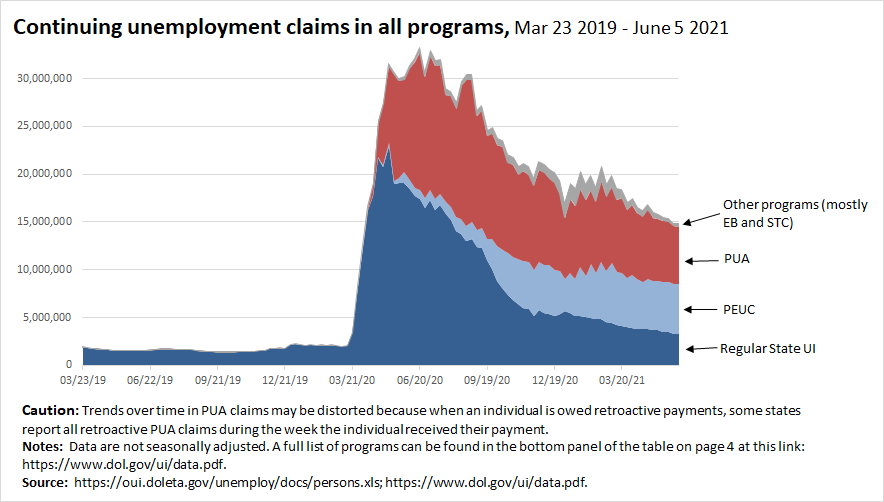

This chart shows continuing claims for unemployment insurance (UI) in all programs (the latest data available for this, released this morning, are from the week ending June 6th). Three-quarters of people on UI are on the pandemic programs Congress created (PUA and PEUC). 1/

Total continuing claims held steady in the latest data but are generally steadily declining—the 4-wk moving average declined by 280,000 and has come down by 4.4 million in just the last three months. However, it’s still roughly 13.5 million above where it was before COVID. 2/

Governors in 25 Republican-led states are canceling pandemic UI benefits early, snatching the lifeline that Congress created. This is a stunning example of how broken our UI system is. 3/

We need fundamental reform that includes guaranteed universal minimum standards so that the UI benefits you get don’t depend on the whims of the governor in your state. For more details on crucial UI reforms, see epi.org/publication/un… #FixUI

• • •

Missing some Tweet in this thread? You can try to

force a refresh