I've updated NVT Signal to correct for upward drift in the metric (due to volumes moving off the blockchain and only L2).

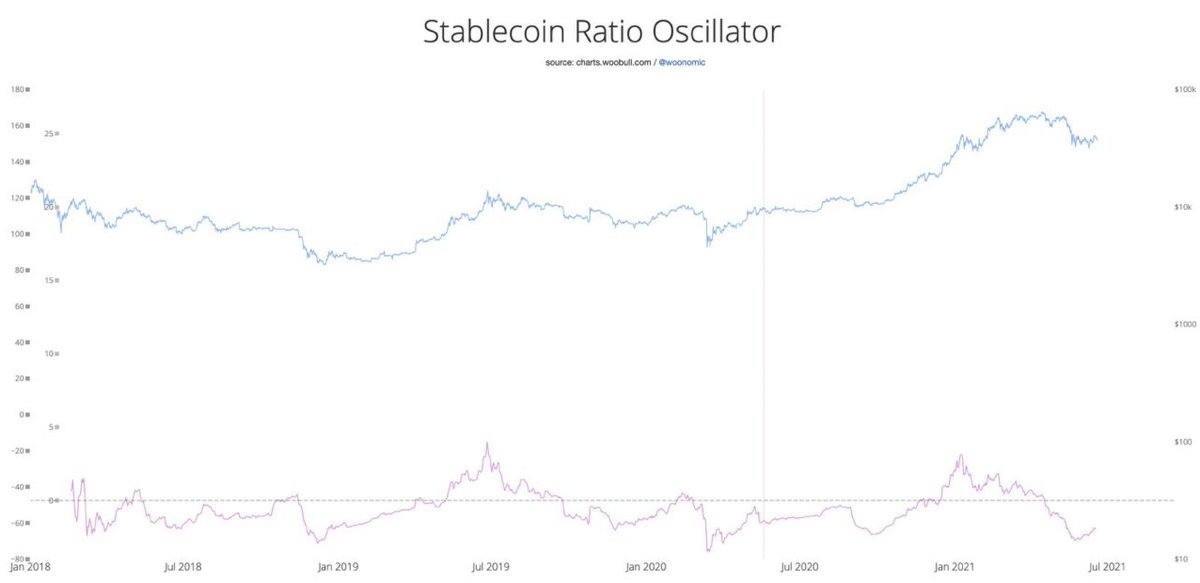

And yes, BTC is OVERSOLD at historic levels.

And yes, BTC is OVERSOLD at historic levels.

NVTS was first published in Feb 2018 by @Kalichkin, as a more responsive trading signal based on my NVT Ratio.

woobull.com/nvt-signal-a-n…

woobull.com/nvt-signal-a-n…

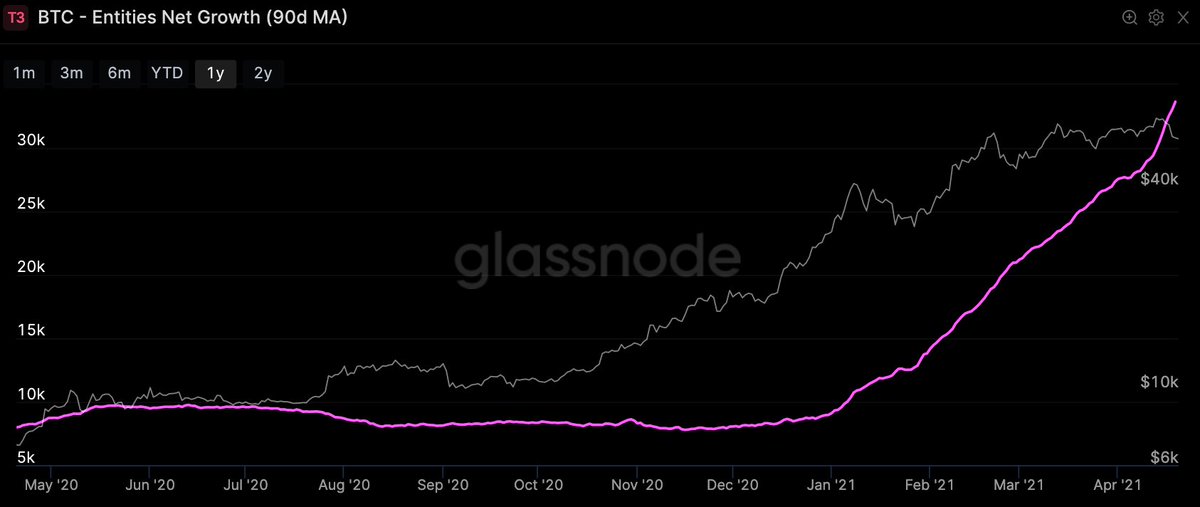

Exchange dominance increased over time. This had the effect of making a proportion of the long term investor volume invisible to on-chain analysis, only happening inside exchanges.

To compensate, instead of displaying the raw NVTS value, we can just show how many standard deviations NVTS is above or below its norm.

I've used the 2yr moving average as the norm and standard deviation is calculated using 2 years of historical sampling.

I've used the 2yr moving average as the norm and standard deviation is calculated using 2 years of historical sampling.

Live chart: charts.woobull.com/bitcoin-nvt-si…

The NVT family of metrics uses economic first principles to value Bitcoin's network.

https://twitter.com/woonomic/status/1399644889596370950?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh