Going through our monthly macro housing/econ deck again for June. Here are some charts catching my attention this month.

1/7: The share of Americans expecting home prices to increase over the next year is now higher than back in 2005.

1/7: The share of Americans expecting home prices to increase over the next year is now higher than back in 2005.

2/7: Looks like tax advantages of owning a home aren't as big of a driver for housing as some thought.

3/7: Trend of shrinking home from 2015-2020 appears to be over. Hopefully not the return of McMansions.

4/7: Median new home prices are just 10% more than resale homes (lowest spread in over a decade). Combination of resale prices shooting higher and builders focusing on entry-level price points last few years driving this trend.

5/7: Amazing how many mortgages were adjustable rate back in prior cycles (not just subprime bubble). When/if rates rise it'll be interesting to watch this trend.

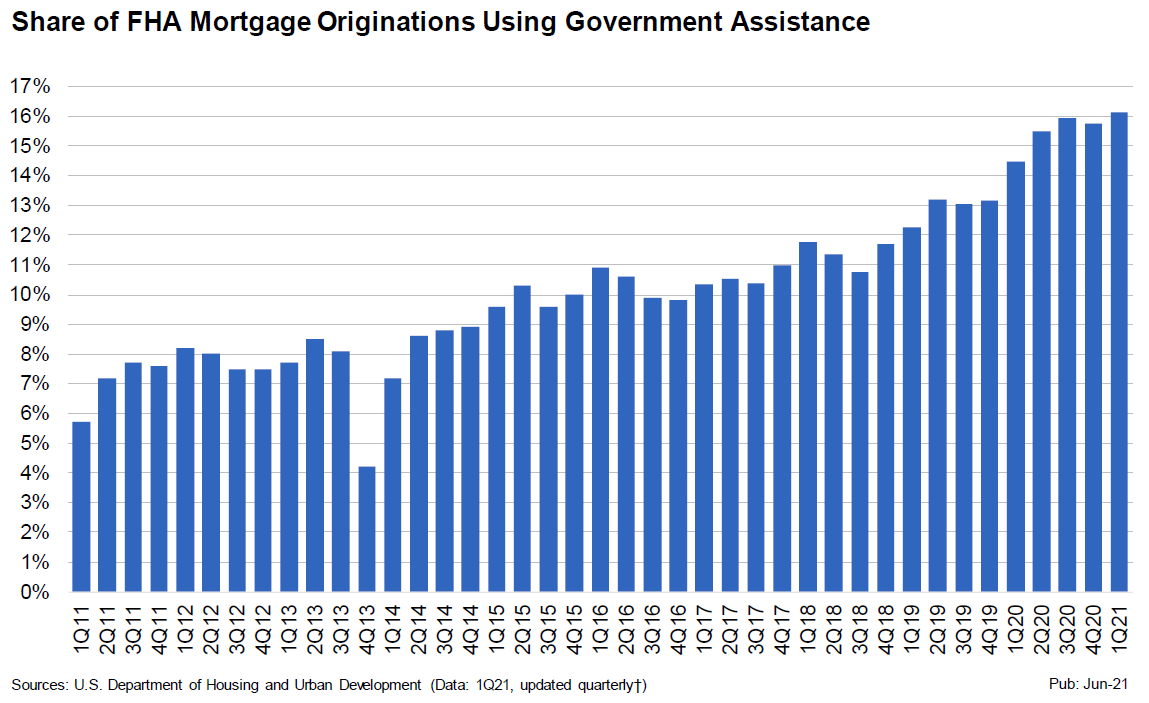

6/7: ~16% of FHA mortgages use additional government assistance to cover home purchase costs. Not much (if any) skin in the game on these loans out the gate.

7/7: Stocks tied to housing crushing broader market. Not meme stock notoriety, but still impressive.

• • •

Missing some Tweet in this thread? You can try to

force a refresh