1/ there is now over $100B of dollars on-chain

there are seven stablecoins with >$1B in market cap

while market cap is an important metric, there are a few other insights we can glean from looking at velocity and collateralization rates

a short thread 👇 on crypto dollars

there are seven stablecoins with >$1B in market cap

while market cap is an important metric, there are a few other insights we can glean from looking at velocity and collateralization rates

a short thread 👇 on crypto dollars

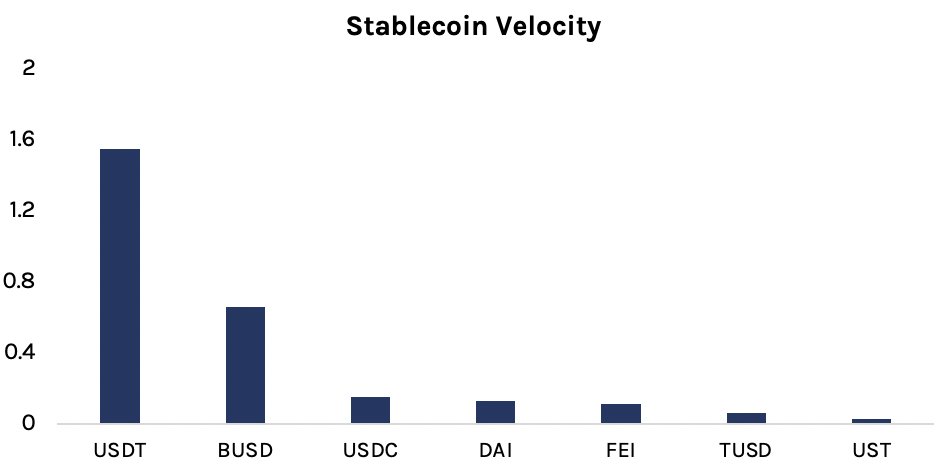

2/ velocity is the rate at which money is exchanged in a financial system

high velocity money tends to be associated with more developed systems

$USDT is HIGH velocity with one tether changing hands more than 1.5x per day

the USDT/BTC trade pair is *BY FAR* the highest volume

high velocity money tends to be associated with more developed systems

$USDT is HIGH velocity with one tether changing hands more than 1.5x per day

the USDT/BTC trade pair is *BY FAR* the highest volume

3/ some stablecoins have virtually no velocity, meaning once issued, their use as a medium for exchange is very limited

notably UST (trueUSD) and TUSD (terra USD) are the lowest velocity - this will be an interesting area to explore further

notably UST (trueUSD) and TUSD (terra USD) are the lowest velocity - this will be an interesting area to explore further

4/ another metric that is useful is collateralization (via @defipulse). stablecoins are a very popular form of DeFi collateral.

USDC is by far the winner here!

over $5B of USDC is locked in DeFi, ~20% of the circulating supply, and yields 5 - 30% per year in APY

USDC is by far the winner here!

over $5B of USDC is locked in DeFi, ~20% of the circulating supply, and yields 5 - 30% per year in APY

5/ USDT only comprises ~$1B of DeFi debt, or 1.5% of the circulating supply of USDT

notably, USDT borrow rates are also lower, at 2 - 20%

structurally, while USDT is much higher velocity than all other stables, it is much less utilized as collateral in DeFi

notably, USDT borrow rates are also lower, at 2 - 20%

structurally, while USDT is much higher velocity than all other stables, it is much less utilized as collateral in DeFi

6/ anyways, just sharing some perspective and nuance on the growing stablecoin ecosystem

while it's exciting to see more dollars on-chain, each stablecoin ecosystem is vastly different and understanding these nuances is helpful and important

/fin

while it's exciting to see more dollars on-chain, each stablecoin ecosystem is vastly different and understanding these nuances is helpful and important

/fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh