Global factory growth ends 2020 close to decade-highs, but supply worsens bit.ly/3bfKA7f

A key contributor to the relatively swift return of robust global #manufacturing growth in the recent months has been a revival in worldwide goods trade. There's some signs of this export boost fading though...

While there were some reports of demand having weakened amid resurgent waves of COVID-19 infections in many parts of the world, notably Europe, output, demand and trade flows were in many cases also constrained by rising supply problems.

With the exception of the supply delays seen at the height of the pandemic in Q2, and the supply issues created by the Fukishima incident in 2011, the incidence of delays in December was the highest since 2004. Prices have risen alongside this shift in supplier pricing power

Companies commonly reported issues with a lack of shipping capacity around the world, including a shortage of containers, and frequently reported bottlenecks as suppliers and logistics firms struggled to meet rising demand from manufacturers.

Having led the global production upturn for two consecutive months up to November, #Brazil was pushed into second place in the global rankings by #Germany, followed by #India. In all three cases, growth rates moderated but remained among the highest seen over the past decade.

The US was the fifth-placed fastest-growing manufacturing economy, behind #Taiwan.

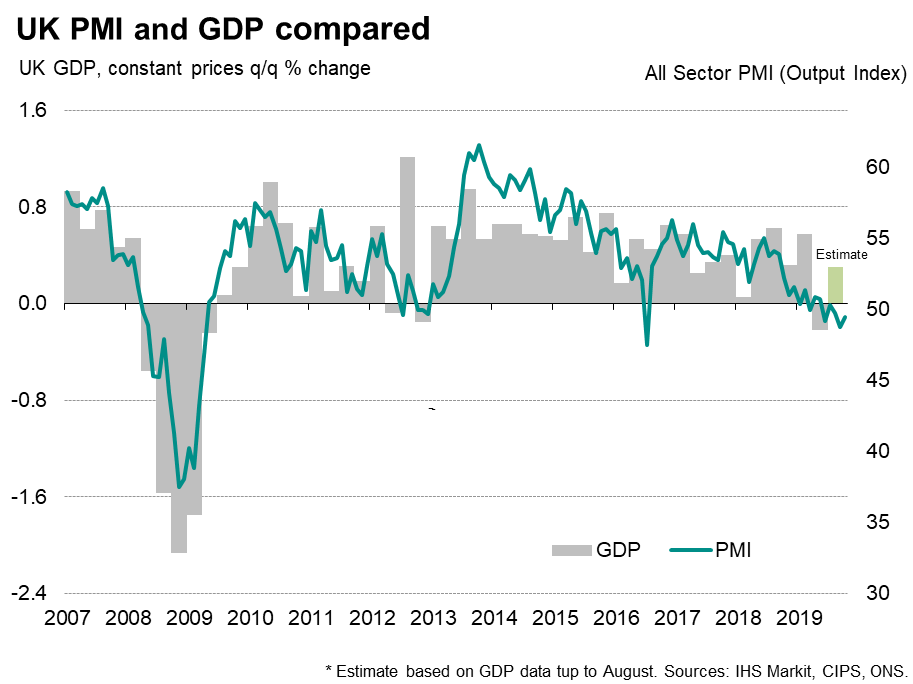

Above average global growth was also seen in the UK. #Japan was noteworthy in seeing its output stabilise, and #China's output growth remained close to decade-highs.

Above average global growth was also seen in the UK. #Japan was noteworthy in seeing its output stabilise, and #China's output growth remained close to decade-highs.

Output in the rest of #Asia meanwhile also grew at a slightly reduced rate, but the expansion was nonetheless the third strongest since April 2011, led by #Taiwan (which reported the fastest growth for a decade).

• • •

Missing some Tweet in this thread? You can try to

force a refresh