1/ About the Uniswap v3 launch and the end of Automated Market Making (AMM)

The AMM of yesterday is longer 💀

A thread.

👇👇👇

The AMM of yesterday is longer 💀

A thread.

👇👇👇

2/ If you have missed it, Uniswap launched yesterday with version 3 that radically changes their automated marketing model (AMM), bringing it closer to the central limit order book (CLOB) model.

Here is a good summary by @fintechfrank

Here is a good summary by @fintechfrank

https://twitter.com/fintechfrank/status/1374407629473083402

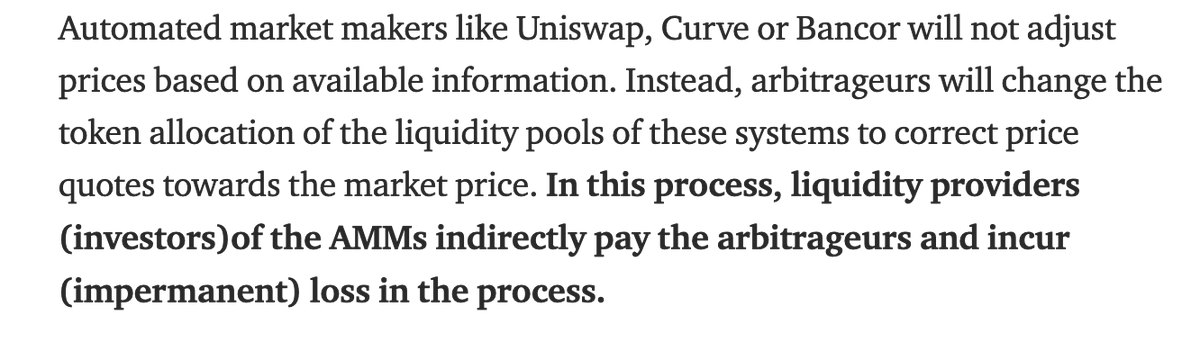

3/ The journey of Automated Market Making has been interesting.

The @synthetix_io innovation of liquidity mining finally made the DeFi ecosystem flourish in 2020.

Until this, on-chain exchanges were dismissed until liquidity mining made many people suddenly rich.

The @synthetix_io innovation of liquidity mining finally made the DeFi ecosystem flourish in 2020.

Until this, on-chain exchanges were dismissed until liquidity mining made many people suddenly rich.

4/ However as pointed out by professionals, being a liquidity provider in an inflexible AMM is like playing poker and your only available action is calling.

(I think it was @Fiskantes who said this)

(I think it was @Fiskantes who said this)

5/ Here is an excellent post by @belyakov123, the co-founder of @Opium_Network

medium.com/opium-network/…

medium.com/opium-network/…

6/ Another proponent of order-book based market making no other than @SBF_Alameda of FTX fame.

Here he gently whips cumbersome AMMs when the @ProjectSerum launched with their on-chain orderbooks

Here he gently whips cumbersome AMMs when the @ProjectSerum launched with their on-chain orderbooks

https://twitter.com/SBF_Alameda/status/1287661223043928064

6/ I assume Uniswap v3 allows informed market makers to optimise their yield curves easily like they would shift limit orders in centralised exchanges.

(People are still trying to wrap their heads around Uniswap v3 code which is an order of magnitude more complicated than v2)

(People are still trying to wrap their heads around Uniswap v3 code which is an order of magnitude more complicated than v2)

7/ I assume other Ethereum connected swap exchanges cannot follow Uniswap v3 model immediately, because they are behind on the innovation curve.

With the new Uniswap 2 yrs time locked GPL license, they cannot just copy-paste the innovation either.

With the new Uniswap 2 yrs time locked GPL license, they cannot just copy-paste the innovation either.

https://twitter.com/moo9000/status/1374414334139400207

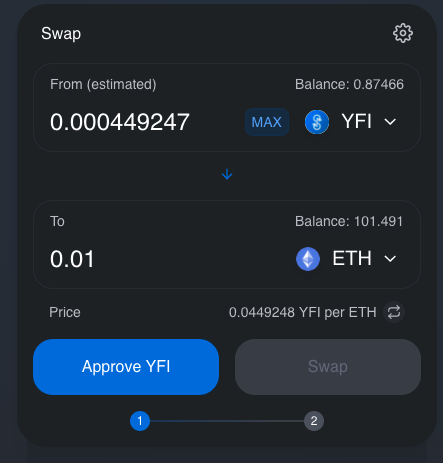

8/ This means that informed Uniswap v3 market makers can make much more profit, or be 4000x more efficient, as Uniswap team themselves stated

https://twitter.com/mhonkasalo/status/1374408266118090753

8/ Also, because Ethereum is full of flash loan bots from @AaveAave , this means these bots are going to have a feast on arbitrage opportunities.

Uniswap v3 follows CEX prices, or "price formation" betters, allowing flash loan bots profit on arb between Uni v3 and other swaps.

Uniswap v3 follows CEX prices, or "price formation" betters, allowing flash loan bots profit on arb between Uni v3 and other swaps.

9/ Note that this arbitration opportunity has always been there between CEX order books and AMMs like Uniswap and SushiSwap.

However you cannot arbitrage on centralised exchanges using flash loans, so this opportunity has not been such capital efficient before.

However you cannot arbitrage on centralised exchanges using flash loans, so this opportunity has not been such capital efficient before.

10/ Also, Ethereum transaction delays and gas fees have made this exploiting CEX-AMM arbitration tricky.

I tried myself.

I tried myself.

11/ Making on-chain trading more powerful will make it harder for retail investors to compete.

Becoming a liquidity provider on Uniswap v2 kind AMMs is just asking informed market makers to take your money for free.

Becoming a liquidity provider on Uniswap v2 kind AMMs is just asking informed market makers to take your money for free.

12/ Of course the real-life is not going to as straightforward as in my little Twitter thread, but I believe the writing has been always on the wall for simplistic AMMs.

The blockchain tech was not there yet to give us anything better.

The blockchain tech was not there yet to give us anything better.

13/ Some specialised AMMs, like @CurveFinance will still flourish, but the era of simple and happy liquidity pool parties is over.

The wolves are coming to the party.

The wolves are coming to the party.

• • •

Missing some Tweet in this thread? You can try to

force a refresh