🏦Fed Jargon 101: A Primer on Hawks, Dots & Monetary Policy🏦

No matter what type of trader u are —discretionary, macro, crypto, chad, virgin— everyone obsesses abt the Fed.

But why? Here's a 🧵 on how Fed moves markets, controls ur PnL & the odd lingo we use to describe it.

👇

No matter what type of trader u are —discretionary, macro, crypto, chad, virgin— everyone obsesses abt the Fed.

But why? Here's a 🧵 on how Fed moves markets, controls ur PnL & the odd lingo we use to describe it.

👇

1/ Beta

#1 reason any trader cares about the Fed is to predict beta.

What's that?

Say u made 120% returns in 2020. Are u a genius or did u just own a buncha tech stocks as #jpow cranked the moneyprinter? Beta is the overall equity market risk (aka rising tide floats all boats).

#1 reason any trader cares about the Fed is to predict beta.

What's that?

Say u made 120% returns in 2020. Are u a genius or did u just own a buncha tech stocks as #jpow cranked the moneyprinter? Beta is the overall equity market risk (aka rising tide floats all boats).

To be "long beta" means ur net long stocks. "Short beta" means ur net short.

Beta on a single asset refers to correlation to an equity benchmark (eg SPY).

β>1: more volatile than SPY

0<β<1: less volatile

-1<β<0: less volatile & anticorrelated

β<-1: more volatile & anticorrelated

Beta on a single asset refers to correlation to an equity benchmark (eg SPY).

β>1: more volatile than SPY

0<β<1: less volatile

-1<β<0: less volatile & anticorrelated

β<-1: more volatile & anticorrelated

2/ Relationship btw Fed & beta

The Fed directly controls directionality of beta, i.e. #jpow can single-handedly crash the market by 5% with an uncomfortable stutter or send it to the moon like in H2 2020.

How? First, understand that the Fed's goal is to keep the economy stable.

The Fed directly controls directionality of beta, i.e. #jpow can single-handedly crash the market by 5% with an uncomfortable stutter or send it to the moon like in H2 2020.

How? First, understand that the Fed's goal is to keep the economy stable.

This includes price of goods, inflation, labor market, etc. In order to achieve its stability goal, the Fed has 3 tools at its disposal:

a. Setting interest rates

b. Setting reserve requirements —overnight bank collateral

c. Open market operations — buying/selling Treasury bonds

a. Setting interest rates

b. Setting reserve requirements —overnight bank collateral

c. Open market operations — buying/selling Treasury bonds

2a/ Fed Funds Rate

Whenever traders use the generic term "rates" (which rates?) assume they mean Fed Funds.

FFR is a base rate — the rate that banks & other depository institutions use to lend money to each other overnight. All other rates are just premiums on top of FFR.

Whenever traders use the generic term "rates" (which rates?) assume they mean Fed Funds.

FFR is a base rate — the rate that banks & other depository institutions use to lend money to each other overnight. All other rates are just premiums on top of FFR.

When the Fed does a "rate hike," it increases FFR by .25% or .5%, making it slightly costlier for banks to borrow from each other. So they pass on that spread, which makes it costlier for you & me to get a mortgage, car loan, etc. This slows down the economy & curbs inflation.

2b/ Reserve requirements

Fed also controls money supply (dollars in circulation) by setting the reserve requirement — amount of funds banks must hold against deposits.

When reqs are low, banks can loan out more $$, which increases money supply & spending, boosting the markets.

Fed also controls money supply (dollars in circulation) by setting the reserve requirement — amount of funds banks must hold against deposits.

When reqs are low, banks can loan out more $$, which increases money supply & spending, boosting the markets.

2c/ Open-market Operations

Lastly, the Fed directly manipulates money supply by buying/selling treasury bonds.

To tighten supply, the Fed sells bonds. This takes cash in & removes dollars from the system.

To increase supply, the Fed buys bonds. This injects cash into the system.

Lastly, the Fed directly manipulates money supply by buying/selling treasury bonds.

To tighten supply, the Fed sells bonds. This takes cash in & removes dollars from the system.

To increase supply, the Fed buys bonds. This injects cash into the system.

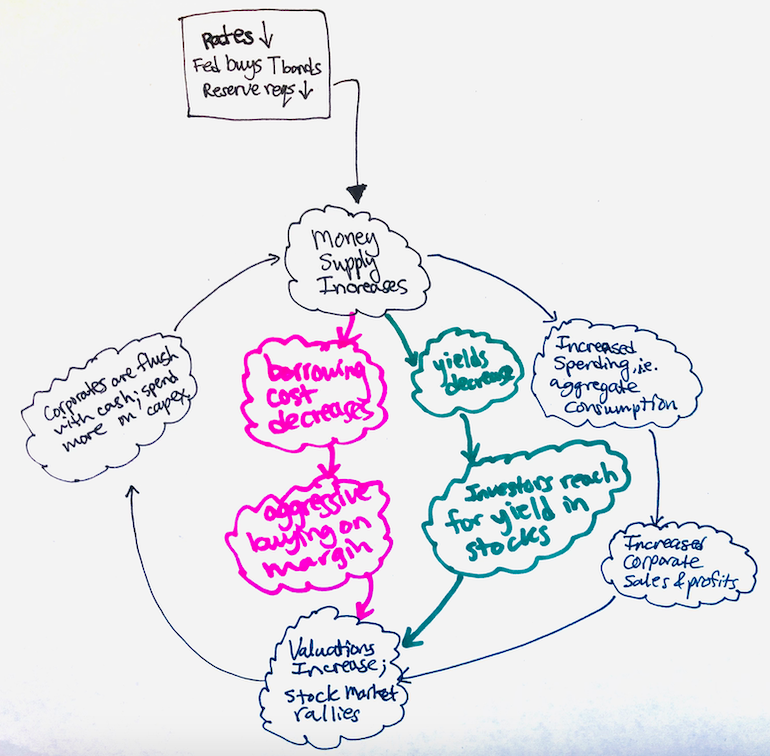

Any one of these Fed superpowers can rattle the equity markets in self-reinforcing ways (see diagram).

It often takes months or years for real economic change to settle in (e.g. for real aggregate consumption to rise), but trader expectations move the markets immediately.

It often takes months or years for real economic change to settle in (e.g. for real aggregate consumption to rise), but trader expectations move the markets immediately.

If u remember nothing else, remember that last pt: Markets never reflect the present; markets always reflect a dollar-weighted avg of all traders' expectations of the future.

And since traders react immediately, markets moves immediately. This is true of any news, not only Fed.

And since traders react immediately, markets moves immediately. This is true of any news, not only Fed.

3/ FOMC & "the Dots"

If u've ever wondered who at the Fed gets to set interest rates & change the reserve reqs, that's the FOMC.

FOMC has 19 ppl total (7 Governors, 12 reserve bank presidents). But only 12 can vote on any given year (all 7 govs + NY Fed pres + 4 rotating votes).

If u've ever wondered who at the Fed gets to set interest rates & change the reserve reqs, that's the FOMC.

FOMC has 19 ppl total (7 Governors, 12 reserve bank presidents). But only 12 can vote on any given year (all 7 govs + NY Fed pres + 4 rotating votes).

The FOMC meets 8 times per year, i.e. 8 chances to raise rates. At each meeting, the 19 members update their target projections for future FFR on a "Dot Plot."

X-axis shows dates. Y-axis shows FFR projections at those dates.

Traders pay attention to the median dot on each date.

X-axis shows dates. Y-axis shows FFR projections at those dates.

Traders pay attention to the median dot on each date.

Why did markets freak out about Dots last week?

At the latest FOMC meeting (6/16/21), the median dot for 2023 showed 2 rate hikes. This surprised traders since prior projections showed 0-1 hikes.

Significance: faster tapering -> economic slowdown sooner -> equities sell-off

At the latest FOMC meeting (6/16/21), the median dot for 2023 showed 2 rate hikes. This surprised traders since prior projections showed 0-1 hikes.

Significance: faster tapering -> economic slowdown sooner -> equities sell-off

4/ Hawks & Doves

Hawkish: describes a central banker (e.g. Yellen) who supports raising rates to fight inflation, at the cost of slowing economic growth & employment

Dovish: describes a central banker (e.g. Powell) who favors QE/printing to boost economic growth & employment

Hawkish: describes a central banker (e.g. Yellen) who supports raising rates to fight inflation, at the cost of slowing economic growth & employment

Dovish: describes a central banker (e.g. Powell) who favors QE/printing to boost economic growth & employment

5/ QE & tapering

QE (quantitative easing): the name we've given to the Fed's policy since 2008, i.e. continually buy tons of treasuries to reduce interest rates, increase money supply, and stimulate lending & spending.

Tapering: "winding down" of QE (reduction in asset buying)

QE (quantitative easing): the name we've given to the Fed's policy since 2008, i.e. continually buy tons of treasuries to reduce interest rates, increase money supply, and stimulate lending & spending.

Tapering: "winding down" of QE (reduction in asset buying)

6/ Yields & spreads

"Spread" generally means the difference in interest rate paid on short-term treasuries (e.g. 3m T-bill rate is often called the "risk-free rate") vs. another riskier bond.

"Yield" (related) refers to the % return you'd expect to get by buying such a bond.

"Spread" generally means the difference in interest rate paid on short-term treasuries (e.g. 3m T-bill rate is often called the "risk-free rate") vs. another riskier bond.

"Yield" (related) refers to the % return you'd expect to get by buying such a bond.

Credit spreads hint at economic conditions.

Spreads "tighten" in frothy markets & good economic conditions. They "widen" when alarming news hits, like when the Fed turns hawkish.

Higher yield means higher risk. In times of distress, bond yields tend to rise faster on junk vs IG.

Spreads "tighten" in frothy markets & good economic conditions. They "widen" when alarming news hits, like when the Fed turns hawkish.

Higher yield means higher risk. In times of distress, bond yields tend to rise faster on junk vs IG.

7/ Yield Curve

The yield curve is a graph that plots the yields of different treasury bonds (think: coupon rates) across different maturities. X-axis shows maturity (full curve stretches form 1 mo. to 30 yr)& Y-axis shows corresponding yield.

The yield curve is a graph that plots the yields of different treasury bonds (think: coupon rates) across different maturities. X-axis shows maturity (full curve stretches form 1 mo. to 30 yr)& Y-axis shows corresponding yield.

8/ Bull vs Bear Flattening/Steepening

When short-term vs long-term rates change unequally, the yield curve either flattens or steepens. In either case, the shape change can be optimistically or pessimistically induced (brought about by a change in either ST or LT expectation).

When short-term vs long-term rates change unequally, the yield curve either flattens or steepens. In either case, the shape change can be optimistically or pessimistically induced (brought about by a change in either ST or LT expectation).

Bull steepening: when ST rates fall; occurs when markets expect the Fed to lower rates & traders get bullish about near-term stock rally.

Bear steepening: when LT rates rise; occurs when inflation begins & traders sell their long-duration bonds to anticipate rising rates.

Bear steepening: when LT rates rise; occurs when inflation begins & traders sell their long-duration bonds to anticipate rising rates.

Bull flattening: when LT rates fall; occurs when investors expect inflation to fall in the long run & move more capital into stocks to "reach for yield"

Bear flattening: when ST rates rise; occurs when markets expect the Fed to hike (in extreme cases, the yield curve can invert)

Bear flattening: when ST rates rise; occurs when markets expect the Fed to hike (in extreme cases, the yield curve can invert)

9/ Inverted Yield Curve: what does it look like? what does it mean?

An "inverted" yield curve occurs when short term yield (typically 1Y T-bill) climbs higher than long term (10Y).

This means there's more economic uncertainty/risk in the short-run, i.e. indicator for recession.

An "inverted" yield curve occurs when short term yield (typically 1Y T-bill) climbs higher than long term (10Y).

This means there's more economic uncertainty/risk in the short-run, i.e. indicator for recession.

10/ Where are we now? What should I buy/sell in my portfolio?

Most traders would say we've entered bear flattening. Is the market gonna crash? Not necessarily, but maybe u should reconsider ur portfolio allocation.

For thoughts on what to buy/sell, see: bit.ly/3gKjA1P

Most traders would say we've entered bear flattening. Is the market gonna crash? Not necessarily, but maybe u should reconsider ur portfolio allocation.

For thoughts on what to buy/sell, see: bit.ly/3gKjA1P

• • •

Missing some Tweet in this thread? You can try to

force a refresh