0/ In today’s Delphi Daily, $BTC on #Ethereum won’t slow down, BTC largest daily outflow, and DeFi loans recover from lows.

Full analysis below👇 👇

delphidigital.io/reports/delphi…

Full analysis below👇 👇

delphidigital.io/reports/delphi…

1/ Market Update-

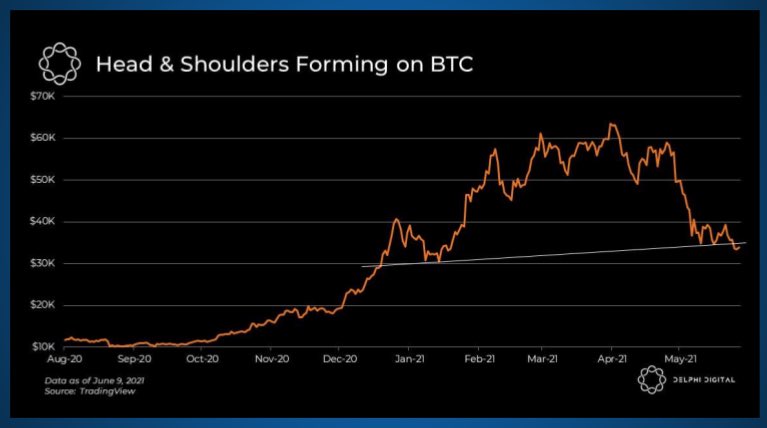

🔹The market had a weak open during Asia hours and the futures premium on BTC has eroded.

🔹BTC is still holding $30,000 implying there’s a strong spot bid.

🔹However, this can change quickly and sellers have continued to offload coins with a vengeance.

🔹The market had a weak open during Asia hours and the futures premium on BTC has eroded.

🔹BTC is still holding $30,000 implying there’s a strong spot bid.

🔹However, this can change quickly and sellers have continued to offload coins with a vengeance.

2/ 1% of all BTC that can ever exist is currently locked on the Ethereum blockchain. $WBTC continues to lead the way and expand its market share.

BTC’s use as collateral in DeFi has skyrocketed in the past 1.5 yrs and is expected to continue growing as it gathers more traction.

BTC’s use as collateral in DeFi has skyrocketed in the past 1.5 yrs and is expected to continue growing as it gathers more traction.

3/ Yesterday marked the largest daily outflow of BTC from exchanges in over 7 months, with nearly 22,500 BTC leaving various exchange wallets.

Large exchange outflows have been a sign of long-term accumulation but as BTC grows in DeFi, these coins could be used as collateral.

Large exchange outflows have been a sign of long-term accumulation but as BTC grows in DeFi, these coins could be used as collateral.

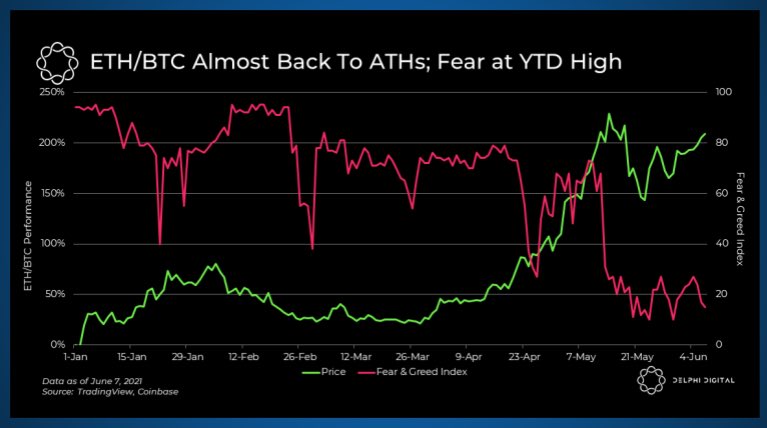

4/ Futures basis on @DeribitExchange and @CMEGroup have slipped into backwardation after a weeks of ranging near 0%.

Term Check: Backwardation refers to a condition where spot price is higher than futures. Contango is a situation where futures prices are higher than spot prices

Term Check: Backwardation refers to a condition where spot price is higher than futures. Contango is a situation where futures prices are higher than spot prices

5/ Loans outstanding in DeFi protocols are recovering despite muted market conditions, with @AaveAave surpassing it’s previous ATH and @MakerDAO closing in on fresh highs.

@Compoundfinance, however, has been a laggard with a sharp decrease in TVL and is yet to recover.

@Compoundfinance, however, has been a laggard with a sharp decrease in TVL and is yet to recover.

6/ Tweets of the day!

Interesting thread speculating @ElonMusk’s long term plans for BTC.

Interesting thread speculating @ElonMusk’s long term plans for BTC.

https://twitter.com/CroissantEth/status/1399828507849527298

7/ The Federal Government seized $2.3m worth of BTCs from the Colonial Pipeline ransomware attack with private key access.

https://twitter.com/GeoffRBennett/status/1401982282815115269

8/ Options flow continues to be mildly bearish with very little volume.

https://twitter.com/DeribitInsights/status/1402219617888636929

• • •

Missing some Tweet in this thread? You can try to

force a refresh