@ArmitageJim @premnsikka @retheauditors 1/ The curious case of the #Earthport crew. While the UK FSA(FCA) turned a blind eye to its ‘small caps cesspit’ & #emoney scene, #Wirecard & it’s ‘brothers with different mothers’ used reverse mergers, ‘sexed up’ M&A & ‘related party’ …

2/ japery to take their ‘high risk payment processing’ (of online gambling +/or pornography +/or blacklisted FX/CFD/Crypto/binary option +/or scam ops) proceeds ‘off the table’ + just keep on doin’ it .. doin’ it .. & doin’ it again (

https://twitter.com/ianbeckett/status/1395379546996842500).

3/ EarthPort’ was founded in 1997 as one of the first e-wallets with gambling transaction processing up front + centre from the start (in the form of lotteries). Co-founded by South African (via Australia) David Vanrenen as Chairman/CEO + with UK national (come Singapore …

4/ centric) Henry O’Sullivan as CTO, Henry O’Sullivan would allegedly play his part in the ‘Wirecard Saga’. Co-founders Alan Tucker & David Vanrenen controlled ~60% equity (pre IPO) of EarthPort PLC which listed on AIM in 2001 with David Vanrenen as Chairman, Graham Newall …

5/ as CEO, Bob Tucker (Tucker Jnr.) as CFO + Adriaan Brink as CTO. Mere months later EarthPort was suspended from AIM & Earthport agreed a rescue package seeing David Vanrenen move to a N.E.D. & Graham Newall/Bob Tucker leave. In the mean time the USA had started to …

6/ crack down hard on the exponentially growing online gambling scene & the ‘murky’ world of it’s ‘transaction processing’ - the UK FSA’s notorious ‘small caps cesspit’ & #emoney scene (with its impotent regulators turning a blind eye) slathered in anticipation.

7/ Around this time (2002) it’s been alleged (Foundation for Financial Journalism & ‘Die Wirecard-Story: Die Geschichte einer Milliarden-Lüge’ book) that David Vanrenen (along with henchman come CEO Henry O’Sullivan) set up the ‘Waltech’ web of IOM (+ other) ‘offshore’ SPV’s …

8/ which it’s been alleged had a focus on this murky ‘trade’. It’s been further alleged that Henry O’Sullivan was CTO of IOM SPV pay2 Ltd (again Setup in 2002), that by the time of its dissolution in 2009 Pay2 Ltd had been processing £50m/month of online transactions + that …

9/ Peter Stenslunde (now a honcho in Wirecard’s South African ops) was formerly Pay2 Ltd’s financial controller … small world. Pay2 Ltd’s initial ‘score’ was as a core part of the notorious global online lottery/virtual stockmarket/casino …

10/ pyramid scheme #WGI (World Games Inc) run by Australian Greg Kennedy. ACCC v Worldplay Services Pty Ltd [2004] (scribd.com/document/51118… ) describes Pay2 Ltd’s role in the pyramid scheme. Worldplay Services Pty Ltd et al vs Quentin George [2003] (scribd.com/document/51116…) …

11/ describes WGI’s alleged plans to list as UK SPV ‘World Games Leisure Plc’. The WGI - Pay2 ‘deal’ is disclosed along with an ‘unlawful SEC auditor’ + a shedload of ‘sexed up’ accounting & related party transactions in the USA filings of an …

12/ unlisted Nevada cash shell Total Horizon Inc (renamed to #Payguard Inc) - sec.report/CIK/0001106976. The 2001 annual report noted the acquisition of the cash shell by allegedly Guernsey resident Colin Gervaise-Brazier (infamous for the ‘shortest lived airline’), …

13/ the cash shell’s acquisition of a tin pot UK SPV (ATM Cards (Europe) Ltd) & the signature of a payment transfer contract with a USA debit card transaction processor .. but no revenue. All change in the 2002 annual report(+exhibits) as with a dose of “Razzall Dazzle” + …

14/ huge sums sprayed around a forest of related parties, in moved Lord Razzall + the #Pay2 crew along with the notorious #WGI pyramid scheme’s honchos. The report stated that Lord Razzall’s associate John Mitchell founded Pay2 (Pay2 Ltd IOM) + other filings stated that …

15/ the pair of them owned 55% of Pay2 + that former Earthport CEO Graham Newall was the CEO of Payguard + also a shareholder in Pay2. The report stated that Pay2 had granted an exclusive 10yr Pay2 licence to Payguard + that Pay2 was a direct licencee of the …

16/ uber notorious CY #FBME bank (buzzfeed.com/tomwarren/secr… AND cointelegraph.com/news/mastercar…) which allegedly had links to Wirecard. The report stated #FBME was Pay2’s VISA/Mastercard card issuer, that Pay2 licenced it’s FBME operating agreement to Payguard + …

17/ that Pay2 ‘owned’ Payguard’s FBME bank accounts (used to settle transactions)/unissued Pay2 cards. The report stated that virtually all of Payguard’s administration was outsourced to UK SPV ‘Apollo Consulting Ltd’ (reported as owned + controlled by the wife of …

18/ John Mitchell & Lord Razzall) + detailed Cyprus SPV #Interpaytech Ltd’s (stated 100% owned by Pay2) role, fronted allegedly by Earthport crewmate & South African (via Australia) Boyd Wilkins. Interestingly another O’Sullivan (Mark O’Sullivan) heads Interpaytech Africa, …

19/ run out of Mauritius - as was a ‘family office’ on his cv!. The report stated that Singapore ‘hosted’ Bermuda SPV Boston Fidelity Ltd was controlled by the families of WGI’s honchos & alluded that UK & CY ‘Argonaut Associates’ SPV’s were controlled by Lord Razzall & John …

20/ Mitchell. The 2003 annual report stated that 2003 transaction volume was $70m (70k Pay2 prepaid cards) in the 6 months of operation to 31/12/03 from the sole merchant - the WGI pyramid scheme. The report stated that Pay2 card transaction acquisition was carried out …

21/ by Frankfurt based ‘Webtrade.net GMBH’ (allegedly entwined with Wirecard’s Rüdiger Trautmann’s Inatec Solutions GmbH). Note Helge Kiessler - party to ‘Webtrade’, ‘Inatec’ + allegedly the #ICC-Cal scandal (en.globes.co.il/en/article-ben… AND timesofisrael.com/wirecard-waves… …

22/ AND haaretz.com/israel-news/bu…) that saw ‘Inatec’/Wirecard’s Dietmar Knöchelmann reported pleading guilty. It’s also interesting to note that both Webtrade.net GMBH & EBS Holding GMBH (aka Wirecard) shared the same Swiss liquidator.

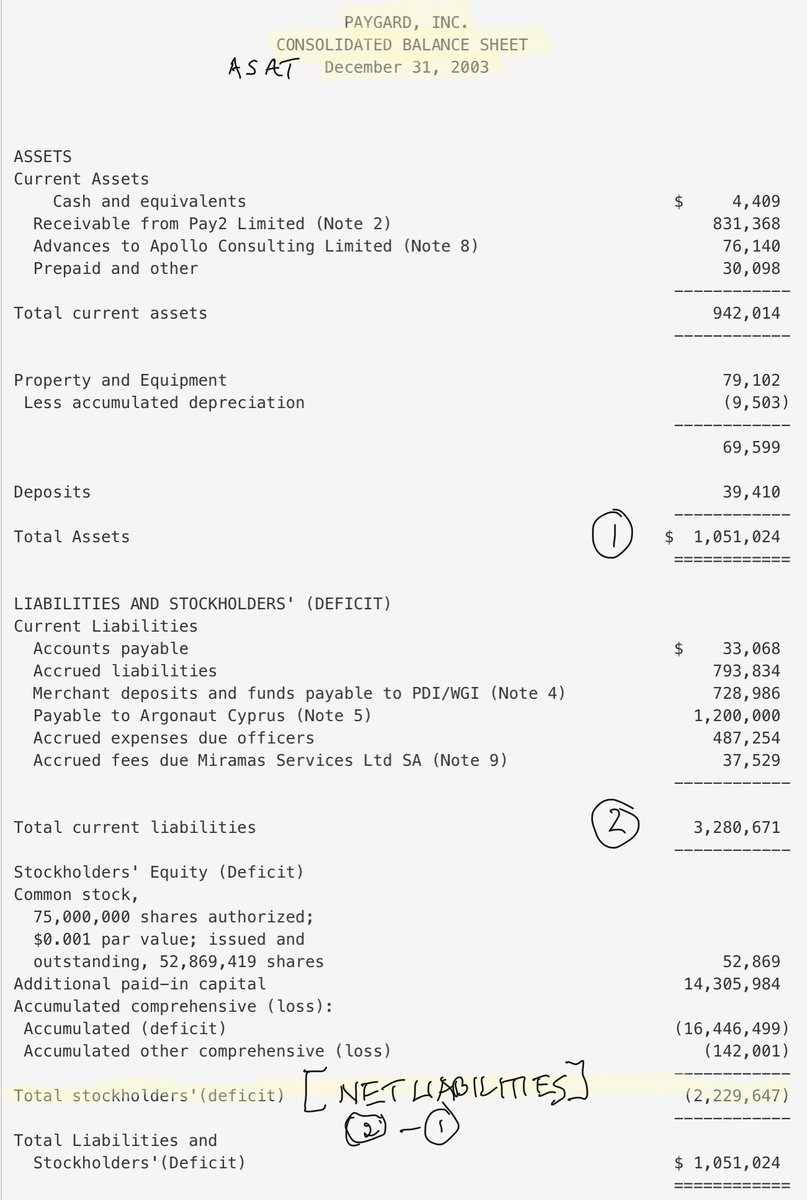

23/ The net effect (as at 31/12/03) of the forest of related party transactions & ‘sexed up’ accounting in Payguard Inc was a net liability of $2.2m & accumulated losses of $16.4m. With the authorities in Canada, Norway & Australia (the UK FSA were slumbering) cracking down …

24/ hard on the WGI pyramid scheme, unsurprisingly no further annual reports were filed + Payguard Inc was ‘left to die’ (SEC revocation) in 2015. Instead, the Pay2 ‘action’ moved back to the UK/IOM. Complementing the former Payguard’s UK SPV ATM Cards (Europe) Ltd & …

25/ Pay2 Ltd (in IOM), Pay2 Limited was setup in the UK in 8/2004 by John Mitchell/Lord Razzall/Christopher Macnee (also a director of ATM Cards (Europe) Ltd). Christopher Macnee would …

26/ more recently: 1. testify in court about his ‘Australian activities’ in relation to notorious convicted fraudster Renwick Haddow’s #CapitalAlternatives mega scam (mondediplo.com/openpage/catch… AND scribd.com/document/51116…). 2. be up front in the notorious ‘Nexus water bonds’.

27/ Lord Razzall would later 1. join Catalyst Investment Group Ltd, part of the notorious ARC Fund Management/Catalyst Group (former billet of notorious convicted fraudsters Renwick Haddow & Andrew Meikle). 2. be the face of the recent #MJSCapital minibond scandal …

28/ (standard.co.uk/hp/front/polic…). UK SPV Pay2 Ltd changed its name in 2006 to WorldWide Pay Ltd & ATM Cards (Europe) Ltd was left to be struck off. Apollo Consulting Ltd was later liquidated by seemingly a rather strange choice of liquidator - a small husband/wife outfit …

29/ from a small town hundreds of miles outside London. Victims of the #LCF minibond scandal will recognise the name of the Fenders’ I.P. firm - Sanderlings LLP (

https://twitter.com/ianbeckett/status/1288853839148457984). Very little revenue appeared to go through WorldWide Pay Ltd which begs the questions …

30/ - *IF* the allegations of Pay2 Ltd (IOM) processing £50m/month of online payment transactions are true, where did all the revenue go + what did the FBME/‘Inatec crew’ powered “Pay2” in IOM morph in to next ? (Australian Tony Corrado’s seamless transition …

31/ from Pay2 Ltd to ‘Walpay Ltd’ [‘Waltech’] is a tease as are the alleged ‘dual roles’ of Henry O’Sullivan at Pay2 & ‘Waltech’). Meanwhile back at Earthport + following the ‘exit’ of messrs VanRenen,Tucker & Newall in 2002, in next to the ‘bombed out’ Earthport came new …

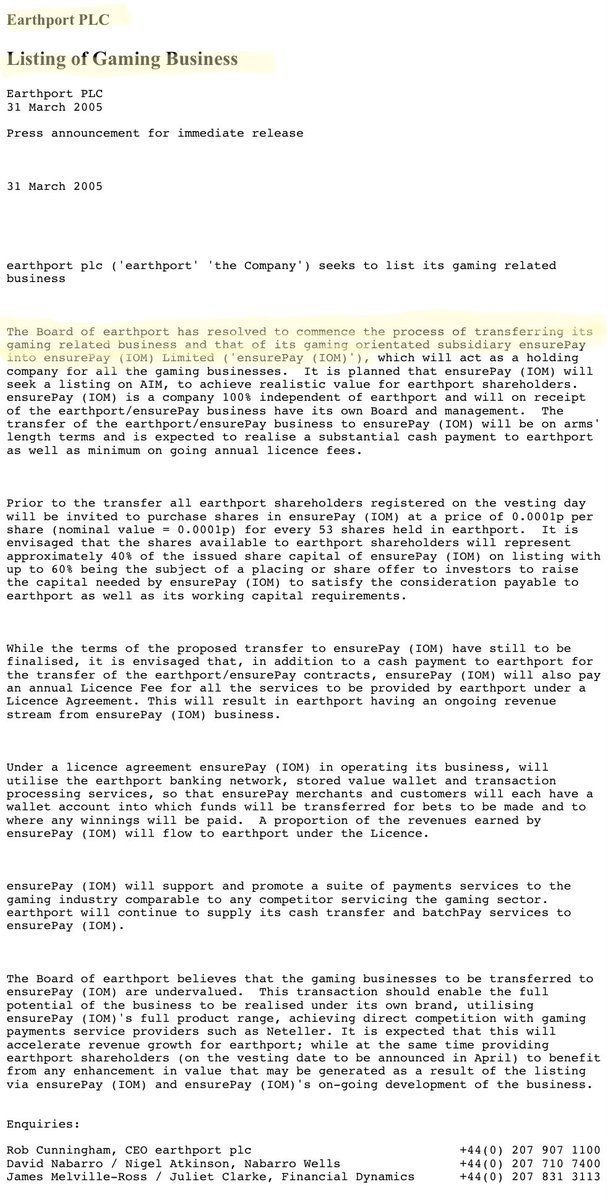

32/ CEO Rob Cunningham + chums on the coat tails of a ‘murky’ highly diluting ‘lifebelt’ fundraising from the allegedly David Vanrenen linked Tallulah Properties Ltd/Java Services Ltd + also the ‘Gelande Corporation’ (allegedly a deal in large part to introduce …

33/ ‘online gambling transactions’). Earthport’s online gambling transaction processing unit ‘#EnsurePay’ was in 2005 spun out offshore to the IOM (‘Gelande Corporation’ getting a large chunk). It’s interesting to note that many of these Ensurepay online gambling …

34/ transaction contracts were via EnsurePay’s reseller ‘E Commerce Services UK Ltd’ (allegedly aka the notorious #Instabill’s honcho Jason Field) which would crash in to liquidation leaving the HMRC on the hook for £800k as Jason Field ‘holed up’ in the USA. A few weeks …

35/ after EnsurePay was spun out offshore in 03/2005, Earthport CEO Rob Cunningham resigned amidst major contract failures. In next as Earthport CEO (11/2006) was USA national David Fife who proceeded to sign up notorious MLM schemes (eg NuSkin) & …

36/ ‘high risk payment processors’ (eg SafePaySolutions). Despite the annual accounts stating he ‘joined the board’ in 02/2007, he never seemed to make it on to Companies House filings, apparently resigning 06/2008 to be replaced by the next CEO up James Bergman who …

37/ strangely was appointed a director 11/2007 + CEO 06/2008. James Bergman would leave Earthport under a cloud, reported “dismissed following an internal enquiry” (thisismoney.co.uk/money/markets/…). James Bergman however would reappear it’s alleged by Fintelegram as an …

38/ executive director of the notorious Bulgarian based payment processor ‘#TransactEurope EAD’ who Fintelegram allege processed $m’s in broker scams including the #WolfOfSophia’s #binaryoption etc scams (fintelegram.org/illegal-broker…). Transact Europe EAD also provided …

https://twitter.com/ianbeckett/status/1358513884047491073

39/ it’s EMI licence to the “#PowerPay21 Fintech Network” aka ‘Inatec reincarnated’ (Dietmar & Ayalet Knöchelmann, Rüdiger Trautmann, Sean Forward & chums) with variously their links to #Wirecard + the #ICC-Cal scandal. Transact Europe EAD also provided it’s EMI licence to …

40/ Cyprus SPV ‘Marimune Ltd’ (directors: Sean Forward/Dietmar Knöchelmann), allegedly linked amongst other things to Inatec’s Marimune ‘payout’ debit card. The FT reported that James Bergman was also employed as COO of key Wirecard business partner Christopher Bauer’s …

41/ Philippines online payment processor #PayEasySolutions International + further reported the Bauers’ PayEasySolutions online payment processor as responsible for 15% of Wirecard’s T/O & 20% of it’s profits (

https://twitter.com/ianbeckett/status/1395379577007099908AND ft.com/content/a22f37…).

42/42 Much more to come in the 2 decade saga of #Wirecard & it’s ‘brothers with different mothers’ … all while the UK’s FSA(FCA) & DE’s BaFin slept at the wheel.

• • •

Missing some Tweet in this thread? You can try to

force a refresh