A powerful leader in today’s Times. Gets across the key message from yesterday’s @theCCCuk Progress Reports: Government must get real on achieving the UK's legal climate targets.

But we need to talk about this “ruinously expensive” Net Zero stuff.

Thread – with some new charts.

But we need to talk about this “ruinously expensive” Net Zero stuff.

Thread – with some new charts.

Net Zero is not ruinously expensive. Certainly not as a proportion of the size of the whole economy.

Conservatively, we estimate that the 'costs' of Net Zero – across a range of scenarios – are less than 1% of GDP each year.

But what does that mean? Let’s build up the picture.

Conservatively, we estimate that the 'costs' of Net Zero – across a range of scenarios – are less than 1% of GDP each year.

But what does that mean? Let’s build up the picture.

We have to do *a lot* of investment to reach Net Zero, replacing all the high carbon assets with zero-carbon alternatives - the electric cars, the windfarms, the heat pumps, the low-carbon plant and machinery.

We estimate an extra £50bn per year of capex is required from 2030.

We estimate an extra £50bn per year of capex is required from 2030.

But that’s not the full story. There are savings too. Particularly because low-carbon technologies are much more efficient than their fossil-fuelled cousins. And they typically use green electricity that gets cheaper and cheaper over time (on the government’s own assessment).

You can see that here. There is an operating saving (below the line) for all that capital investment (above the line). And those OPEX savings grow over time.

The net position is an aggregate ‘cost’ that’s less than 1% of GDP each year. Across all five of our scenarios to get to Net Zero by 2050.

But that’s not all. There are wider benefits too. Investing at that level would add an eighth to economy-wide CAPEX (pre-pandemic levels).

There are new jobs, installing all that low carbon tech. We are bringing back to the UK goods and services that are currently imported.

There are new jobs, installing all that low carbon tech. We are bringing back to the UK goods and services that are currently imported.

And there’s more. There are wider economic benefits to Net Zero:

Benefits to health.

Benefits to air quality.

Benefits to the environment.

They are real – and they will make lives better for people living in the UK. For me, these are some of the best reasons to *do* Net Zero.

Benefits to health.

Benefits to air quality.

Benefits to the environment.

They are real – and they will make lives better for people living in the UK. For me, these are some of the best reasons to *do* Net Zero.

In our cost assessment, we haven’t counted these wider benefits. Deliberately, to avoid any accusations of glossing over the real costs.

Hence my description of our costs as “conservative”.

So, what do these costs look like when we look out over the next 30 years?

Hence my description of our costs as “conservative”.

So, what do these costs look like when we look out over the next 30 years?

Let’s first get a handle on the UK economy. This shows you the OBR’s assessment of the pre and post-COVID outlook for the economy. You can see what a major impact the pandemic has had on the size of the economy.

Now let’s see how Net Zero will impact on the size of the economy.

Now let’s see how Net Zero will impact on the size of the economy.

This blue dotted line shows you the impact of the Net Zero costs.

Can you see the gap between the red line and the blue dotted line? Unlikely, because it’s too small at this scale.

*That’s* how small Net Zero is in comparison with the whole economy.

Can you see the gap between the red line and the blue dotted line? Unlikely, because it’s too small at this scale.

*That’s* how small Net Zero is in comparison with the whole economy.

Our estimates put aggregate costs of the transition to Net Zero at less than 1% of GDP each year.

That means reaching the 2050 GDP that we would have reached *absent* Net Zero midway through April 2051, about 4 months later.

That means reaching the 2050 GDP that we would have reached *absent* Net Zero midway through April 2051, about 4 months later.

So, conservatively, Net Zero means a *four month* delay to growth over 30 years. In other words, it's completely lost in the rounding.

And that’s if you believe that it even *will* be a cost.

And that’s if you believe that it even *will* be a cost.

The yellow line shows our assessment of what could happen if we consider the boost to the economy from all that Net Zero investment.

There is potential for ‘upside’ impacts of climate action to boost GDP by 1-3% each year, as the economy rebuilds after the COVID-19 crisis.

There is potential for ‘upside’ impacts of climate action to boost GDP by 1-3% each year, as the economy rebuilds after the COVID-19 crisis.

And that’s not all. As the world increasingly embraces a trajectory towards Net Zero, the costs for any country of following that trajectory are likely to fall, while the risks of following an alternative path increase.

Again, we aren’t factoring that in. Deliberately.

Again, we aren’t factoring that in. Deliberately.

And of course, this ignores the chaos and the huge costs of inaction on climate change.

We explored some of that that last week in our assessment of the climate risks we face as a country. Suffice it to say, it’s definitely an investment worth making avoid costs later.

We explored some of that that last week in our assessment of the climate risks we face as a country. Suffice it to say, it’s definitely an investment worth making avoid costs later.

So aggregate costs are very small as a proportion of the economy. But the costs are real – and some people and business will experience more costs than other, depending on their circumstances.

The issue is not the cost itself, but how to spread the costs and the benefits fairly.

The issue is not the cost itself, but how to spread the costs and the benefits fairly.

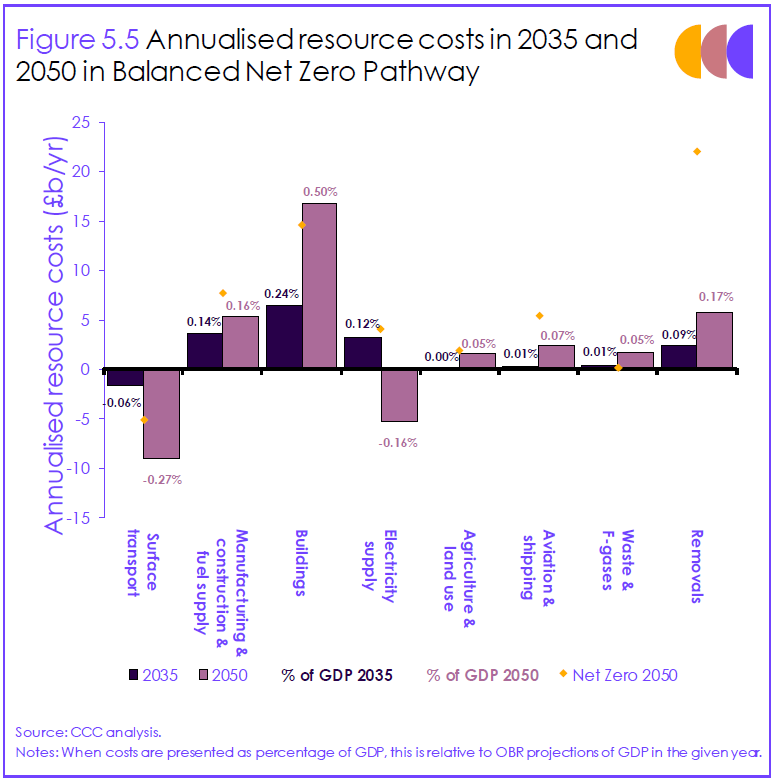

This is how those costs and benefits look across the economy and over time.

There are real costs in some very sensitive areas: homes and industries. The public purse will have to help here.

But there are also real savings in surface transport and in energy production.

There are real costs in some very sensitive areas: homes and industries. The public purse will have to help here.

But there are also real savings in surface transport and in energy production.

Capturing some of the savings and using them to help pay for the real costs is a major challenge. And that’s why we need the Chancellor to step up (as I hope he will).

We *can* have a low-cost transition, protect those people who can least afford it.

We *can* have a low-cost transition, protect those people who can least afford it.

https://twitter.com/TimesRadio/status/1407971083010052099?s=20

But let’s knock this “ruinously expensive” stuff on the head. We can certainly afford to do Net Zero – I would argue we can’t afford *not* to do Net Zero.

Link to the Times Leader here:

thetimes.co.uk/article/the-ti…

And link to our Progress Reports here:

theccc.org.uk/publication/20…

thetimes.co.uk/article/the-ti…

And link to our Progress Reports here:

theccc.org.uk/publication/20…

• • •

Missing some Tweet in this thread? You can try to

force a refresh