On this momentous night in #Bitcoin history, I’ve see a number of people ask “how could this possibly not cause the price to go up?”

My theory: individual events don’t impact bitcoin’s price, at least, not really and not alone.

🧵time!

My theory: individual events don’t impact bitcoin’s price, at least, not really and not alone.

🧵time!

Bitcoin markets seem driven by big, structural narratives that create raison d’etre for new entrants to participate.

We’ve been in one of those since March 2020: money-printer-go-brrr-means-inevitable-inflation-means-institutions-get in here.

We’ve been in one of those since March 2020: money-printer-go-brrr-means-inevitable-inflation-means-institutions-get in here.

Within the context of those meta narratives, individual events that validate and amplify the narrative can impact price - both by drawing new people in on the strength of the evidence for the narrative as well as by arming bulls and traders who are inclined to go long.

The end of Q4/ beginning of Q12021 was all about these type of events - culminating with Tesla’s $1.5B buy.

But then something happened, and we started to head sideways and down.

Was it the endless barrage of FUD? Tether? China? Environment? Elon? China again?

I don’t really think so.

Was it the endless barrage of FUD? Tether? China? Environment? Elon? China again?

I don’t really think so.

To the extent individual events did start downward action, they weren’t the force that shaped how far the fall took us.

@AlamedaTrabucco has explained this in about a dozen threads like this one:

@AlamedaTrabucco has explained this in about a dozen threads like this one:

https://twitter.com/alamedatrabucco/status/1395211736026959874

But even beyond leverage, I think that something bigger was happening: the money printer go brrr meme - the meta narrative that set the context for the last year plus - was losing steam on a macro scale.

Because remember - money printer go brrr wasn’t just a bitcoin meme. It was a meme that explained and justified exorbitant valuations across the stock market, but especially in tech stocks and risk on bets.

The vaccine and re-opening changed everything.

Or, more specifically, it changed the markets belief in the Fed’s ability to keep monetary policy as it has been.

Or, more specifically, it changed the markets belief in the Fed’s ability to keep monetary policy as it has been.

For the last few months, every time Powell has said they aren’t even thinking about raising rates, markets have basically said: we don’t believe you.

So markets started to reconsider some prices - particularly around the riskiest things in tech.

So markets started to reconsider some prices - particularly around the riskiest things in tech.

Instead of a money-printer-go-brrr/stocks only go up market, we started to be in a “who TF knows what happens next market.” This doesn’t tend to lend itself to pouring into risk assets/novel monetary systems. 🤣

And to the extent that macro folks DID have conviction they knew what was coming, their bet was inflation that forced Powell/Yellens hand to back off - which would mean rising interest rates and lower valuations for stocks (and BTC)

Now of course, there are plenty of macro folks who have bought into the narrative of BTC as inflation hedge and have continued to be bullish.

But on a macro scale, that take on BTC 1) competes with other idea of it like a risk on asset, and...

But on a macro scale, that take on BTC 1) competes with other idea of it like a risk on asset, and...

2) is a looooooong duration view. Ie I imagine there are a hell of a lot of people who have long term conviction that the programmatically hard capped supply asset is going to be a great fiat/inflation counterweight over time but will still trade like a risk on asset short term

So what you’ve got is a set up where there is a lot of macro context for CFOs and institutions to take a more “wait and see” approach - and certainly the endless chain of FUD doesn’t help here.

That means no momentum and narrative supporting news for the traders and bulls to make their levered bets on which raise the price and offer that confirmation bias of the institutional narrative.

Instead just a slow (to not so slow) drip of FUD without counter weighing institutional entrance event announcements, set in a larger liminal macro moment where everyone feels like we’re in an in between.

So we tread water, waiting for either a) the institutional narrative to reassert itself, perhaps with some new dimension, or b) a new bull market meta narrative to emerge to take its place that doesn’t rely on the same things.

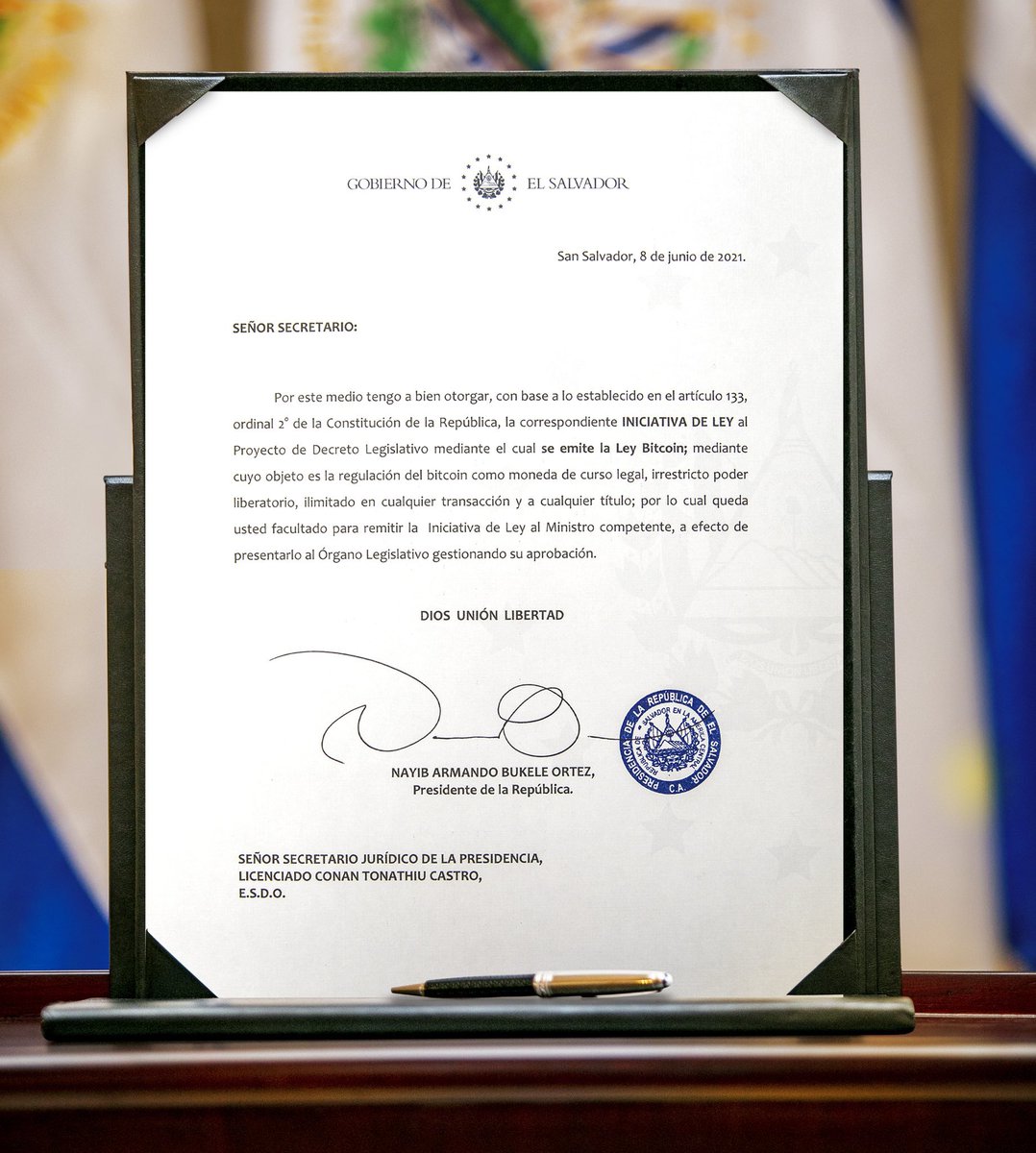

So getting back to El Salvador, it’s not impossible that if this truly does start a cascade of similar events, that it forms the seed of (b) that new meta narrative.

But that’s a thing that’s going to take time to play out.

But that’s a thing that’s going to take time to play out.

Frankly, I don’t care about El Salvador’s impact on price. I care about it’s significance in the history of Bitcoin, of the country of El Salvador, and in the nature of how economic power is apportioned globally.

And what’s more: what the fuck do I know about any of this? I’m not a trader, just an observer of as many patterns as I can get my head around, so make of this what you will.

• • •

Missing some Tweet in this thread? You can try to

force a refresh