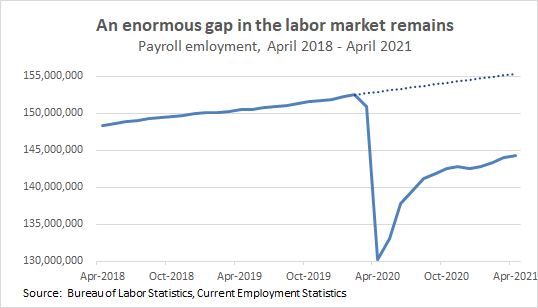

The labor market added 266,000 jobs in April, solid growth but far below expectations. Growth in March was also revised down. Further, we still have 8.2 million fewer jobs than we did before the recession, in February 2020. 1/

And, that 8.2 million is not the total gap in the labor market. Pre-COVID, we were adding about 200,000 jobs a month. At that pace, we would have added 2.8 million jobs in the last 14 months, so the total gap in the labor market right now is around 8.2 + 2.8 = 11 million jobs. 2/

Do today’s data reveal whether there is anything behind anecdotal claims of worker shortages, particularly in restaurants? (As background, here’s my thread explaining why I’m quite skeptical of claims of widespread labor shortages.) 3/

https://twitter.com/hshierholz/status/1389571936506634245?s=20

A key footprint of labor shortages is wage growth. Employers who truly face shortages of workers will respond by bidding up wages to attract those workers, and employers whose workers are being poached will raise wages to retain their workers, and so on. 4/

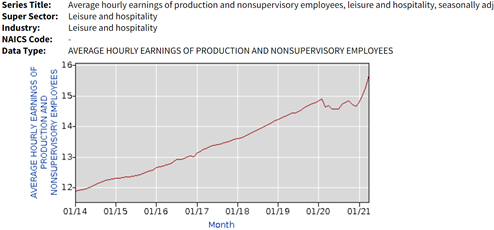

Wage growth measures released today are problematic due to pandemic composition effects. To address that, you can look at the wage growth of a pretty homogenous group: nonsupervisory workers in leisure and hospitality. 5/

Wages of nonsupervisory workers in leisure and hospitality have risen in recent months but have only now gotten back on their pre-COVID trend. This is not signaling a massive shortage. 6/

And remember, you’d expect restaurant wages to be substantially *higher* now than pre-COVID because the jobs are different/harder/riskier than before because workers have to deal w/ anti-maskers, lower aggregate tips, sanitizing, social distancing, and ongoing health concerns. 7/

Leisure and hospitality added 331,000 jobs in April, a larger gain than March and the 6th largest percent gain in the last half century, even though average weekly earnings for nonsupervisory workers in that sector equate to annual earnings of just $20,628. 8/

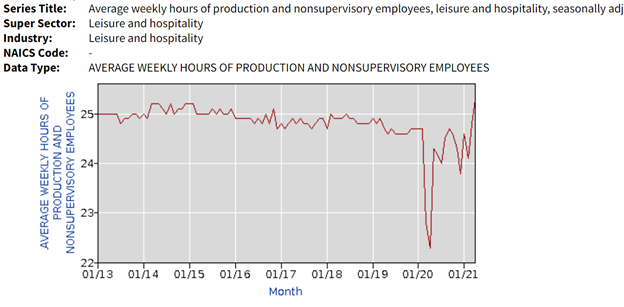

Further, if employers really couldn't find the workers they need, you'd expect them to be ramping up the hours of the workers they have. Hours have risen but are not extremely unusual—they are roughly in line with where they were in 2014/2015. 9/

In sum: today’s data show that leisure and hospitality has gotten tighter, but still suggest that the claims of labor shortages in restaurants are largely the result of frustration on the part of restaurants that they can’t find workers to fill jobs at relatively low wages. 10/

At 6.1%, the unemployment rate is still very elevated (though it ticked up in April for “good" reasons—workers entering the labor force to look for work). However, the unemployment rate is not counting all coronavirus-related labor market pain. Not even close. 11/

In April, there were 9.8 million workers who were officially unemployed, up from 9.7 million in March. And there were an additional 558,000 workers who were temporarily unemployed but who were being misclassified as “employed not a work” (this is down from 636,000 in March). 12/

Further, the number of workers who were out of work as a result of the virus but were being counted as out of the labor force instead of as unemployed because they weren’t actively seeking work was 4.4 million, a large drop from 4.8 million in March. 13/

If all these workers were taken into account, the unemployment rate would have been 8.9% in April. This is down from 9.1% in March. 14/

Usual caveat: This does not mean @BLS_gov is cooking the books. BLS is completely transparent and provides all the information needed (and more!) to do these kinds of calculations. 15/

More labor market pain not captured by the official unemployment rate: 4.6 million workers were employed in April but saw a drop in hours and pay as a result of the virus (this is down from 5.8 million in March). 16/ bls.gov/web/empsit/cov…

Another concern in this report is that very long-term unemployment is rising. There are now 2.7 million workers who have been unemployed for at least a year, an increase of 307,000 from March. 17/

Currently, more than one-in-four unemployed workers (27.2%) have been unemployed for at least a year. Many people who lost their jobs at the start of the pandemic have been unemployed ever since. Long-term unemployment is a big part of the K-recovery. 18/

Job growth in State & Local government was lower than is needed (+39,000 in April). We're still down 1.3 million S&L govt jobs since Feb ‘20—most of it (909,000) in education—so there’s a long way to go. It’s crucial S&L governments use their ARP funds to refill those jobs. 19/

Our history & present of systemic racism hugely affect the labor market. B/c of occupational segregation, discrimination, & other disparities rooted in white supremacy, this crisis is hitting Black & Brown workers far harder than white workers—particularly Black & Brown women.20/

The Black unemployment rate was 9.7% in April, the Latinx unemployment rate was 7.9%, the Asian unemployment rate was 5.7%, and the white unemployment rate was 5.3%. 21/

Good point here. There were big labor force gains in April but entirely from men—the number of women in the labor force actually ticked down. 22/ bls.gov/news.release/e…

https://twitter.com/mikemadowitz/status/1390659078955970563?s=20

This is fascinating. 23/

https://twitter.com/DanielBZhao/status/1390657105468829698?s=20

Two states have canceled pandemic UI benefits. It’s just breathtakingly terrible economics. It will cause enormous suffering of those whose benefits are cut off, and damage state economies by turning away federal money that is providing fiscal support.

https://twitter.com/ArthurDelaneyHP/status/1390493576631656450?s=19

I note above the wages of nonsupervisory workers in leisure & hospitality are only now reaching their pre-COVID trend, so even though they've risen in recent months, it's not screaming shortages. It's worth noting that *if wage growth continues on this trend,* I will reevaluate!

• • •

Missing some Tweet in this thread? You can try to

force a refresh