0/ In today’s Delphi Daily, mixed trading signals for $BTC, @terra_money and #ethereum undervalued, and $ETH supply in smart contracts.

delphidigital.io/reports/delphi…

delphidigital.io/reports/delphi…

1/ Market Update-

🔹El Salvadore passed the bill that makes BTC legal tender in Central American country.

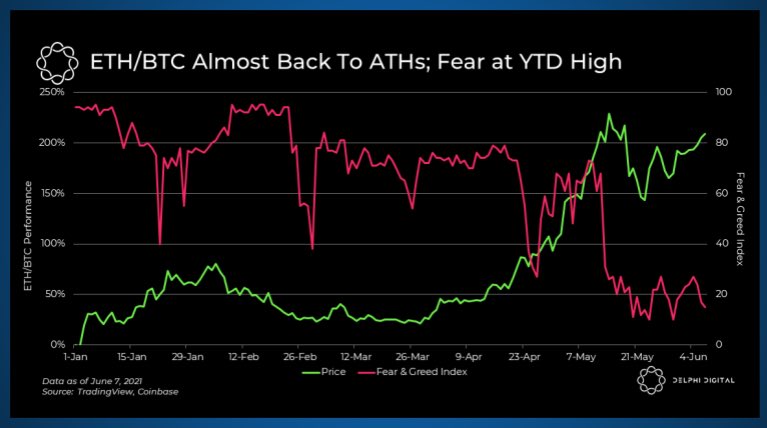

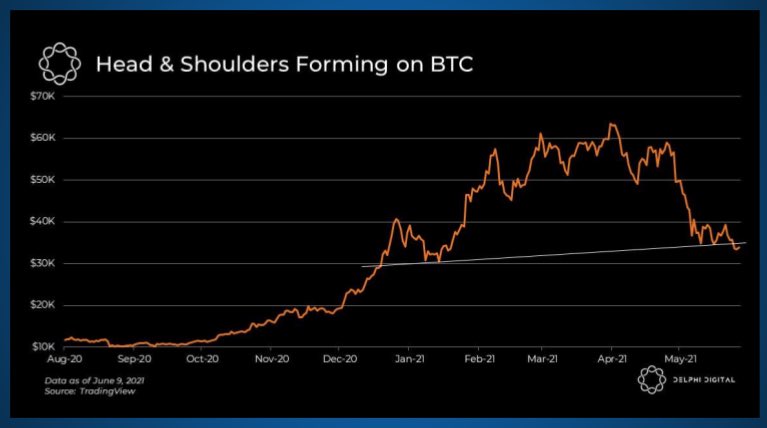

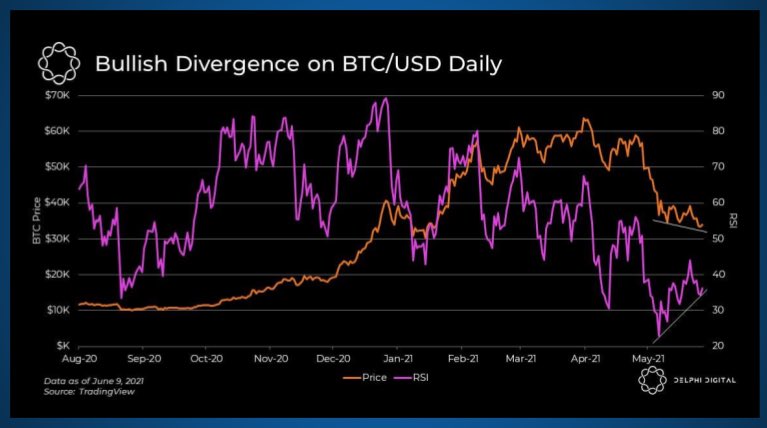

🔹Technical indicators are giving mixed signals with a bullish divergence forming while BTC defends its H&S neckline.

🔹ETH supply in smart contracts makes new highs.

🔹El Salvadore passed the bill that makes BTC legal tender in Central American country.

🔹Technical indicators are giving mixed signals with a bullish divergence forming while BTC defends its H&S neckline.

🔹ETH supply in smart contracts makes new highs.

2/ Yesterday, BTC attempted a test of its 2021 yearly open support level at $29,400. This level is crucial to defend if the longer-term bull market structure is to continue. This is accompanied by dip-buying and exchange withdrawals as mentioned in our previous daily.

3/ Historically, RSI bullish divergence precedes reversals. The last time bullish divergence was confirmed was 12/2019.

That being said, BTC will need to defend the $30,000 level this wk. It might be a good idea for traders to wait for reversal confirmation on the weekly close.

That being said, BTC will need to defend the $30,000 level this wk. It might be a good idea for traders to wait for reversal confirmation on the weekly close.

4/ Ethereum and DeFi usage seems relatively unfazed during market volatility seen in the last 24 hours.

ETH supply locked in smart contracts continue to make new all-time highs, currently at 23% of total circulating supply.

ETH supply locked in smart contracts continue to make new all-time highs, currently at 23% of total circulating supply.

5/ Comparing TVL/FDV of smart contract layer 1 assets, it is apparent that $LUNA & $ETH stands out as being significantly undervalued to other L1 peers.

LUNA is also used as a reserve asset to back Terra’s arsenal of stablecoins, so TVL/FDV alone only tells part of the story.

LUNA is also used as a reserve asset to back Terra’s arsenal of stablecoins, so TVL/FDV alone only tells part of the story.

6/ Time for tweets of the day!

El Salvador parliament passes the #BitcoinLaw and BTC is officially legal tender.

El Salvador parliament passes the #BitcoinLaw and BTC is officially legal tender.

https://twitter.com/DocumentingBTC/status/1402595671291613188

7/ Great educational resource thread from Ari Paul.

https://twitter.com/AriDavidPaul/status/1402382042189422599

8/ @OkEx will start supporting direct deposits and withdrawal from @0xPolygon.

https://twitter.com/0xPolygon/status/1402644318561607685

• • •

Missing some Tweet in this thread? You can try to

force a refresh