The race is on! The declining COST of wind and solar power is in a race with declining MARKET VALUE: which will win? New research in Joule looks at trends by region, at emp.lbl.gov/news/declining… THREAD!

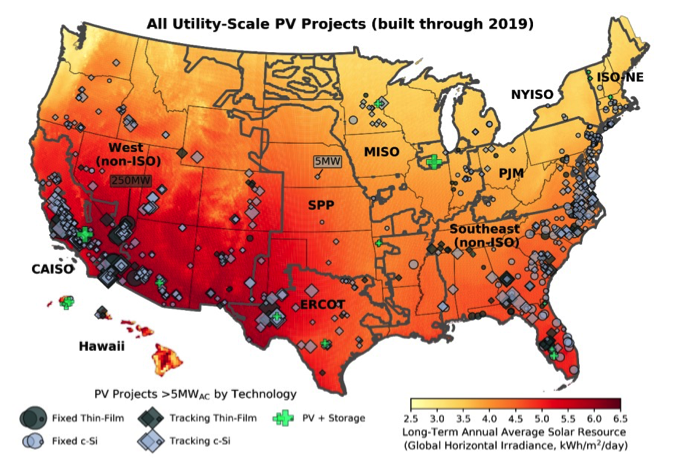

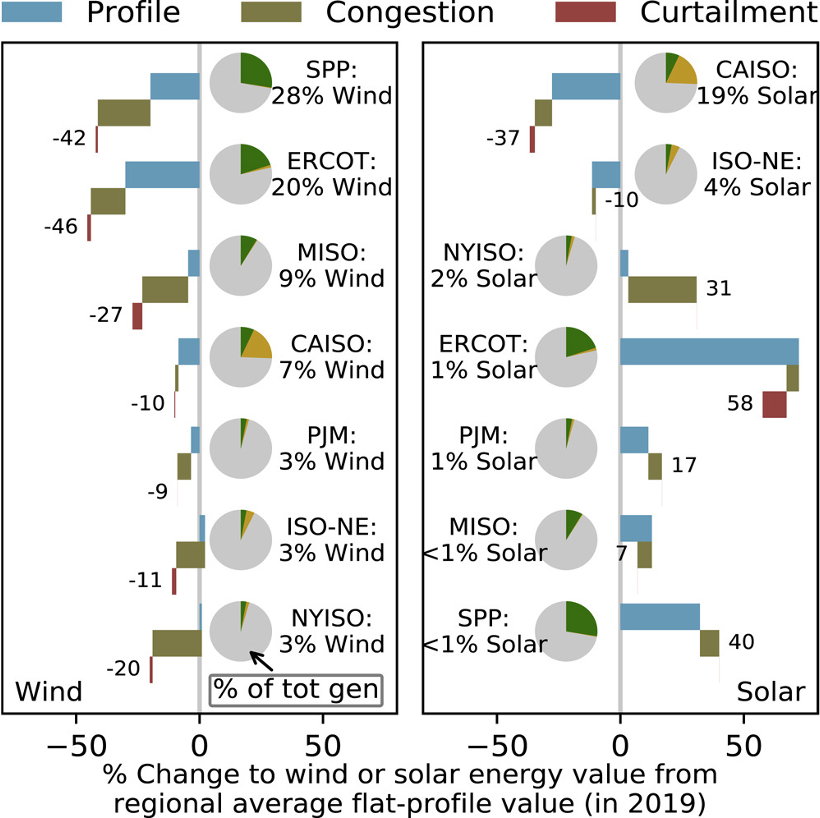

While solar has high value at low penetrations, value falls as output grows – solar is 19% of generation in CAISO, with major drops in value. Wind has low value at every penetration, but has faced less value decline with market share to date. 2/x

The biggest value penalties come from the timing of generation not matching high market prices, and from congestion causing pockets of low prices. Curtailment was not a major factor. Value penalties rise with market share. 3/x

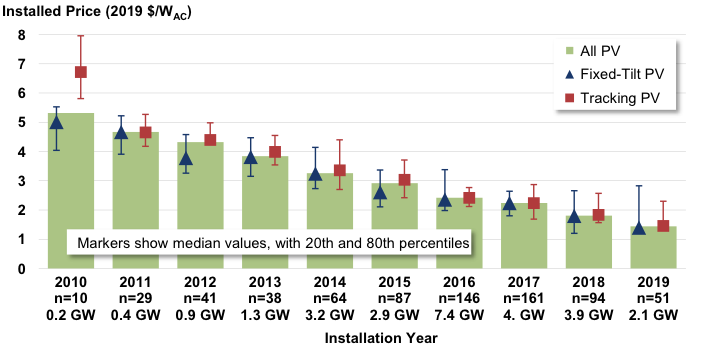

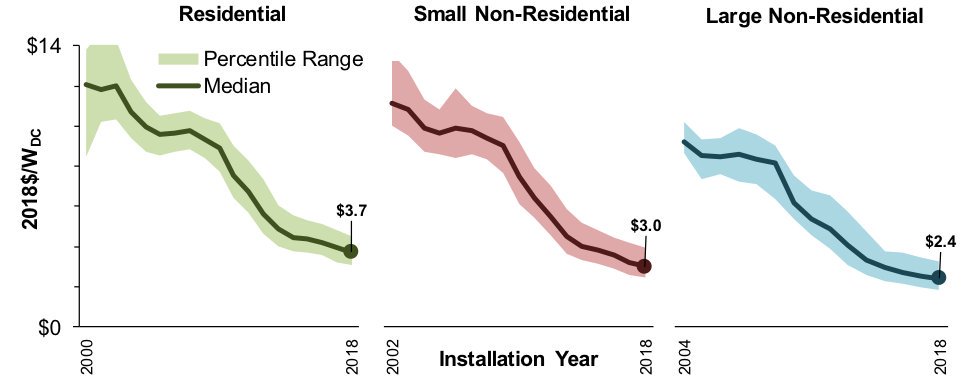

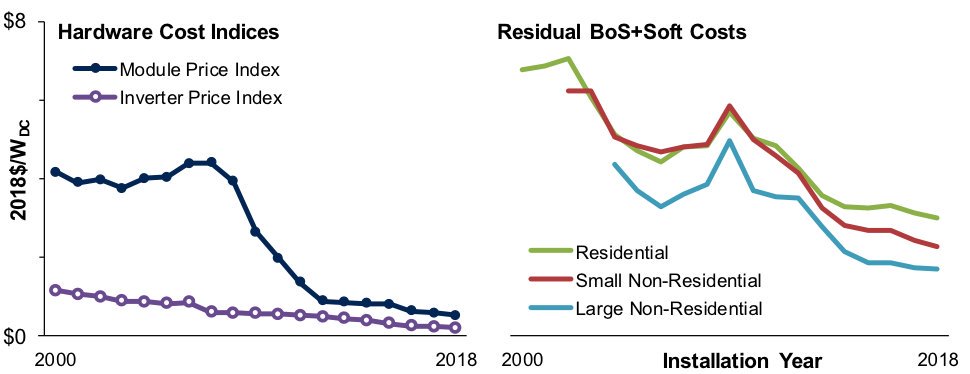

The good news is that the COST of wind and solar has fallen faster than its VALUE. But how long can that continue? What happens if future value falls below cost?

New research in Joule looks at trends by region, at emp.lbl.gov/news/declining…

4/x

New research in Joule looks at trends by region, at emp.lbl.gov/news/declining…

4/x

Strategies to minimize value decline must be matched with its cause in each region. New transmission will relieve congestion penalties. Storage or flexible demand will help with the timing penalty. 5/x

Solar developers are responding by pairing #solarenergy with batteries in “hybrid” plants. Wind developers are using larger blades to shift output to more hours. Vehicle and building electrification may change the game altogether.

6/x

6/x

For the full analysis of the race between COST and VALUE of wind and solar, see the @BerkeleyLab research in the journal Joule at emp.lbl.gov/news/declining…. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh