Moving Averages 📚

💎SECRET INFO inside

🧠Great for both beginners & advanced traders

▪️ What are they?

▪️ Types of MAs

▪️ Why are they such a powerful tool?

▪️ How to properly use them?

▪️ My best SECRET EMA value?

▪️ Which Timeframe to use?

▪️ Advanced EMA technique?

1/20

💎SECRET INFO inside

🧠Great for both beginners & advanced traders

▪️ What are they?

▪️ Types of MAs

▪️ Why are they such a powerful tool?

▪️ How to properly use them?

▪️ My best SECRET EMA value?

▪️ Which Timeframe to use?

▪️ Advanced EMA technique?

1/20

▪️ What are they?

Moving average is nothing more than an average price of the last (value) of candles.

If we are gonna use an example of MA(50) it is gonna be the mean price of the last 50 candles

General rule:

Price above = Bullish 🐂

Price below = Bearish 🐻

2/20

Moving average is nothing more than an average price of the last (value) of candles.

If we are gonna use an example of MA(50) it is gonna be the mean price of the last 50 candles

General rule:

Price above = Bullish 🐂

Price below = Bearish 🐻

2/20

▪️ Types of Moving Averages

1) Simple Moving Average - SMA

2) Exponential Moving Average - EMA

3) Smoothed Moving Average - SMMA

4) Volume Weighted Average Price - VWAP

There are a few more but these are the most important in my opinion.

3/20

1) Simple Moving Average - SMA

2) Exponential Moving Average - EMA

3) Smoothed Moving Average - SMMA

4) Volume Weighted Average Price - VWAP

There are a few more but these are the most important in my opinion.

3/20

I won't be going that much into detail about each of them in this thread but more so covering MAs in general.

The important takeaway is there are many methods of calculations and each offers bit different pros & cons

I'll leave experimenting with each of them up to you

4/20

The important takeaway is there are many methods of calculations and each offers bit different pros & cons

I'll leave experimenting with each of them up to you

4/20

▪️ Why are they such a powerful tool?

Because they help everyone, even newbies, that are just starting out, to easily & visually clearly identify trends without understanding the advanced Market Structure techniques.

Price above = 🐂

5/20

Because they help everyone, even newbies, that are just starting out, to easily & visually clearly identify trends without understanding the advanced Market Structure techniques.

Price above = 🐂

5/20

https://twitter.com/jackis_trader/status/1280130845030965250

In my opinion, they are a must for everyone just starting out & even advanced traders

Make no mistake, even big hedge funds use MAs

And by following the rule of only taking trades in the direction of the trend it will improve your portfolio in a big way

Price below =🐻

6/20

Make no mistake, even big hedge funds use MAs

And by following the rule of only taking trades in the direction of the trend it will improve your portfolio in a big way

Price below =🐻

6/20

▪️ How to properly use them?

The best technique is to use a good pair of two EMAs

One faster & one slower. In this example (50/100)

You can clearly see how much it would help us to identify the trend early & at the same time tell us when to avoid the market

7/20

The best technique is to use a good pair of two EMAs

One faster & one slower. In this example (50/100)

You can clearly see how much it would help us to identify the trend early & at the same time tell us when to avoid the market

7/20

You can use various combinations based on your style.

These ones I recommend.

Aggressive ones

(9/18)

(18/40)

(20/50)

Conservative ones

(50/100)

(50/200)

(100/200)

8/20

These ones I recommend.

Aggressive ones

(9/18)

(18/40)

(20/50)

Conservative ones

(50/100)

(50/200)

(100/200)

8/20

Aggressive ones are great for more immediate trend following whereas conservative ones are more for investing over a longer period of time.

It's not that one is better than the other it's more about which one suits your psychology better

9/20

It's not that one is better than the other it's more about which one suits your psychology better

9/20

Once you have established your desire EMAs you look to trade in the direction of the trend ONLY.

You either wait for a classic S/R or till the price is trading between the EMAs

The important thing is to have the patience to wait for it & follow the plan

10/20

You either wait for a classic S/R or till the price is trading between the EMAs

The important thing is to have the patience to wait for it & follow the plan

10/20

▪️ My best SECRET EMA value?

I'm giving you my ALPHA value here for FREE and it's EMA 89 on the H1 TF

It's great for intraday scalps & short term trading

This EMA clearly shows the current trend and price has a big tendency to come back to it all the time.

11/20

I'm giving you my ALPHA value here for FREE and it's EMA 89 on the H1 TF

It's great for intraday scalps & short term trading

This EMA clearly shows the current trend and price has a big tendency to come back to it all the time.

11/20

I recommend using this Higher Timeframe EMA indicator in @tradingview made by ZenAndTheArtOfTrading

12/20

12/20

What it does, is that it allows you to switch between each timeframe while EMA is still set on the hourly

In this case M15 timeframe but using EMA 89 from the hourly.

You can clearly see, there is a magical number after all.

Use it well.

13/20

In this case M15 timeframe but using EMA 89 from the hourly.

You can clearly see, there is a magical number after all.

Use it well.

13/20

▪️ Which Timeframe to use?

As always, I highly recommend using the Daily & Weekly for the general directional bias.

However, you can use MAs on any timeframe.

And when you align Daily & Intraday MAs in a trend & only trade when the price is above, magic happens.

14/20

As always, I highly recommend using the Daily & Weekly for the general directional bias.

However, you can use MAs on any timeframe.

And when you align Daily & Intraday MAs in a trend & only trade when the price is above, magic happens.

14/20

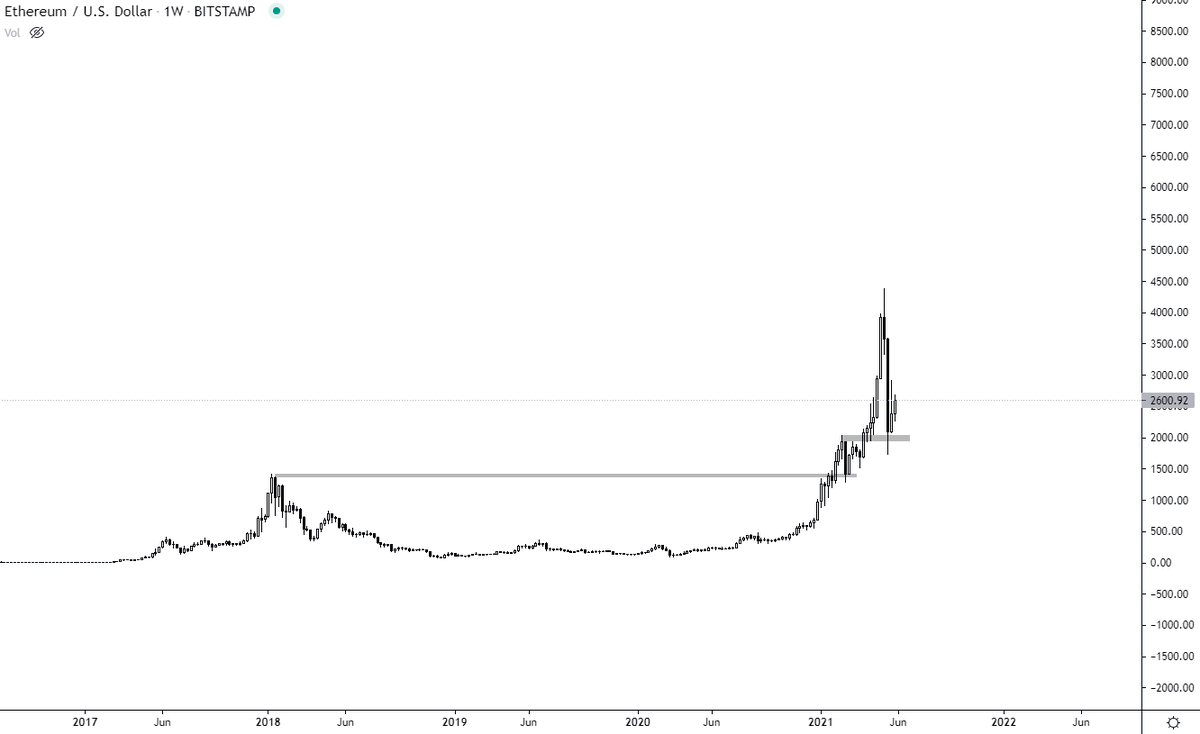

▪️ Advanced EMA technique?

Use one general trend divider EMA like (100) or (200)

Wait for the price to break above it.

If it finds momentum, the trend is established.

15/20

Use one general trend divider EMA like (100) or (200)

Wait for the price to break above it.

If it finds momentum, the trend is established.

15/20

You then go and start adjusting the EMA value number so it touches the last point of the bounce before it found the momentum to continue to higher.

In this case, it is 29, in some cases, it will be 18 or 36 or w/e. Just find the point of touch

16/20

In this case, it is 29, in some cases, it will be 18 or 36 or w/e. Just find the point of touch

16/20

Once you have found this EMA, it will be the critical point till the trend momentum prevails.

You can either use it as a tool to see if the trend is still going or buy near the EMA

17/20

You can either use it as a tool to see if the trend is still going or buy near the EMA

17/20

Works great everywhere even in the old $ALT / $BTC charts.

Requires a bit of work and patience but is another great tool.

18/20

Requires a bit of work and patience but is another great tool.

18/20

Something to think about

Some people use more than two EMAs like three or four and some even use the Rainbow indicator

This can be helpful, however, I like to keep my charts clean and I think two EMA do the job just perfect

But as always, try & see what fit you the best

19/20

Some people use more than two EMAs like three or four and some even use the Rainbow indicator

This can be helpful, however, I like to keep my charts clean and I think two EMA do the job just perfect

But as always, try & see what fit you the best

19/20

As with everything, this is not a holy grail but another great tool to use to spot the future markets moves and add to your probabilities

If you have found this thread valuable please consider liking & sharing it with your friends to help them

Thank you for your time 🙌

20/20

If you have found this thread valuable please consider liking & sharing it with your friends to help them

Thank you for your time 🙌

20/20

• • •

Missing some Tweet in this thread? You can try to

force a refresh