0/ In today’s Delphi Daily, $ETH gas prices reach pre-DeFi summer levels, utilization rates in DeFi markets remain high, and implied volatility of $BTC options have fallen.

👇👇👇

delphidigital.io/reports/delphi…

👇👇👇

delphidigital.io/reports/delphi…

1/ Market Update-

🔹Crypto markets enjoy bounce across the board.

🔹 @coinbase’s announced its 4% rewards card can be spent through Apple Pay and Google Pay

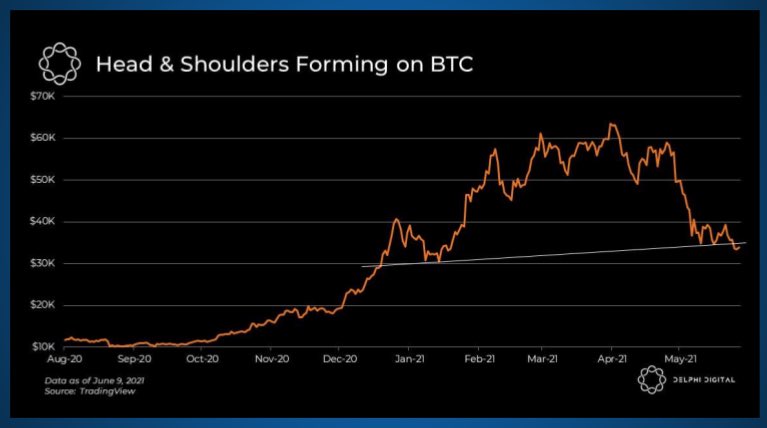

🔹Next few weeks of price action are likely to be choppy, but early data suggests volatility may be culled for now.

🔹Crypto markets enjoy bounce across the board.

🔹 @coinbase’s announced its 4% rewards card can be spent through Apple Pay and Google Pay

🔹Next few weeks of price action are likely to be choppy, but early data suggests volatility may be culled for now.

2/ Implied volatility for various durations of BTC options have fallen over the past week, indicating cheaper options across the board (good for buyers, bad for sellers).

Implied volatility, as the name suggests, is not a measure of actual volatility.

Implied volatility, as the name suggests, is not a measure of actual volatility.

3/ Gas prices have tanked to pre-DeFi summer levels, which signals lower demand for Ethereum blockspace.

Low gas prices are potential indicator of lower incoming volatility.

While not perfect, ETH volatility and gas prices tend to trend in the same direction for the most part.

Low gas prices are potential indicator of lower incoming volatility.

While not perfect, ETH volatility and gas prices tend to trend in the same direction for the most part.

4/ Despite the sell-off in DeFi tokens, utilization rates in DeFi native money markets are still quite high.

It’s worth noting TVL in @AaveAave is back to pre-crash levels, while @compoundfinance and @MakerDAO are still far below ATHs.

It’s worth noting TVL in @AaveAave is back to pre-crash levels, while @compoundfinance and @MakerDAO are still far below ATHs.

5/ Valuation methodology is a murky topic in DeFi, but using a rough proxy of network value to monetizable value (market cap/total assets locked), all three major protocols’ tokens trade in a similar range, but $COMP has a slight edge over $AAVE and $MKR.

6/ @Bancor tends to be on the higher end of the spectrum (relatively overvalued) and @SushiSwap on the lower end (relatively undervalued).

Of the four listed, only Bancor ($BNT) and Sushiswap ($SUSHI) monetize value on a protocol level and distribute it to staked holders.

Of the four listed, only Bancor ($BNT) and Sushiswap ($SUSHI) monetize value on a protocol level and distribute it to staked holders.

7/ Tweets of the day!

Valuing Bitcoin against on-chain volume.

Valuing Bitcoin against on-chain volume.

https://twitter.com/woonomic/status/1399644889596370950

8/ @CurveFinance is the ultimate winner of the @ConvexFinance vs @iearnfinance situation.

https://twitter.com/Cryptoyieldinfo/status/1399707801258061825

9/ As mentioned above, valuation in DeFi is a murky subject, precisely for the reasons outlined this tweet.

https://twitter.com/DegenSpartan/status/1399699746562875393

• • •

Missing some Tweet in this thread? You can try to

force a refresh