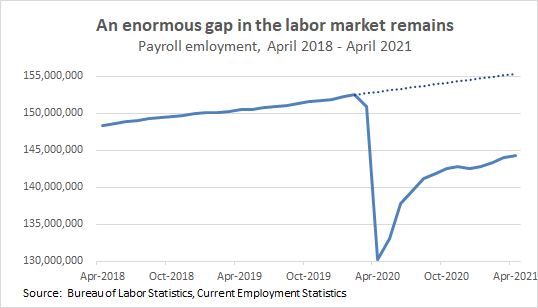

Talk of labor shortages is everywhere. What is really going on? A thread. 1/

Before the April jobs data were released last Friday, the data did not point to widespread labor shortages. But the April data—while still not pointing to *widespread* labor shortages—are indeed flashing shortages in isolated sectors. 2/

Backing up for a second: Remember that the footprint of a labor shortage is very fast wage growth. If an employer can’t attract the workers they need, they will raise wages to poach workers from other employers, who will in turn raise wages to retain their workers, and so on. 3/

This picture shows hourly wages for nonsupervisory workers in leisure and hospitality. This picture shows that wage growth has accelerated in recent months at a rate that would be unsustainable *if* it continued on this trajectory. 4/

Does that mean wage levels in leisure and hospitality are now too high? NO. These wages plummeted in the recession and have just regained their pre-COVID trend—i.e. they are now roughly where they’d be if COVID had never happened. 5/

The current average weekly wage for nonsupervisory workers in leisure and hospitality translates into annual earnings of $20,628. Yes, you read that right. $20,628. 6/

But again, while wage *levels* in leisure and hospitality are extremely low, wage *growth rates* have been very strong recently, signaling that as the leisure and hospitality sector is reopening more broadly, employers have indeed had to wage raises to attract workers. 7/

Is this something we have to worry about? NO. For one, there is very little reason to worry that labor shortages in leisure and hospitality will spill over into other sectors and drive economywide “overheating.” 8/

The leisure and hospitality labor market is very segmented-off from other sectors. A striking feature of the COVID recession and the K-recovery is how insulated other sectors in the economy are from the extreme labor market distress experienced in face-to-face services. 9/

And notably, wages in leisure and hospitality are still far (far) lower than in other sectors, even with the recent acceleration. Those increases are not going to create broad wage pressure. 10/

Further, the big drop in wages in leisure & hospitality in the first 10 months of COVID didn’t really spill over into widespread wage declines. Given that, it’s hard to see why recent wage *increases* in leisure & hospitality would spill over into widespread wage acceleration.11/

Also, the total wage bill in leisure and hospitality accounts for just 4% of the total private wage bill in the U.S. economy. At that size, wage trends in the sector are highly unlikely to meaningfully affect the trajectory in other sectors. 12/

And, wage acceleration in leisure and hospitality doesn’t appear to have really held back job growth *even in leisure and hospitality.* Job growth in that sector in April was by far the strongest of any sector, even accounting for the fact that it has more ground to make up. 13/

Nevertheless, many people are seeing the tightness in leisure and hospitality and concluding that pandemic unemployment insurance (UI) benefits are damaging the labor market by keeping people out of work. But there is no compelling evidence of this.14/

First, low-wage sectors—where workers are receiving a higher share of their prior income than in other sectors—saw much faster job growth than higher-wage sectors in April. This is exactly the opposite of what you’d expect to see if UI was keeping people from working. 15/

Further, labor force participation rose rapidly in April, but the gains were all among men—women actually lost ground. Given that women still shoulder the lion’s share of caregiving responsibilities, this points to care needs being the thing holding back labor supply, not UI. 16/

Case in point, in April, more than a quarter of schools were still closed. 17/

https://twitter.com/ZParolin/status/1391739297473179650?s=20

Even further, the disappointing net job gains in April were not due to a slowdown in hiring—hiring actually rose. The disappointing April job gains were due to a large increase in layoffs and other job separations AMONG WOMEN. 18/

Additionally, millions of workers still have legitimate health concerns about returning to work. Unsurprisingly, as vaccinations go up, employment goes up. That’s clearly not about UI. 19/

https://twitter.com/aaronsojourner/status/1382673136429142016

Many leisure and hospitality jobs have become far harder and riskier since COVID. Well-functioning labor markets would account for this by offering higher wages. Notably, if pandemic UI benefits are playing a role in allowing this to happen, this is efficiency *enhancing*. 20/

And, cutting pandemic unemployment insurance benefits would not just create economic inefficiencies and hurt workers who cannot find work or are unable to work, it will also drag on the economy, because those benefits are supporting spending. 21/

Policies that expand opportunities and remove key barriers to work—policies like vaccine distribution and the investments in care work provided in the American Jobs Plan and the American Family Plan—are the kind of labor supply policies our economy needs right now. 22/

And surprise, here’s all this in a blog post. Note, the lion’s share was written by the brilliant @joshbivens_dc. 23/ epi.org/blog/restauran…

• • •

Missing some Tweet in this thread? You can try to

force a refresh