A short inspirational thread

Found out a surprising thing yesterday. My uncle had after working in a small company for about 35-40 years retired recently. He's from a typical middle-class Indian family and didn't have much in terms of property, money etc.

Found out a surprising thing yesterday. My uncle had after working in a small company for about 35-40 years retired recently. He's from a typical middle-class Indian family and didn't have much in terms of property, money etc.

He's not well educated and had just passed his 10th and he's worked for most of his life doing odd things before settling at his last job.

So the question of retirement expenses came up and we were generally talking about it as we were cleaning up his old books and files. In the middle of this, I found a bunch of old paper certificates. He

Turns out, my uncle had invested some money in a bunch of stocks, IPOs, mutual funds and forgotten them. He didn't know anything, but his friend was a savvy guy who dabbled in stocks.

What I found out was quite inspirational and changed how I think about investing, and I'm sure it will change your mind too.

His dad had sold some land, and he had invested some 5000 rs in the Infy IPO at Rs 95 a share. Today it's worth nearly 1.5 crores+.

He had invested another Rs 5000 in HDFC Bank IPO, and that is worth another 1.5cr+

He had a SIP in Franklin Prima for about 15 years. His Rs 2000 SIP is about 14-15 lakhs today.

The SIP of the same duration in UTI Master share is worth 10lks today.

The SIP of the same duration in UTI Master share is worth 10lks today.

He had invested another 50,000 in HDFC Equity fund which is about Rs 1.5 lakh today.

If you've read so far, this is a bullshit story. The reason I wanted to write this is that there's an epidemic of this profoundly horseshit "if you had invested X in 1900" tweets and stories.

These stupid bullshit stories are among the most annoying stories on the internet. But the best part is, if you want to build a following on Twitter, these tweets are like drugs to people. And a bunch of smart people have figured this shit out.

Everybody will fall for them and you'll get 1000s of retweets and likes. Such blogposts also get 100 gazillion shares. They are quite seductive and a brilliant growth hack.

These stupid bullshit stories are riddled with survivorship bias. First of all, 3.5 people knew about the stock market way back when. Investing in stocks was harder than finding a copy of Playboy in India.

And then, for every wealth-creating IPO like Infosys, Reliance, there are 1000s that have gone to 0. The paper certificates of these stocks are worth more than their invested value.

In real life, a small number of stocks generate all the returns. Prof. Bessembinder In the US, found that 4% of all listed companies accounted for all of the returns. The rest of the 96% of stocks underperformed a savings bank/FD. It's the same for India too.

It's the same Internationally ex-US:

"About 61 per cent of non-US stocks underperformed Treasury bills in the 1990-2018 period, and less than 1 per cent accounted for the entire $16tn of net wealth creation over the period."

ft.com/content/557382…

"About 61 per cent of non-US stocks underperformed Treasury bills in the 1990-2018 period, and less than 1 per cent accounted for the entire $16tn of net wealth creation over the period."

ft.com/content/557382…

The other profoundly obvious issue with these stupid "If you had invested X" bullshit is that not everybody would've got an IPO allotment.

So, if you're buying, selling IPOs, stonks based on these tweets and blogposts, which if printed, wouldn't be worth wiping a goat's ass with, you'll be disappointed.

I'm not saying don't pick stonks, IPOs etc. Please by all means. But, if you're motivated with Rocky music in your head after reading one of these stupid tweets or blogs be aware that the odds of success are quite thin.

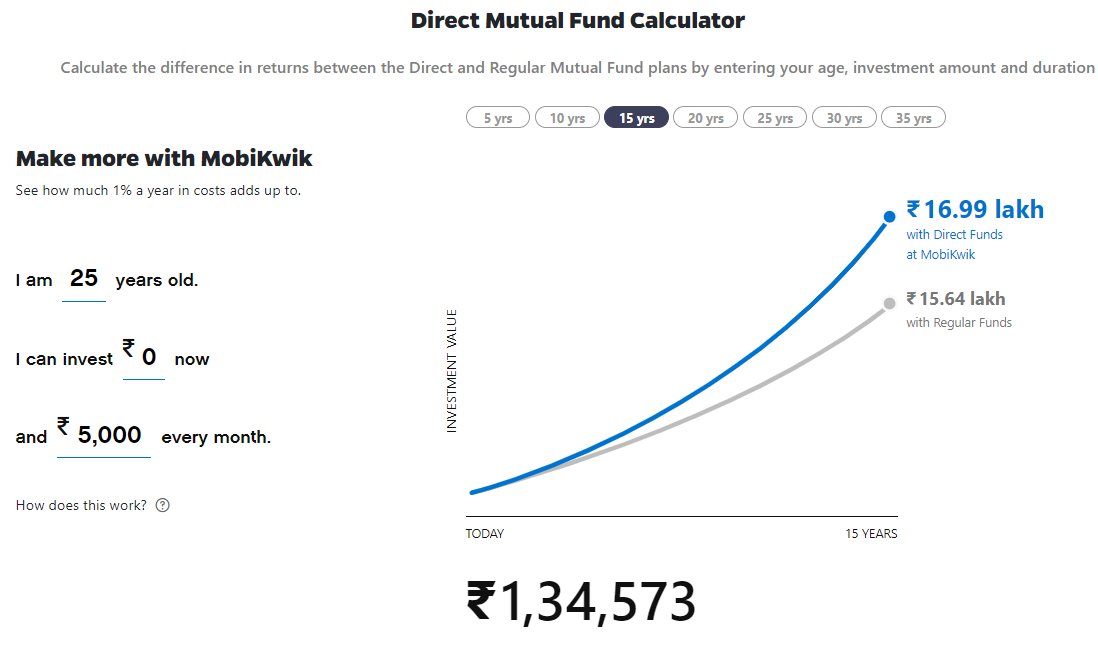

Having said all this, equities are still the best options for us The great unwashed to beat inflation. For us, mutual funds are probably the best route if you're aren't a gifted stonk picker.

All these "If you had invest X" stories are absolutely stupid. They don't mean anything and are pure horseshit.

If you fall for them, god bless you.

The end, gotta go meet my uncle.

If you fall for them, god bless you.

The end, gotta go meet my uncle.

• • •

Missing some Tweet in this thread? You can try to

force a refresh