JDC Group AG Part2:

his can also bee seen from the revenue growth

his can also bee seen from the revenue growth

T. In 2016 and 2017 the growth was mainly in the broker pool segment but from 2018 and 2019 it started to accelerate with the B2B rollout. 2020 was a little lower due to Covid but now in 2021 JDC again guide for close to 20 % revenue growth.

The other interesting part is the scalability that is about to happen now. The company invested for many years in the technology, in M&A and in the app to be at the forefront of changes. Now they can start to reap benefits as the business starts to scale.

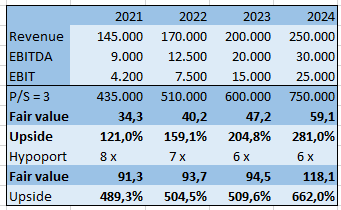

The EBITDA margin went from 0 % in 2018 to 2,2 % in 2019 to 4,7 % in 2020 and now around 6-7 % in 2021. We think long term there is a potential to go to 12-15 EBITDA margin and 10-12 % EBIT margins.

It is important to understand that JDC collect all the commission from its white-label partners and broker clients etc. and then split that commission with them. Depending on the size and the relationship JDC will pay out 50-75 % in commission.

The Gross margin of JDC have therefore been stable around 25-28 % and we expect that to decline slightly to 22-25 % as they get more revenue form larger clients going forward.

But because there is massive scale benefits they are still able to achieve decent 10-15 % EBITDA margins over time.

What is JDC then worth? That’s the hard question – but we think significantly more than the current market cap around 190 million EUR.

In Germany there is a company called Hypoport that is the leader in loans, mortage, credit cards etc. for banks and brokers. They have penetrated that market and became the leader there with scale benefits and network effects.

We think JDC have every change to achieve the same position within insurance that Hypoport has achieved in mortage/loans.

Hypoport today trades at around 8 x 2020 revenue, 40x 2020 EBITDA and 80 x P/E. This shows that the market in Germany is willing to pay high multiples for category winners in high growing digital industries with recurring revenue streams.

Using a 3x revenue multiple (25-30 x EBITDA) we see upside 120-200 % over the next 2-3 years in JDC. A 3x multiple is still a significant discount to Hypoport.

While we are not willing to underwrite Hypoport multiples ourself one should acknowledge that JDC will have higher growth and is earlier in the transition than Hypoport and therefore one could argue they deserve the premium multiple.

Just using a Hypoport multiple on JDC would deliver a 500 % upside in the stock from here.

• • •

Missing some Tweet in this thread? You can try to

force a refresh