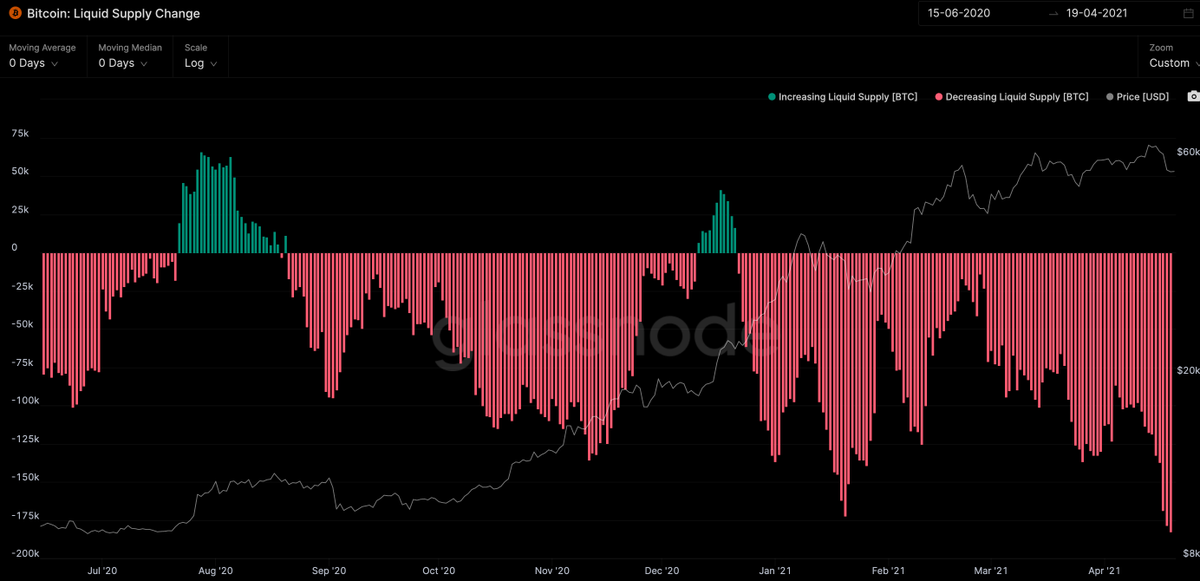

The previous chart was a 30 day sum of coin movements.

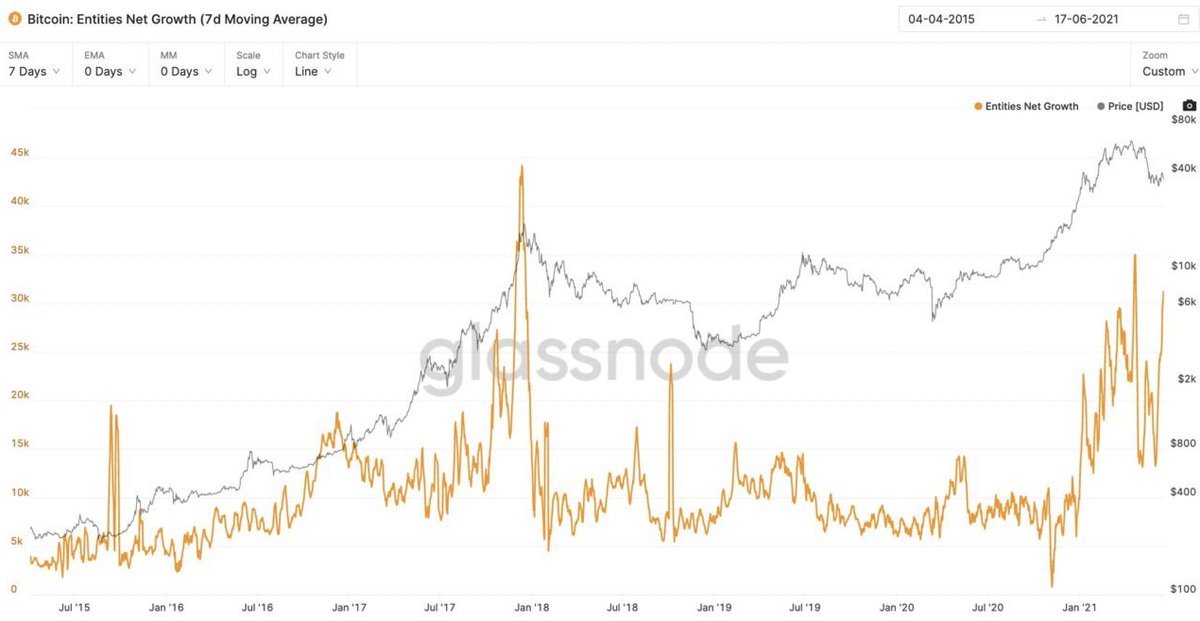

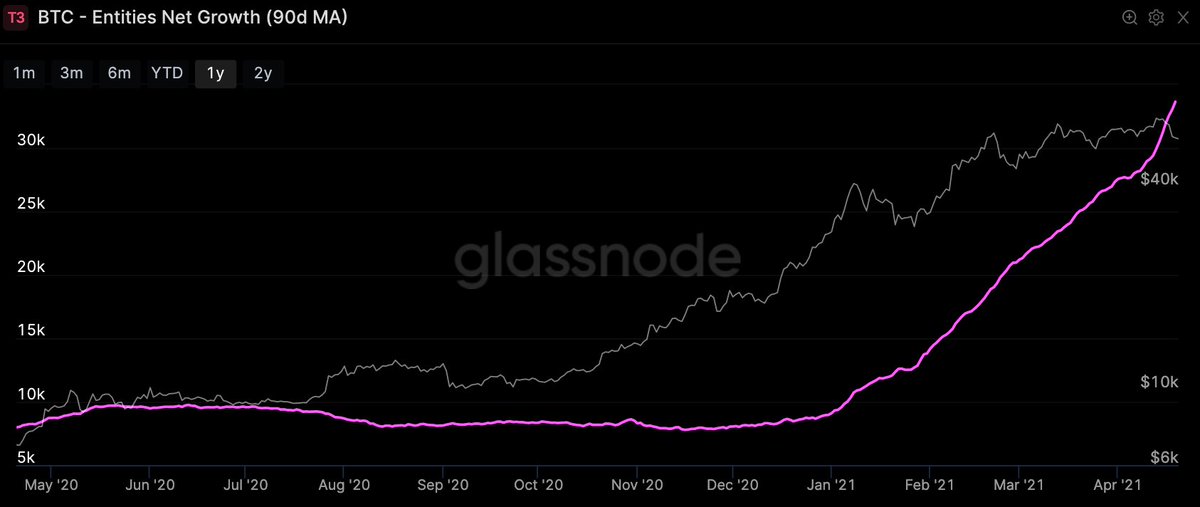

Here's the 7 day view showing greater granularity.

We can see how the mass of coins dumped out to speculative hands are being re-accumulated by strong hands in a pattern similar to the COVID recovery (8 weeks to recover).

Here's the 7 day view showing greater granularity.

We can see how the mass of coins dumped out to speculative hands are being re-accumulated by strong hands in a pattern similar to the COVID recovery (8 weeks to recover).

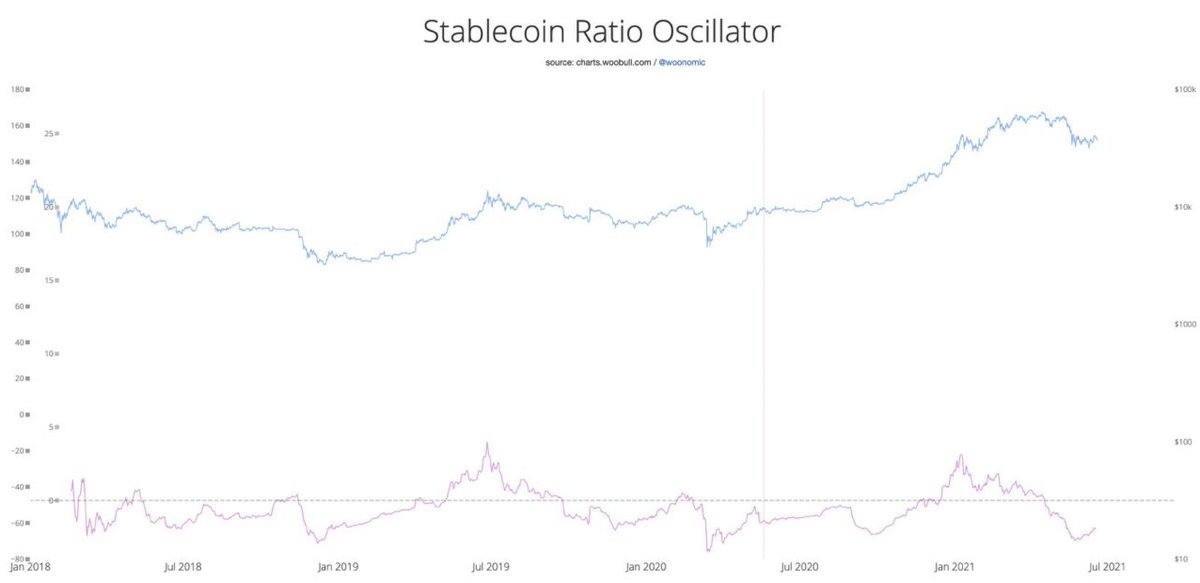

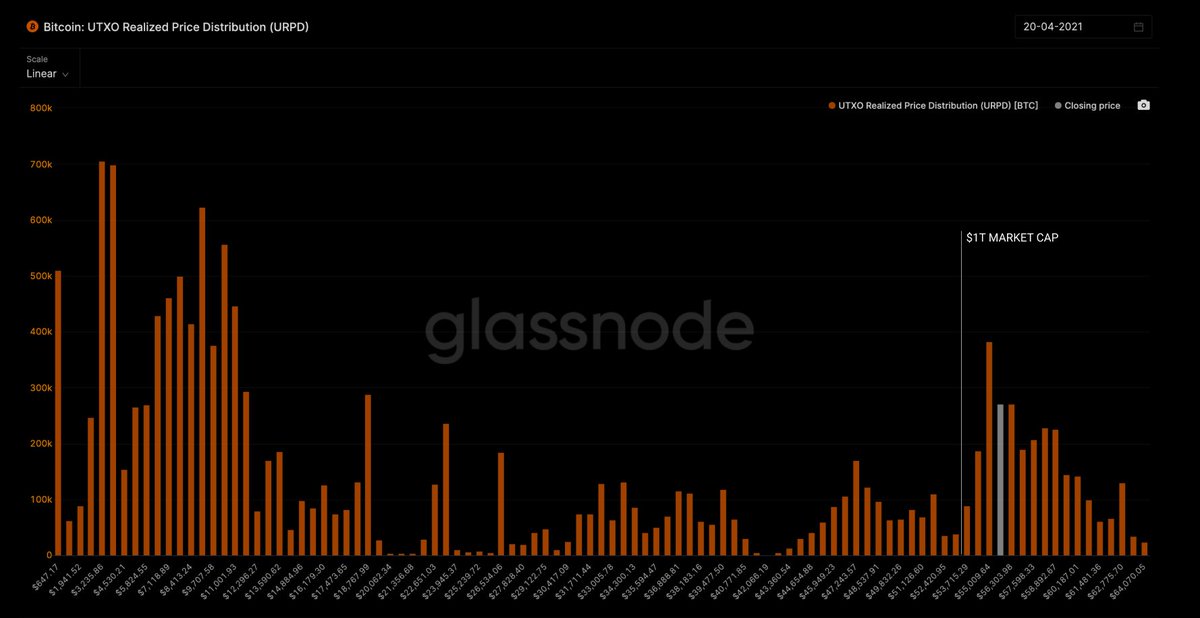

So who is selling?

Whales aren't selling.

Sharks aren't selling.

Dolphins aren't selling.

Big holders are holding.

Whales aren't selling.

Sharks aren't selling.

Dolphins aren't selling.

Big holders are holding.

So yeah, it's definitely a bear market folks.

🙄←sarcasm

We should all panic sell because traders tell us there's two moving averages that just crossed and they carry the name "death" in it. Sounds so scary. 😱

🙄←sarcasm

We should all panic sell because traders tell us there's two moving averages that just crossed and they carry the name "death" in it. Sounds so scary. 😱

This tweet was brought to you with the help of @glassnode on-chain data.

Cryptotwitter tells me this data is a hopium conspiracy; I can neither confirm or deny this fact, but please post me your bear porn.

Cryptotwitter tells me this data is a hopium conspiracy; I can neither confirm or deny this fact, but please post me your bear porn.

• • •

Missing some Tweet in this thread? You can try to

force a refresh