1/ Welcome to #DeFi Wednesday.

Let's talk about how interest-bearing cash on a blockchain is going to revolutionise boring corporate treasury management that concerns every company is is a larger business than all crypto trading in the world.

Enter the thread

👇👇👇

Let's talk about how interest-bearing cash on a blockchain is going to revolutionise boring corporate treasury management that concerns every company is is a larger business than all crypto trading in the world.

Enter the thread

👇👇👇

2/ Blockchain community is often seen as toxic maxis and redditors who shill other their weekly favourite shitcoin in the hope of getting Lambo.

Sometimes we also do things that progress humanity towards the better future and interest-bearing cash is one of those things.

Sometimes we also do things that progress humanity towards the better future and interest-bearing cash is one of those things.

3/ Less chad and more things that actually matter:

My incomplete theory of interest-bearing cash is also available also as a blog post:

capitalgram.com/posts/interest…

It is 15 pages. Pick your slow poison or die fast by continue reading here.

My incomplete theory of interest-bearing cash is also available also as a blog post:

capitalgram.com/posts/interest…

It is 15 pages. Pick your slow poison or die fast by continue reading here.

4/ First time in the history we have an ability to create interest-bearing cash-like instruments.

Interest-bearing cash ticks up dollar (euro) balance real-time in your wallet.

Here is a demonstration using @aaveaave aDAI, based on @makerdao DAI, and @TrustWalletApp

Interest-bearing cash ticks up dollar (euro) balance real-time in your wallet.

Here is a demonstration using @aaveaave aDAI, based on @makerdao DAI, and @TrustWalletApp

5/ Interest-bearing cash is not like your bank's saving account. Your money in a bank is not yours, but bank's. There are some flaws in the current banking system causing a headache for Chief Financial Officers (CFOs)

6/ Ability to have interest-bearing cash will crank the efficiency of revenue and receivable management to 11.

Treasury managers no longer need to move money between the portfolio accounts and cash in hand.

Treasury managers no longer need to move money between the portfolio accounts and cash in hand.

7/ This is especially handy in the time of asset inflation. Chief financial officers should value stored in assets that keep going up.

More about asset and other inflations in this newsletter from @LynAldenContact "Defining inflation"

lynalden.com/november-2020-…

More about asset and other inflations in this newsletter from @LynAldenContact "Defining inflation"

lynalden.com/november-2020-…

8/ But let's start from the beginning.

Why this innovation could not have happened before? How interest-bearing cash is related to cryptocurrencies, but not being a cryptocurrency itself? What is the history that brought us here.

👇👇👇

Why this innovation could not have happened before? How interest-bearing cash is related to cryptocurrencies, but not being a cryptocurrency itself? What is the history that brought us here.

👇👇👇

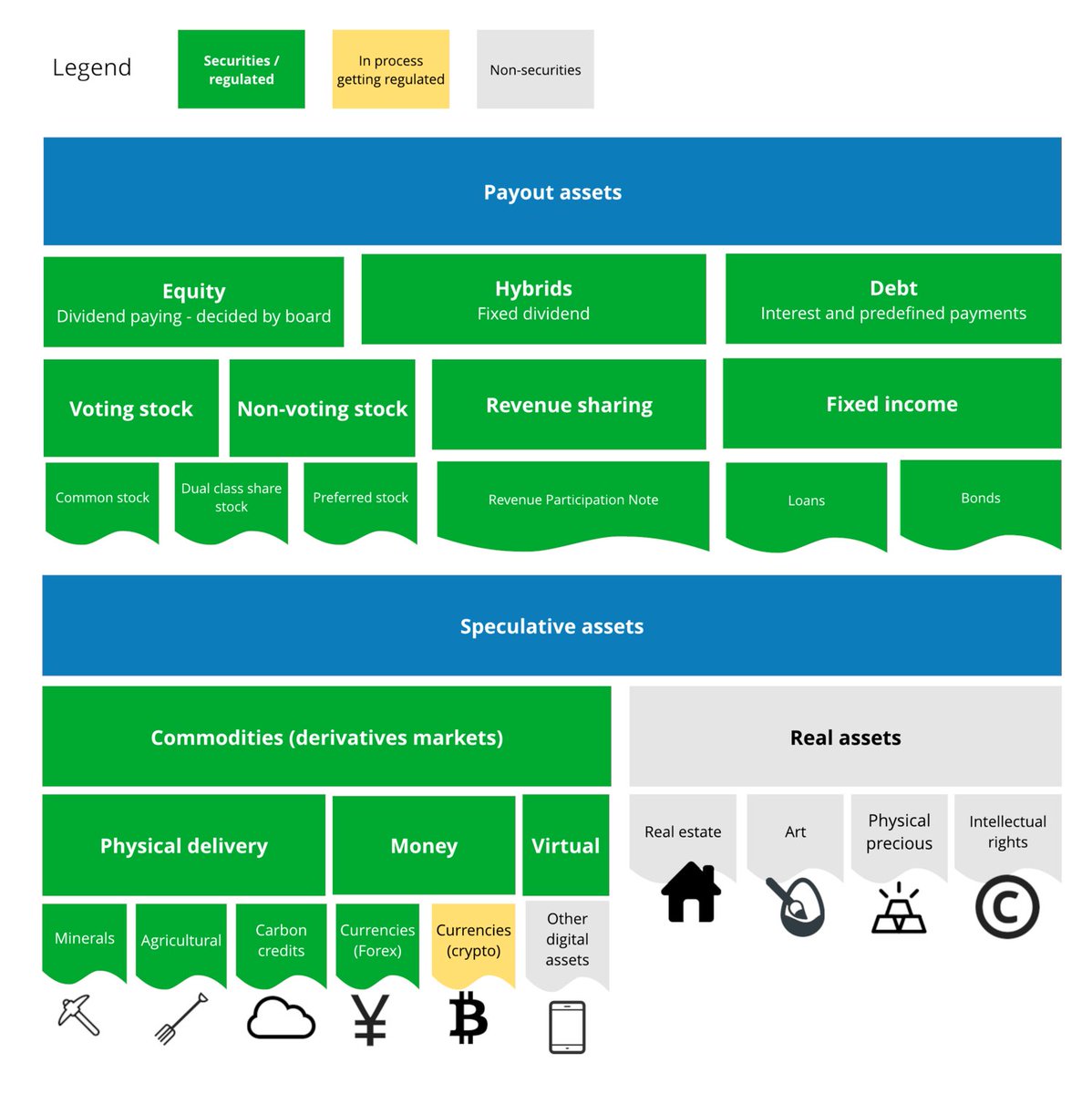

9/ We can roughly classify payment and treasury management financial assets to two categories:

Money and securities (equities, bonds) and then non-liquid assets like real estate and your art collection.

Here is a full picture.

Money and securities (equities, bonds) and then non-liquid assets like real estate and your art collection.

Here is a full picture.

10/ From the point of information infrastructure (IT), money and securities run on different "rails". Below is how we ended up in this situation.

You cannot "send stocks and shares on PayPal"

You cannot "send stocks and shares on PayPal"

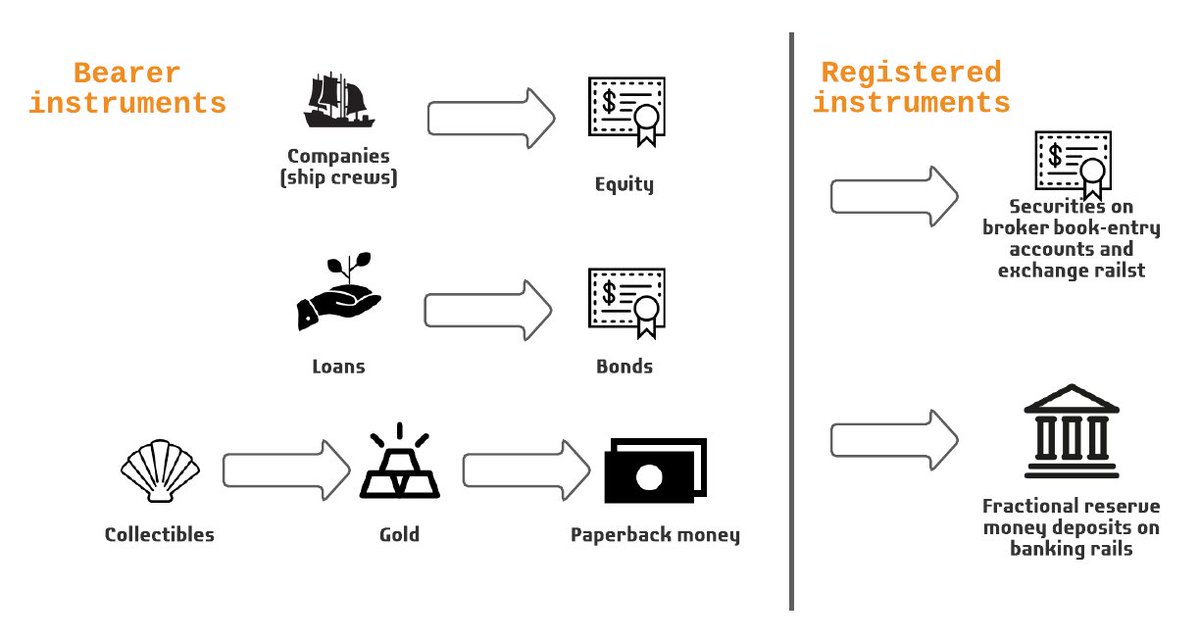

11/ Money is traditionally called a "bearer instrument". Because anyone who carries paper bills can use them to make payment.

Whereas stocks and bonds are "registered" held on a broker and you pay your broker (and 100s of other middlemen) for this fantastic service.

Whereas stocks and bonds are "registered" held on a broker and you pay your broker (and 100s of other middlemen) for this fantastic service.

12/ The divide between bearer and registered instruments isn't that black and white nowasdays.

Most of money is on registered bank accounts. Bearer bonds are a thing, because registered bonds are too expensive and investors prefer the freedom they give.

ecsda.eu/wp-content/upl…

Most of money is on registered bank accounts. Bearer bonds are a thing, because registered bonds are too expensive and investors prefer the freedom they give.

ecsda.eu/wp-content/upl…

13/ Distinction between money and securities rails is legal and regulatory.

For both online bank accounts and online broker accounts computers the same thing: when you buy something in a transaction computer debits one account and credits another.

Computer does not care.

For both online bank accounts and online broker accounts computers the same thing: when you buy something in a transaction computer debits one account and credits another.

Computer does not care.

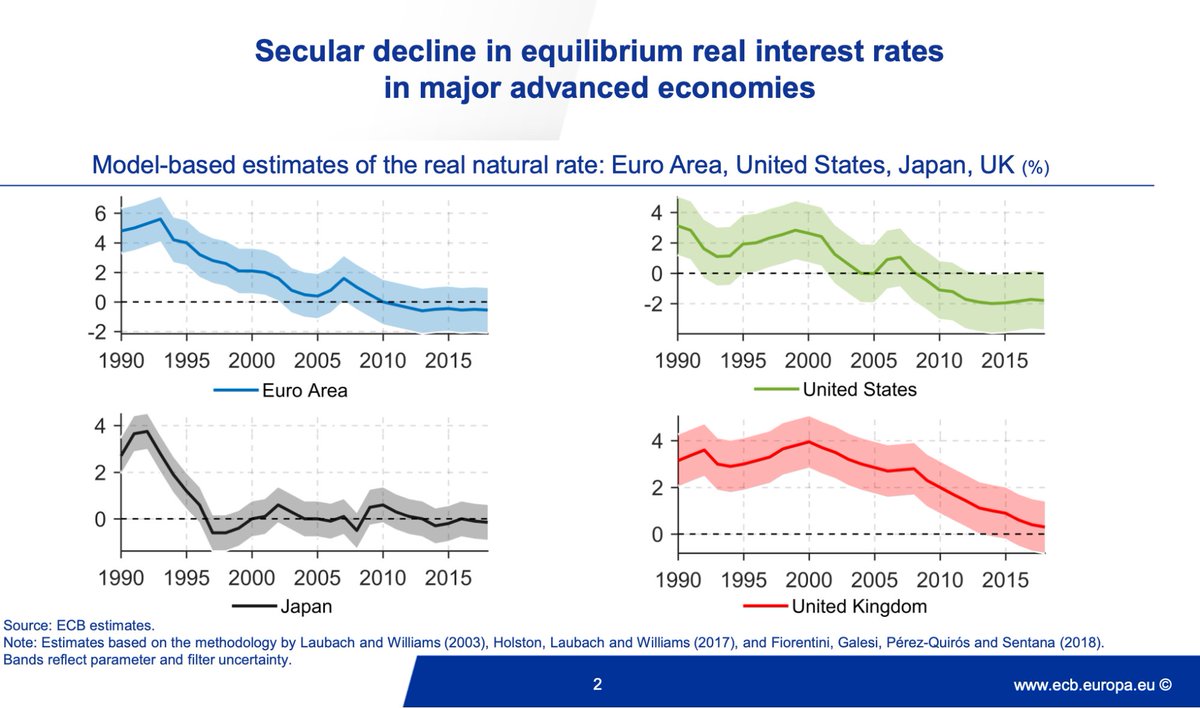

14/ Your money is on a bank account. Checkings and savings account no longer give meaningful nominal interest, not to mention real interest. You lose value every day your money is in a bank.

15/ Negative interest is rarely pushed to retail bank accounts, but corporate accounts already suffer from it. Businesses, especially large ones, are bleeding that -0.35% plus tons of other corporate banking fees every month.

ecb.europa.eu/press/key/date…

ecb.europa.eu/press/key/date…

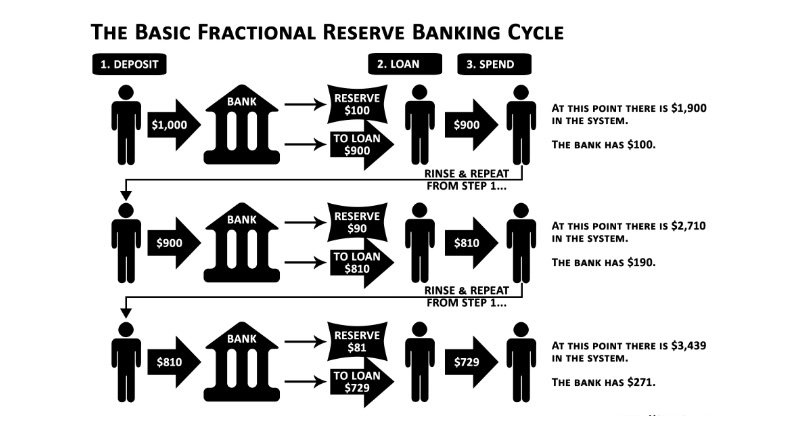

16/ Having money in a bank is also a risk. The financial crisis of 2008, Cyprus haircut, etc. near-history events show this. The fractional banking system is overleveraged.

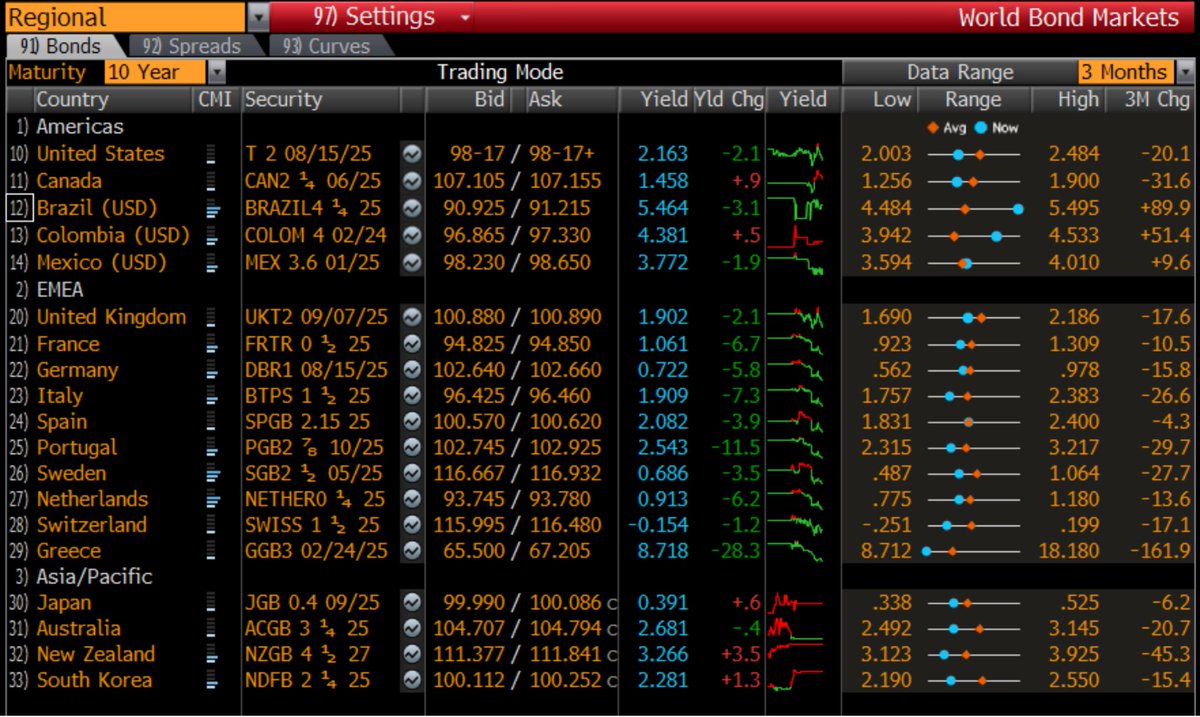

17/ Because of the counterparty risk of having your assets in a bank, large capital seeks another medium of exchanges and store of value. Enter the bonds. Especially treasury bonds (T-bills in the US).

18/ With national treasury bonds the counterparty risk you have is only with a state. Granted, countries default now and then, but it is still an order of a magnitude improvement over having a counterparty risk with an overleveraged bank.

19/ Treasury bonds are used as collateral for trading. Large funds, like pension funds, store wealth in them.

20/ Granted, bonds are also going to negative % territory.

There are still ways to get profit margins out of them. You can e.g. trade the negative yield bond with "roll downs" for profit.

corporatefinanceinstitute.com/resources/know…

There are still ways to get profit margins out of them. You can e.g. trade the negative yield bond with "roll downs" for profit.

corporatefinanceinstitute.com/resources/know…

21/ But one thing you cannot do with a bond is to pay your cup of latte. The IT rails for securities are optimised for large transactions. The fixed overhead per transaction is too high to use them as a medium of exchange for good and services.

22/ Here is the summary of "drivers" for interest-bearing cash

- An account in a bank is not good store of value

- Having assets in a bank poses a counterparty risk

- Bonds are already used as MoE a SoV in large transactions

- Computers do not care what you use for a payment

- An account in a bank is not good store of value

- Having assets in a bank poses a counterparty risk

- Bonds are already used as MoE a SoV in large transactions

- Computers do not care what you use for a payment

23/ What is interest-bearing cash and how it is created?

Let's look at the example running on @aaveaave protocol

👇👇👇

Let's look at the example running on @aaveaave protocol

👇👇👇

24/ What if we can combine good medium-of-exchange and store-of-value properties in the same financial instrument?

25/ The original promise of Bitcoin was this: "peer-to-peer" cash.

Unfortunately, #Bitcoin and other cryptocurrencies proved too volatile to be used as a medium of exchange. The coffee shop small business owner is in troubles if his December revenue received -33% haircut.

Unfortunately, #Bitcoin and other cryptocurrencies proved too volatile to be used as a medium of exchange. The coffee shop small business owner is in troubles if his December revenue received -33% haircut.

26/ We need something with the stability of bonds, decent yield and the cheap, efficient way to transact as we have with cash.

27/ Aave is a money-market protocol that matches lenders are borrowers.

Although Aave supports interest-bearing aTokens for every possible token, US dollar-based markets are the most popular ones.

Although Aave supports interest-bearing aTokens for every possible token, US dollar-based markets are the most popular ones.

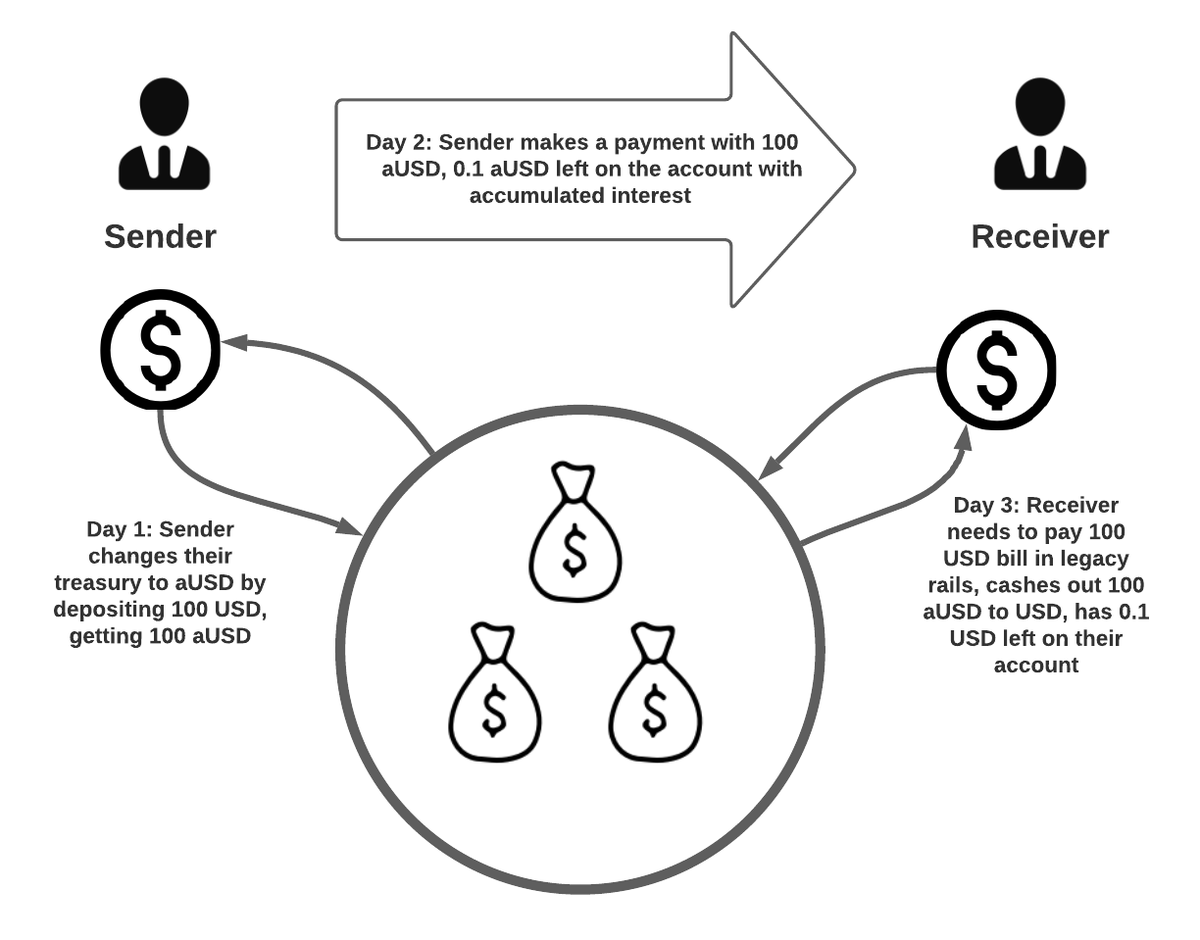

28/ When you put 100 USD into Aave lending pool as a lender, you receive 100 aUSD "aTokens" back.

Here is an example using tokenised GUSD dollar from @Gemini exchange, from @tyler and @cameron Winklewoss fame.

Here is an example using tokenised GUSD dollar from @Gemini exchange, from @tyler and @cameron Winklewoss fame.

29/ The underlying lending pool receives interest. The corresponding aUSD amount in your wallet goes up in real-time.

Here is @aaveaave aDAI balance ticking up real-time in @trustwallet

(Animation sped up for the effect)

Here is @aaveaave aDAI balance ticking up real-time in @trustwallet

(Animation sped up for the effect)

30/ When you make a payment with aUSD, you will debit the dollar amount from your account as normal. The trick here is that the receiver who gets aUSD starts gaining interest on the moment of payment.

31/ If transacting payer and receiver in are happy with the (low) risk profile of Aave USD pools, they never need to do "downshift" to money money, making smaller number of transactions and having yield generating capability maximised.

32/ Aave aTokens are not only interest-bearing cash tokens in #Ethereum. As far as I know, the concept was originally piloted by rDAI (redeemable DAI, @rDAI_dao)

rdai.money

rdai.money

33/ What is the innovation that makes interest-bearing cash possible now?

"Ethereum of course!" would be a nice shilly answer, but there is more into it.

Here is a breakdown of the last 7 years of blockchain development.

👇👇👇

"Ethereum of course!" would be a nice shilly answer, but there is more into it.

Here is a breakdown of the last 7 years of blockchain development.

👇👇👇

34/ Stablecoins were created in 2014. The first one was @officialnubits, soon followed by Tether. They predate smart contracts.

You need to have something pegged to USD or EUR to call it stable.

You need to have something pegged to USD or EUR to call it stable.

35/ Then we have smart contracts that were created with #Ethereum

Smart contracts enable non-custodial, counterparty risk-free transactions, like ones with a lending pool.

No bank manager can mismanage your funds.

Smart contracts enable non-custodial, counterparty risk-free transactions, like ones with a lending pool.

No bank manager can mismanage your funds.

36/ Blockchain has #opensource ecosystem and a public ledger.

It is almost zero cost for third parties to integrate with.

Whereas Visa/Mastercard, etc. are behind proprietary protocols where you pay up just to read the documentation.

It is almost zero cost for third parties to integrate with.

Whereas Visa/Mastercard, etc. are behind proprietary protocols where you pay up just to read the documentation.

37/ To have yield, you need demand (borrowers)

#DeFi protocols, in development since 2017, demand in stablecoin borrowing started 2020: reached a maturity level they really took off.

entrepreneur.com/article/362319

#DeFi protocols, in development since 2017, demand in stablecoin borrowing started 2020: reached a maturity level they really took off.

entrepreneur.com/article/362319

38/ Currently DeFi lending is mostly used by crypto traders, but this does not need to be the case.

5% - 15% interest is in a range of a Western credit card or developing nation business loan.

5% - 15% interest is in a range of a Western credit card or developing nation business loan.

39/ We really are there - the only problem to figure out is blockchain scaling.

I am happy to see @NEARProtocol and @ElrondNetwork doing excellent work here.

I am happy to see @NEARProtocol and @ElrondNetwork doing excellent work here.

40/ But how about the risk?

That's the first question from every CFO.

👇👇👇

That's the first question from every CFO.

👇👇👇

41/ Historically, March 2020 was the first real life stress test for #DeFi

Cryptocurrency, most prevalent collateral in lending pools, crashed down billions of dollars in value.

Cryptocurrency, most prevalent collateral in lending pools, crashed down billions of dollars in value.

42/ DeFi still held.

MakerDAO took $4M haircut, but it is peanuts compared to the total value of DeFi lending pools.

forum.makerdao.com/t/black-thursd…

MakerDAO took $4M haircut, but it is peanuts compared to the total value of DeFi lending pools.

forum.makerdao.com/t/black-thursd…

43/ The systematic risk in smart contract-based lending pools is smaller than in traditional banking.

- Positions are always collateralised

- Asset baskets are 100% transparent

- No insider fraud

- No credit card

- Positions are always collateralised

- Asset baskets are 100% transparent

- No insider fraud

- No credit card

44/ Granted there is technology risk.

What if smart contracts have bugs in them?

However this risk is a fixed cost and relative to the size of Assets Under Management (AUM)

What if smart contracts have bugs in them?

However this risk is a fixed cost and relative to the size of Assets Under Management (AUM)

45/ Also, being conservative with collateral also means that crypto margin trading, longing/shorting, is less capital efficient than professional stock markets.

Wall Street and London City traders complain they cannot do 100x kek kek.

Wall Street and London City traders complain they cannot do 100x kek kek.

46/ How about the future?

Here is the part where I tell you banks will die.

👇👇👇

Here is the part where I tell you banks will die.

👇👇👇

47/ I see the future of treasury management as a web page dashboard.

CFOs to adjust the treasury risk/reward ratio based on their corporate needs. Underlying positions are automatically updated.

CFOs to adjust the treasury risk/reward ratio based on their corporate needs. Underlying positions are automatically updated.

48/ Whenever a payment is made, it goes out in an interest-bearing instrument. In business-to-business payments, there is no need to exchange instruments forth and back to money on a checking account if both parties are happy with the underlying risk parameters which are low.

49/ A “downshift” back to legacy money rails is only needed when a payer conducts payments requiring a legal tender, like taxes.

50/ When there is less need for parties to go back and forth to actual money and cash, there is less need for banks.

The whole banking machinery can be replaced by a smart contract having money inflows, outflows and risk parameters.

The whole banking machinery can be replaced by a smart contract having money inflows, outflows and risk parameters.

51/ Automated smart contracts are vastly more efficient than banks that tend to high-cost structure and management bonuses.

52/ There is also less need for eMoney companies (PayPal) and card companies (Visa/Mastercard) because blockchain rails are open and operate payments more efficiently with less staff.

53/ Due to the open and global reach of blockchains, it is easier for people to opt into different payment instruments instead of a national bank account. People’s savings in interest-bearing cash are less punishable by monetary policy screw-ups

55/ Raise of flexible interest-bearing cash-like instruments mean national central banks, and Federal Reserve and European Central Bank, have less room to manipulate monetary policy to cover issues with over-indebtedness, both government and financial system in general.

56/ Why would you accept bad government money, when there is an easy way to accept sound Internet money?

FIN.

FIN.

57/ Ps. The link to the full blog post again - please share to your CFO

capitalgram.com/posts/interest…

capitalgram.com/posts/interest…

• • •

Missing some Tweet in this thread? You can try to

force a refresh