JDC Group AG Part1: Symmetry has over the last few months build a big position in the German InsurTech company JDC Group AG. After following the name for a while, we think now is a great to get involved.

The company is at an inflection point as several of their big J-curve investments are now starting to pay off.

JDC Group is an Insurtech company that is helping intermediates with technology, administration and back-office solutions etc. JDC is NOT an insurance company – the best way to describe it is a technology driven BPO-business with a lot of recurring sticky revenue

. But before going more into JDC I wanted to share a little more on the German insurance market:

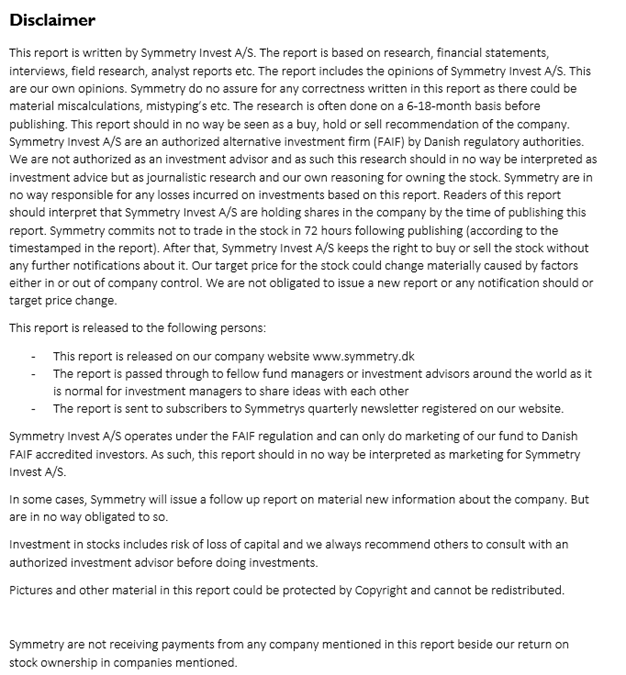

The German insurance market is huge at 217 billion EUR and growing steadily at a low single digit percentage each year.

The German insurance market is huge at 217 billion EUR and growing steadily at a low single digit percentage each year.

The thing that’s a little unique here is the number of different carriers each household use. Based on our research the average household use 4-6 different insurance carriers and have on average 10 contracts.

The insurance companies pay around 17 billion EUR a year in commission to intermediaries. That’s the target market for JDC. To help all these intermediaries.

Whats interesting with the german insurance market is that its still mainly brokered by tied agents and related broker channels. So you think about the typical suit and tie insurance salesmen.

Bancassurance (banks selling insurance) and digital brokers (including price comparison sites) is still a smaller fraction of the market. We have seen in other parts of Europe (like Denmark where I am from) ....

...that digital channels and bancassurance is becoming a significantly bigger part of the market. JDC as the technology and backoffice supplier to these channels is perfectly fitted to benefit from this transition in Germany and the digitalization of the industry.

JDC works in different segments of the market. They have a small insurance brokerage arm themselves (called Finum). Its around 20 % of the revenue and is a more stable cash flow provider with slow growth.

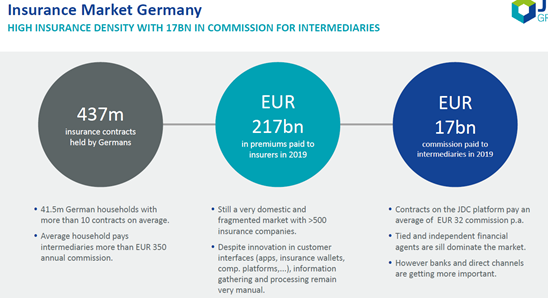

The biggest part of the business is the broker pool (technical platform) called Jung, DMS & CIE (JDC). Here JDC helps alle the insurance brokers (both individual and online brokers) with their technology, back office, administration etc.

. JDC have agreements with most of the 200 insurance companies in Germany and have build the infrastructure to handle all the workflow and payments etc.

So if you are an insurance broker and want to sell insurance, you will be entitled to a yearly recurring commission as long as that insurance contract is still in place.

But most of the insurance companies in Germany is still not digital on the front end, they still send a lot of physical paperwork to fill etc. . So the best way for an insurance broker to handle all that is to join a broker pool.

Here JDC will handle all the contracts etc. collect the commission and then split the commission with you. Because JDC have significant scale (the second largest broker pool) and great technology they can do this a lot more efficient.

This part of the business have been the good growth driver over the the last 10 years growing around 10 % per year with improving profitability. The broker pool market is still highly fragmented. As the second largest player JDC only have around 5 % of the market.

The market have and will continue to consolidate and JDC can act as a natural consolidator on attractive terms.

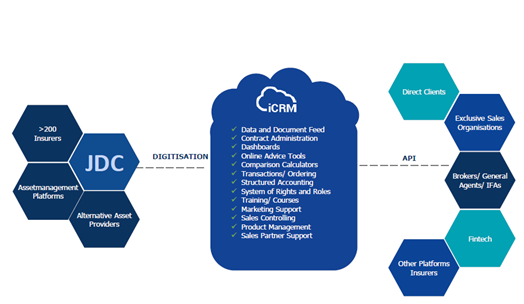

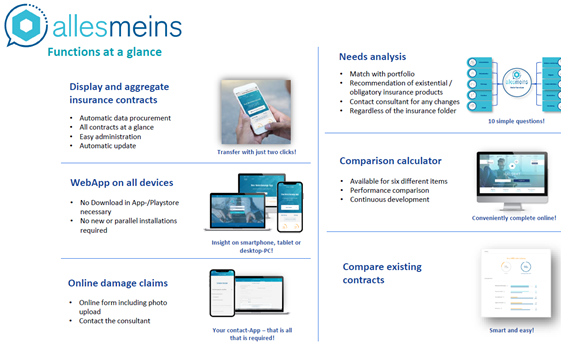

The most interesting part of JDC is the B2B business or the direct clients business. JDC has develop an insurance app with a digital wallet that can handle all the contracts, to price comparison, control terms and give users ad clear oversight ...

...of all their insurance contracts in one digital app. That app then sits on top of the JDC broker pool and can collect the commissions.

This digital app called “Allesmeins” is distributed as a white-label solutions to banks, digital brokers etc. So, if you are a bank in Germany or a digital first company etc. that wants to sell insurance you can white-label the Allesmeins

and get your own digital app in your own colors and name etc. Especially big corporates with a lot of employees (that allready sell some insurance products) can use this to cross sell more insurance.

For banks in Germany with declining interest rates insurance is a big opportunity to create new revenue streams. For banks to get a digital insurance app that they can sell to their banking clients is a big way to get additional revenue.

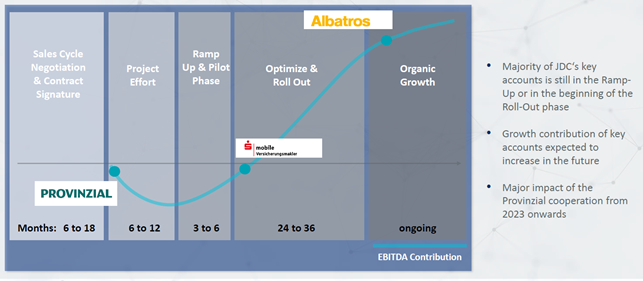

These contracts is a land and expand model where JDC first sign the contract, develop App to the white-label partner then pilot it and then start to ramp it up. As the partner then start to get end users into the app JDC can start to collect the commission and ramp the revenue.

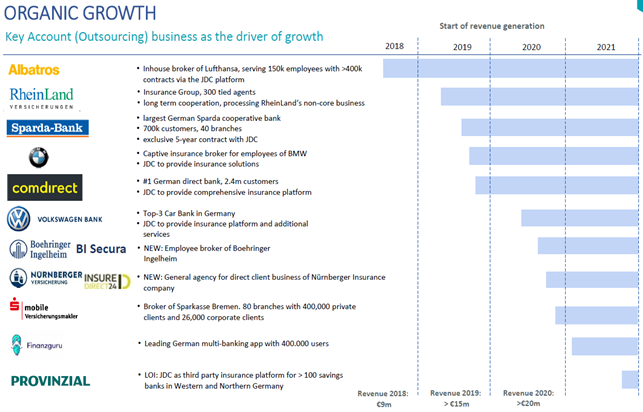

JDC has over the last several years added a lot of new clients that is still in the ramp-up phase. But revenue here is growing quickly with 66 % in 2019 and 47 % in 2020. As these new clients go into the J-curve phase we think the revenue ramp-up for JDC could be significant.

• • •

Missing some Tweet in this thread? You can try to

force a refresh