0/ In today’s Delphi Daily, ETH/BTC shrugs off the correction, the battle for @CurveFinance, and DEX spot volumes hit YTD lows.

Check out the full analysis below 👇 👇

delphidigital.io/reports/delphi…

Check out the full analysis below 👇 👇

delphidigital.io/reports/delphi…

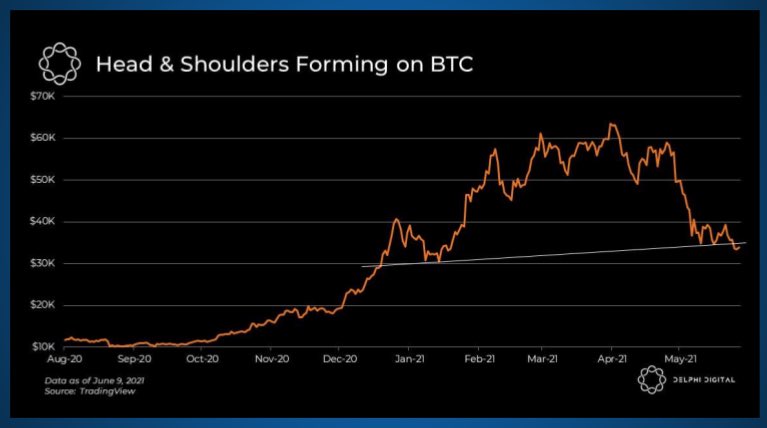

1/ Quick Market Update-

🔹The market had yet another quiet weekend with little volume across the top 100 coins (likely a result of most of the industry gathering in Miami).

🔹Despite $BTC falling less than $ETH from current ATHs, ETH looks like the stronger asset for now.

🔹The market had yet another quiet weekend with little volume across the top 100 coins (likely a result of most of the industry gathering in Miami).

🔹Despite $BTC falling less than $ETH from current ATHs, ETH looks like the stronger asset for now.

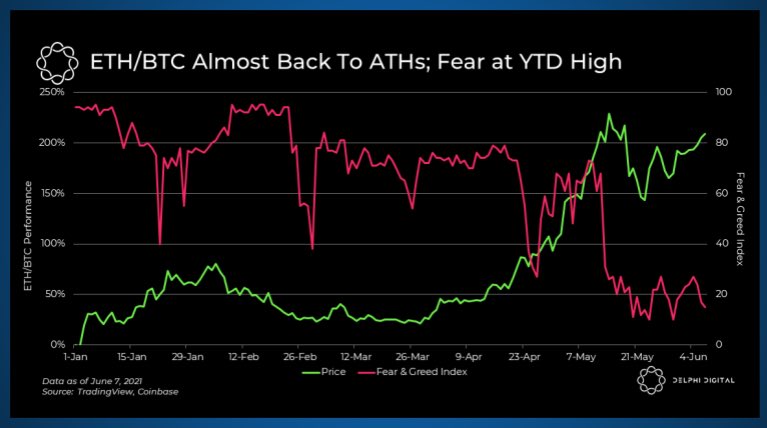

2/ If you look at the YTD ETH/BTC chart in isolation, you probably wouldn’t guess fear in the crypto market is the highest it’s been in a year.

It’s worth noting that in 2017, ETH/BTC topped out mid cycle and proceeded to trend down as BTC ripped to $20,000.

It’s worth noting that in 2017, ETH/BTC topped out mid cycle and proceeded to trend down as BTC ripped to $20,000.

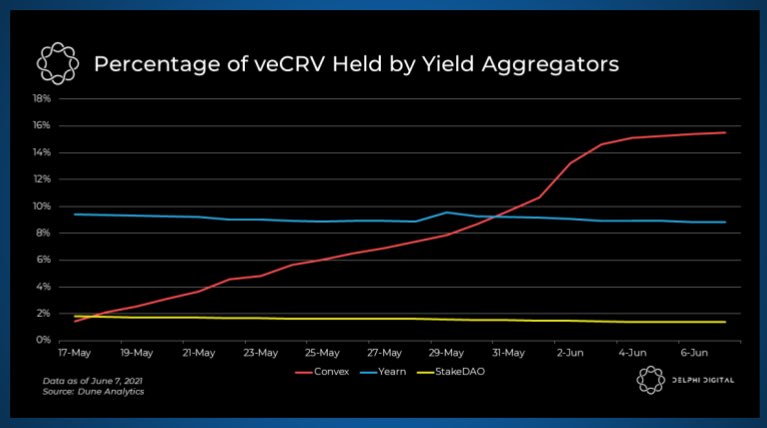

3/ With a unique incentive scheme for $CRV lock ups, @ConvexFinance has surpassed @iearnfinance’s $veCRV locked less than a month since launching.

It’s important to note that Yearn’s strategies also include depositing and farming CVX, so Yearn isn’t quite in the backseat yet.

It’s important to note that Yearn’s strategies also include depositing and farming CVX, so Yearn isn’t quite in the backseat yet.

4/ DEX volumes have receded hard over the past few weeks. Even @Uniswap, which has grown through previous pullbacks in 2020, has seen it’s volume shrink.

However, this isn’t exactly a DEX-specific phenomenon, as volume on centralized spot exchanges fell in tandem with DEXes.

However, this isn’t exactly a DEX-specific phenomenon, as volume on centralized spot exchanges fell in tandem with DEXes.

5/ Tweets of the day!

@AndreCronjeTech, inventor of @iearnfinance, teases a new DeFi product he’s finishing up.

@AndreCronjeTech, inventor of @iearnfinance, teases a new DeFi product he’s finishing up.

https://twitter.com/AndreCronjeTech/status/1401889111582167041

6/ In a landmark move, El Salvador became the first country to adopt Bitcoin as a legal tender.

https://twitter.com/nayibbukele/status/1401633334481100802

7/ MicroStrategy announces another $400 million round of financing to buy more BTC.

https://twitter.com/michael_saylor/status/1401879767943729154

• • •

Missing some Tweet in this thread? You can try to

force a refresh