Thread Threadexplaining #PE Ratio & #PEG Ratio & its use in #FundamentalAnalysis

(Must read for #FA learners)

🙏Like & RT to spread learning with all🙏

Views Welcome👉@dmuthuk @Vivek_Investor @datta_arvind @caniravkaria @FI_InvestIndia

#FundamentalAnalysis #StockMarket

(Must read for #FA learners)

🙏Like & RT to spread learning with all🙏

Views Welcome👉@dmuthuk @Vivek_Investor @datta_arvind @caniravkaria @FI_InvestIndia

#FundamentalAnalysis #StockMarket

1⃣

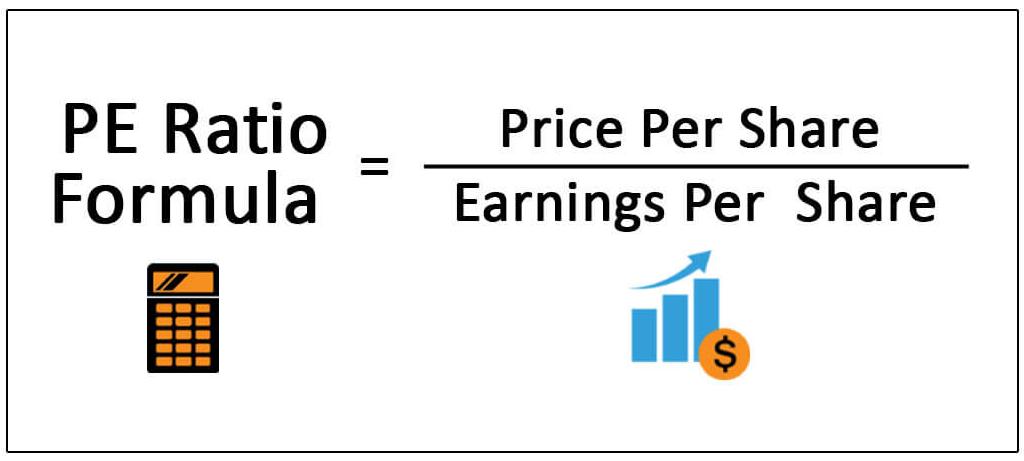

Price to Earnings (#PE) ratio, also known as price multiple or earnings multiple is the ratio obtained by dividing the current share price by earnings per share (#EPS).

#StockMarket #Investing #FundamentalAnalysis

Price to Earnings (#PE) ratio, also known as price multiple or earnings multiple is the ratio obtained by dividing the current share price by earnings per share (#EPS).

#StockMarket #Investing #FundamentalAnalysis

2⃣

P/E ratio is a reflection of the market's opinion of the earnings capacity & future business prospects of a company.

Companies which enjoy high investor confidence & have a higher market standing usually command high P/E ratio.

#StockMarket #Investing #FundamentalAnalysis

P/E ratio is a reflection of the market's opinion of the earnings capacity & future business prospects of a company.

Companies which enjoy high investor confidence & have a higher market standing usually command high P/E ratio.

#StockMarket #Investing #FundamentalAnalysis

3⃣

On the face, it would seem that companies with low P/E ratios would offer most attractive investment opportunities. This is not always true.

Companies with high current earnings but dim future prospects often have low P/E ratio.

#StockMarket #Investing #FundamentalAnalysis

On the face, it would seem that companies with low P/E ratios would offer most attractive investment opportunities. This is not always true.

Companies with high current earnings but dim future prospects often have low P/E ratio.

#StockMarket #Investing #FundamentalAnalysis

4⃣

As an #investor your primary concern is with future prospects of a company & not so much with its present performance.

This is why companies with low current earnings but bright future prospects usually command high P/E ratio.

#StockMarket #Investing #FundamentalAnalysis

As an #investor your primary concern is with future prospects of a company & not so much with its present performance.

This is why companies with low current earnings but bright future prospects usually command high P/E ratio.

#StockMarket #Investing #FundamentalAnalysis

5⃣

Better to invest in a stock with P/E ratio of 30 having good future growth prospects rather than investing in a stock having low P/E ratio of 5 or 6 but has an uncertain or bleak future growth prospects.

But at the same time never buy companies with too high valuations.

Better to invest in a stock with P/E ratio of 30 having good future growth prospects rather than investing in a stock having low P/E ratio of 5 or 6 but has an uncertain or bleak future growth prospects.

But at the same time never buy companies with too high valuations.

6⃣

Hence its always advisable to judge #PE ratio in conjunction with prospects of future earnings & growth of the company. This can be done using P/E ratio in conjunction with #PEG ratio.

@caniravkaria @Arpit1223 @FI_InvestIndia

#StockMarket #Investing #FundamentalAnalysis

Hence its always advisable to judge #PE ratio in conjunction with prospects of future earnings & growth of the company. This can be done using P/E ratio in conjunction with #PEG ratio.

@caniravkaria @Arpit1223 @FI_InvestIndia

#StockMarket #Investing #FundamentalAnalysis

7⃣

Price/Earnings to Growth (#PEG) ratio is calculated dividing company’s P/E ratio by growth rate of its earnings for a specified time period.

#StockMarket #Investing #FundamentalAnalysis

Price/Earnings to Growth (#PEG) ratio is calculated dividing company’s P/E ratio by growth rate of its earnings for a specified time period.

#StockMarket #Investing #FundamentalAnalysis

8⃣

PEG ratio gives a better picture about valuation of a company as compared to P/E ratio since it takes into consideration the company's earnings growth.

#StockMarket #Investing #FundamentalAnalysis

PEG ratio gives a better picture about valuation of a company as compared to P/E ratio since it takes into consideration the company's earnings growth.

#StockMarket #Investing #FundamentalAnalysis

9⃣

In case of companies having high growth rates, their P/E ratio might be high & in such cases using just P/E ratio these high-growth companies would appear overvalued relative to others & in such cases better to use PEG ratio to get clear picture about company’s valuation.

In case of companies having high growth rates, their P/E ratio might be high & in such cases using just P/E ratio these high-growth companies would appear overvalued relative to others & in such cases better to use PEG ratio to get clear picture about company’s valuation.

🔟

#investor can use PEG ratio to know if a stock is overvalued or undervalued.

✅PEG ratio greater than 1 means stock is relatively expensive.

✅PEG ratio lower than 1 means stock is below its fair value.

✅PEG ratio will be negative when there is de-growth in earnings.

#investor can use PEG ratio to know if a stock is overvalued or undervalued.

✅PEG ratio greater than 1 means stock is relatively expensive.

✅PEG ratio lower than 1 means stock is below its fair value.

✅PEG ratio will be negative when there is de-growth in earnings.

1⃣1⃣

Theory of #PEG Ratio gained it’s popularity when #PeterLynch started using it as one of his valuation metrics.

Peter Lynch would always prefer to invest in stocks whose PEG Ratio was less than 1.20.

#StockMarket #Investing #FundamentalAnalysis

Theory of #PEG Ratio gained it’s popularity when #PeterLynch started using it as one of his valuation metrics.

Peter Lynch would always prefer to invest in stocks whose PEG Ratio was less than 1.20.

#StockMarket #Investing #FundamentalAnalysis

1⃣2⃣

#PEG ratio actually factors-in both price valuation & stock’s future growth prospects.

If handled correctly, PEG can prove to be a reliable intrinsic value pointer.

#StockMarket #Investing #FundamentalAnalysis

#PEG ratio actually factors-in both price valuation & stock’s future growth prospects.

If handled correctly, PEG can prove to be a reliable intrinsic value pointer.

#StockMarket #Investing #FundamentalAnalysis

• • •

Missing some Tweet in this thread? You can try to

force a refresh