A story of an investor

Gets first salary

Decides to invest

Googles " how to invest" & finds a Moneycontrol article "These stocks can up 30% in short term"

They don't

Writes a blog title "the stock market is a scam"

Sees a P&L screenshot from a 17-year-old trading mentor

Gets first salary

Decides to invest

Googles " how to invest" & finds a Moneycontrol article "These stocks can up 30% in short term"

They don't

Writes a blog title "the stock market is a scam"

Sees a P&L screenshot from a 17-year-old trading mentor

Signs up for an options seminar

Makes some profits

Tweets some Jack Shivajinagar quotes

Gets buggered by a malnourished Black Swan event & loses everything

Tags PM, FM, CM asking them to protect "innocent retail investors"

They don't

Makes some profits

Tweets some Jack Shivajinagar quotes

Gets buggered by a malnourished Black Swan event & loses everything

Tags PM, FM, CM asking them to protect "innocent retail investors"

They don't

Gets a reply from a crypto guy saying "this is why you should crypto bro"

Updates the "stock market is a scam" blog

Invests in $ASS coin & $CUMMIES

Loses 90%

Mom finds out

Updates the "stock market is a scam" blog

Invests in $ASS coin & $CUMMIES

Loses 90%

Mom finds out

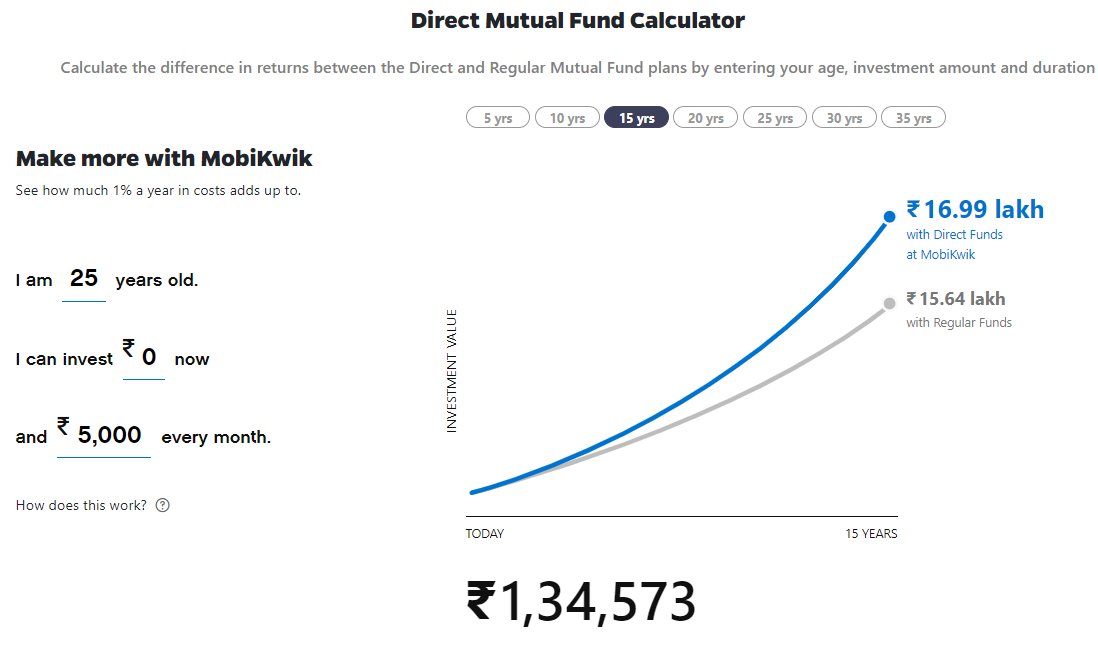

Decides to invest in mutual funds

Picks active funds

After 5 years learns what benchmark is

Finds out active funds are stealing money

Writes post titled "active mutual funds are a scam"

Picks active funds

After 5 years learns what benchmark is

Finds out active funds are stealing money

Writes post titled "active mutual funds are a scam"

Granny finds out

Invests in FD

Writes post titled "Dear stock market, I believed in you but you gave dhoka"

Invests in FD

Writes post titled "Dear stock market, I believed in you but you gave dhoka"

• • •

Missing some Tweet in this thread? You can try to

force a refresh