📈Investing through inflation: What to buy? What to avoid?📈

Everyone’s talkin bout it. Dalio, Druck, Buffett. Even ur local lumberjack.

Is exploding inflation a real concern or just another cock-n-bull from 2008 PTSD? And most importantly, how can you win with ur portfolio?

👇

Everyone’s talkin bout it. Dalio, Druck, Buffett. Even ur local lumberjack.

Is exploding inflation a real concern or just another cock-n-bull from 2008 PTSD? And most importantly, how can you win with ur portfolio?

👇

1/ Before diving into the best & worst assets to hold through inflation, let’s take a short but necessary detour to explore the relationship btw inflation, currency devaluation, reserve currency status, & bubbles. For more on this topic, read Ray Dalio’s “Changing World Order.”

2/ Here’s a question to start. What’s similar about: Venezuela 2017-2020, Zimbabwe '06-'08, Turkey '94-'95, Germany '23-'24?

The obvious answer is hyperinflation >100%.

But a 2nd oft-overlooked answer is: in the years leading up to inflation, all 4 currencies devalued by >80%.

The obvious answer is hyperinflation >100%.

But a 2nd oft-overlooked answer is: in the years leading up to inflation, all 4 currencies devalued by >80%.

3/ What causes inflation?

It begins w/ rising fiscal deficit (after a war, pandemic, etc): Gov spent more than it makes. To finance such def, gov issues bonds. Central bank purchases said bonds, raising 💸 supply. Supply shock w/out demand causes cash to plummet vs other assets.

It begins w/ rising fiscal deficit (after a war, pandemic, etc): Gov spent more than it makes. To finance such def, gov issues bonds. Central bank purchases said bonds, raising 💸 supply. Supply shock w/out demand causes cash to plummet vs other assets.

What happens when the secret gets out & even Joe da Plumber knows his dollar today is gonna be less tomorrow?

Investors pile into stocks: equity bubble ensues

Consumers pile into goods: CPI skyrockets

Focus on stocks or focus on goods; either way the inflation beast has awoken.

Investors pile into stocks: equity bubble ensues

Consumers pile into goods: CPI skyrockets

Focus on stocks or focus on goods; either way the inflation beast has awoken.

4/ Why does ZI spiral down hyperinflation while we US 🐒s keep our 🍌s stable?

Back to the earlier statement “supply shock w/out demand causes cash value to 📉.”

The key difference btw USD & ZWL is demand:

Global demand for ZWL is nonexistent

Global demand for USD is insatiable

Back to the earlier statement “supply shock w/out demand causes cash value to 📉.”

The key difference btw USD & ZWL is demand:

Global demand for ZWL is nonexistent

Global demand for USD is insatiable

When the Zimbabwe money printer goes brr, there’s no forex reserves to back up the newly infused cash. Import prices skyrocket. To afford goods, the gov prints even more money, and the self-perpetuating cycle turns inflation to hyperinflation.

Conversely, when the US money printer goes brr, each marginal dollar has a guaranteed sink. USD, as primary reserve currency, makes up >60% of global fx reserves. For the last 50y this status has granted the US a blank check balance sheet to effectively take on infinite leverage.

5/ Who gave the US its infinite balance sheet? The secret handshake between Nixon & the Oil Kings

In 1974, Nixon persuaded OPEC to sell oil exclusively in USD. Result: every nation began hodling $. Exporters ended up w/ $ surpluses which they recycled by buying US investments.

In 1974, Nixon persuaded OPEC to sell oil exclusively in USD. Result: every nation began hodling $. Exporters ended up w/ $ surpluses which they recycled by buying US investments.

This “petrodollar system" was a monumental win for the US. So long as the rest of the world demanded oil, and USD remained pegged to oil, the global trade market would continue to finance America's growing fiscal deficit, all risk-free. That is, until somehow the peg breaks...

6/ The end of petrodollar?

In 2018, China launched yuan-denominated crude-oil futures. Though nowhere comparable to WTI volume, this move was just the beginning of a slippery slope to push USD off its reserve currency throne. Since COVID USD has already devalued 12% against CNY.

In 2018, China launched yuan-denominated crude-oil futures. Though nowhere comparable to WTI volume, this move was just the beginning of a slippery slope to push USD off its reserve currency throne. Since COVID USD has already devalued 12% against CNY.

So what, you ask? Why should I care and how does USD's reserve status affect my personal wealth?

Ray Dalio paints a good picture for you:

Ray Dalio paints a good picture for you:

TLDR: while USD is still #1 reserve, Fed can keep printing, Elon can keep pumping $DOGE, stonks only go up & inflation spooks will continue to last only 2-3 days.

If USD falls off its throne, market dynamics will flip 180. IMO it's time to reallocate ur portfolio.

If USD falls off its throne, market dynamics will flip 180. IMO it's time to reallocate ur portfolio.

7/ What to buy & why?

- Commodities: Dollar and commodity prices are historically anti-correlated. Though the relationship has weakened in recent years (petrodollar depegging), USD is still the benchmark pricing mechanism for most commodities. So, falling dollar = rising crude.

- Commodities: Dollar and commodity prices are historically anti-correlated. Though the relationship has weakened in recent years (petrodollar depegging), USD is still the benchmark pricing mechanism for most commodities. So, falling dollar = rising crude.

- Real Estate: There are 2 reasons to buy real estate through inflation. (a) Rising prices of hard assets should increase the resale value of the property over time. (b) Buy then lease out to capture upside while rental income is rising.

- REITS: alternative option to home-buying

- REITS: alternative option to home-buying

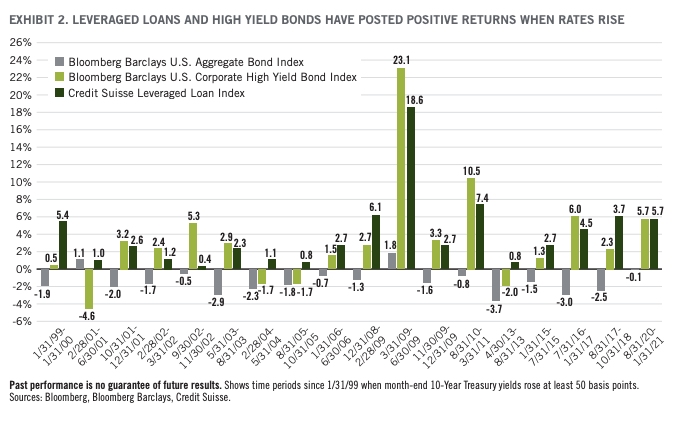

- Leveraged Loans: With inflations on the horizon, the name of the game is to short duration. As a floating rate asset class, lev loans have the least duration risk & are anti-correlated with Treasuries.

(side note: Rising rates means floating notes pay higher coupons vs fixed)

(side note: Rising rates means floating notes pay higher coupons vs fixed)

- Emerging Markets: If you're concerned about the US equities bubble, it makes sense to look @ other geos. But choose carefully. If ur goal is to escape the money printer ghost, London won't help. (Chart below comparing US to UK M2 confirms this.) Better luck investing in Asia.

-TIPS: "treasury inflation protected securities" are pegged to CPI. (when CPI rises, so do TIPS). Direct investment in TIPS can be made through the U.S. Treasury or via a brokerage account. They're also held in some mutual funds and ETFs.

8/ What to avoid and why?

- Cash: goes w/out saying

- Treasuries: All that buzz on 10Y yields wasn't for naught. When rates spike, prices fall. Suddenly ur $100 bond is worth $95, 80... Plus, T-bonds pay fixed interest whereas comparable FRNs will pay higher & higher interest.

- Cash: goes w/out saying

- Treasuries: All that buzz on 10Y yields wasn't for naught. When rates spike, prices fall. Suddenly ur $100 bond is worth $95, 80... Plus, T-bonds pay fixed interest whereas comparable FRNs will pay higher & higher interest.

- Zero-Coupon Bonds: These are the WORST assets to hold through inflation (basically like hodling cash). Why? Because ZCBs have longest duration, i.e. highest sensitivity to rate changes.

Imagine a $90 ZCB expiring in 1y. Given inflation the $100 face value may only be $80 today.

Imagine a $90 ZCB expiring in 1y. Given inflation the $100 face value may only be $80 today.

9/ And finally what about Bitcoin? Is it an inflation hedge?

I believe in crypto. I believe in DeFi. I believe in long-term digital stores of value. HODL! But is BTC an inflation hedge? God no

"But there's a limited supply!" Ya, of BTC. But there's also Doge, SHIB, CUMROCKET...

I believe in crypto. I believe in DeFi. I believe in long-term digital stores of value. HODL! But is BTC an inflation hedge? God no

"But there's a limited supply!" Ya, of BTC. But there's also Doge, SHIB, CUMROCKET...

10/ The end. Happy Memorial Day Weekend to my friends in the US! I hope you're contentedly inebriated, not worrying about inflation. Happy workday Monday to everyone else!

• • •

Missing some Tweet in this thread? You can try to

force a refresh