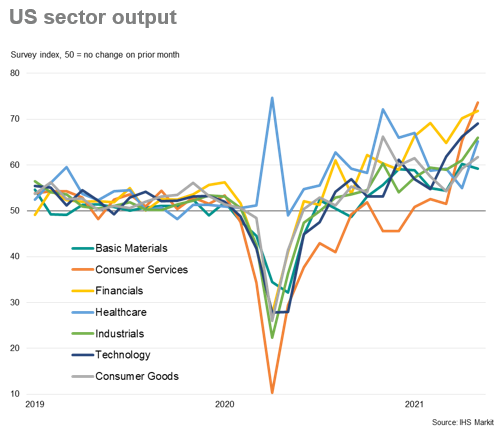

US #PMI data from @IHSMarkit show the economy surged in May, led by the largest expansion of consumer services activity on record. #GDP growth could reach double-digits as the economy opens up, adding further pressure on the #FOMC. More at bit.ly/3wnJVZb

@IHSMarkit Here's the latest @IHSMarkitPMI US survey data tracked against historical @FOMC policy decisions, highlighting the unprecedented surge in economic activity ...

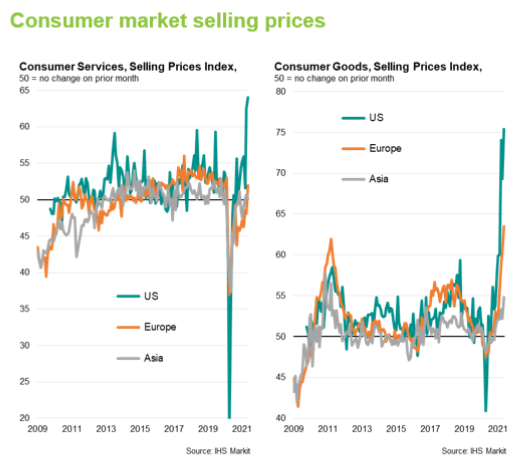

@IHSMarkit @IHSMarkitPMI @fomc This economic boom in the US is being accompanied by price rises which far outpace the rate of inflation seen in other countries, with the PMI's index of prices charged for goods and services at a record high by some margin in the US....

@IHSMarkit @IHSMarkitPMI @fomc The extent to which prices charged for US consumer goods and services is exceeding that seen in Europe and Asia is quite striking, and likely reflects the turbo-boosting of the US rebound via consumer-focused fiscal policy stimulus measures

• • •

Missing some Tweet in this thread? You can try to

force a refresh