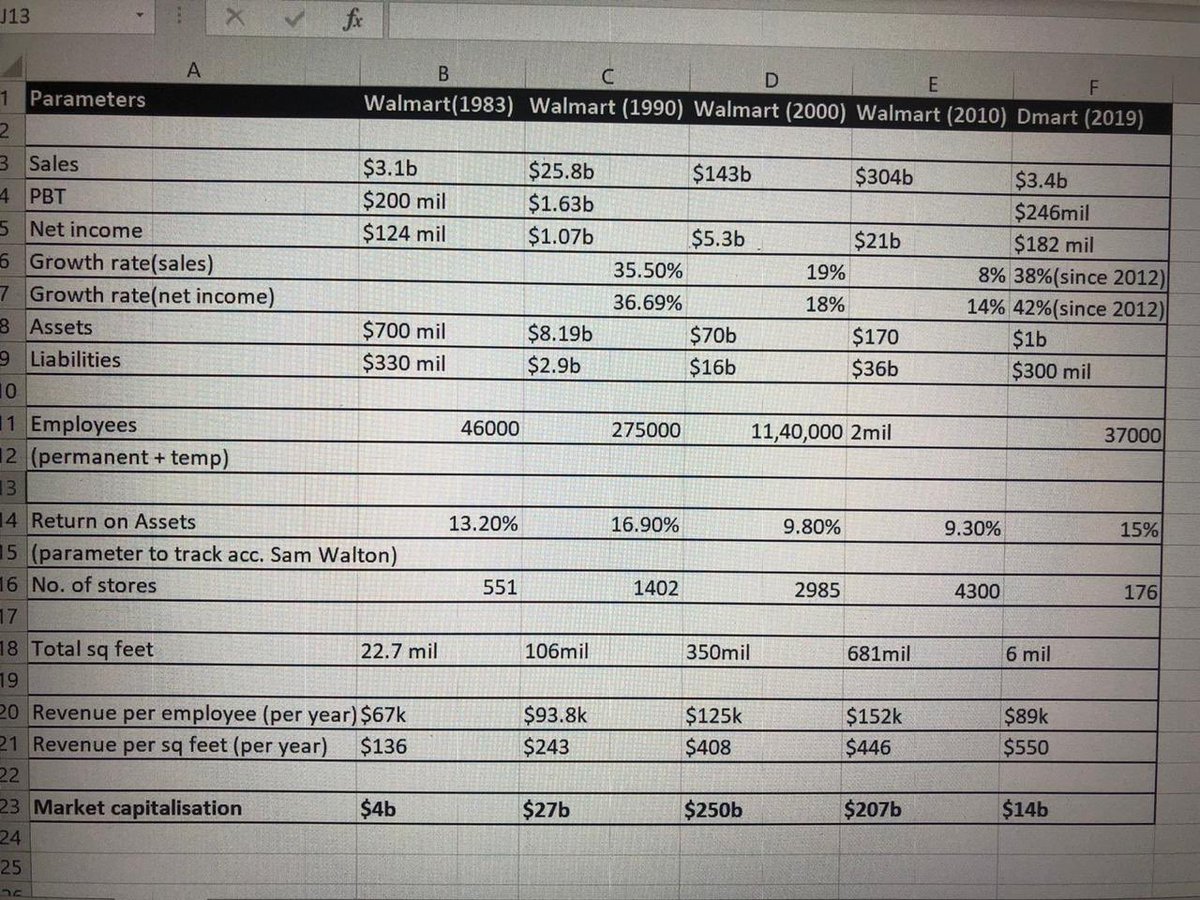

FY21 Results for co

pnbhousing.com/wp-content/upl…

1/N

Today's announcement abt proposed Caryle led 4K cr investment in the co is against minority shareholders

As a background PNB and Carlyle both owns ~1/3 of the co. and ~10% by GA. (~25% by rest of the public)

FY21 Results for co

pnbhousing.com/wp-content/upl…

2/N

Above results and management con call confirmed that there was no extraordinary stress with the co. Infact it was profitable, adequately capitalized (CRAR >20%) and expected only 75bps of credit cost in FY22

Then what was the need for co. to issue 4K crs at 25% discount to BV

Above results and management con call confirmed that there was no extraordinary stress with the co. Infact it was profitable, adequately capitalized (CRAR >20%) and expected only 75bps of credit cost in FY22

Then what was the need for co. to issue 4K crs at 25% discount to BV

3/N

which gives majority control to #Carlyle without the need to pay for control premium at the cost of minority investors

Original plan of 1800 crs rights issue was the right way to raise capital. Even when RBI didn't give approval to PNB, the co decided to pref allotment

which gives majority control to #Carlyle without the need to pay for control premium at the cost of minority investors

Original plan of 1800 crs rights issue was the right way to raise capital. Even when RBI didn't give approval to PNB, the co decided to pref allotment

4/N

This is where things get murkier and doesn't pass the smell test. Instead of raising 1800 crs , co decided to raise 4K crs which will give Carlyle majority control through the back door without paying control premium. Whats worse GA was also allowed to buy at 390-400

This is where things get murkier and doesn't pass the smell test. Instead of raising 1800 crs , co decided to raise 4K crs which will give Carlyle majority control through the back door without paying control premium. Whats worse GA was also allowed to buy at 390-400

So everyone is allowed (except PNB because and RBI) and minority investors. Why didn't co. didn't do rights issue and allowed minority investors to participate?

Why didn't co announce #AdityaPuri joining the board before the capital raise?

Why didn't co announce #AdityaPuri joining the board before the capital raise?

5/N

If they had to do a pref why not restrict it to 1000-1500 crs? Its not that co needs a lot of capital at this point.

Even at 1800crs pref to same investors , price would have zoomed to >600/- They could have done a subsequent raise next year.

If they had to do a pref why not restrict it to 1000-1500 crs? Its not that co needs a lot of capital at this point.

Even at 1800crs pref to same investors , price would have zoomed to >600/- They could have done a subsequent raise next year.

6/N

Assuming price will settle at 600/-,

Carlyle robbed minority investors of ~500Crs. (25% of 4K @ 400 or 1k would have become 1.5K cr at 600/-)

Thankfully #Mahindra Finance and many other firms opted for rights issue

Poor corporate governance!!!!

@contrarianEPS

@dmuthuk

Assuming price will settle at 600/-,

Carlyle robbed minority investors of ~500Crs. (25% of 4K @ 400 or 1k would have become 1.5K cr at 600/-)

Thankfully #Mahindra Finance and many other firms opted for rights issue

Poor corporate governance!!!!

@contrarianEPS

@dmuthuk

• • •

Missing some Tweet in this thread? You can try to

force a refresh