@ArmitageJim @premnsikka @retheauditors 1/ The curious case of ‘El Filibusterismo’. An aide memoire on : 1. Payment Service Providers “PSP’s” (

https://twitter.com/ianbeckett/status/1406246502410956804). 2. Unlawful Pharma dispensary affiliate ops (

https://twitter.com/ianbeckett/status/1406250686250106881) - affiliate pornography ops …

2/ operate in a similar fashion except they are ‘virtual goods’, so are ‘digital fulfilled’. In 07/2009 the #Earthport Crew (

https://twitter.com/ianbeckett/status/1403086823916818435) announced (shortly before its then CEO James Bergman was reported ‘dismissed following an internal enquiry’) that Philippines …

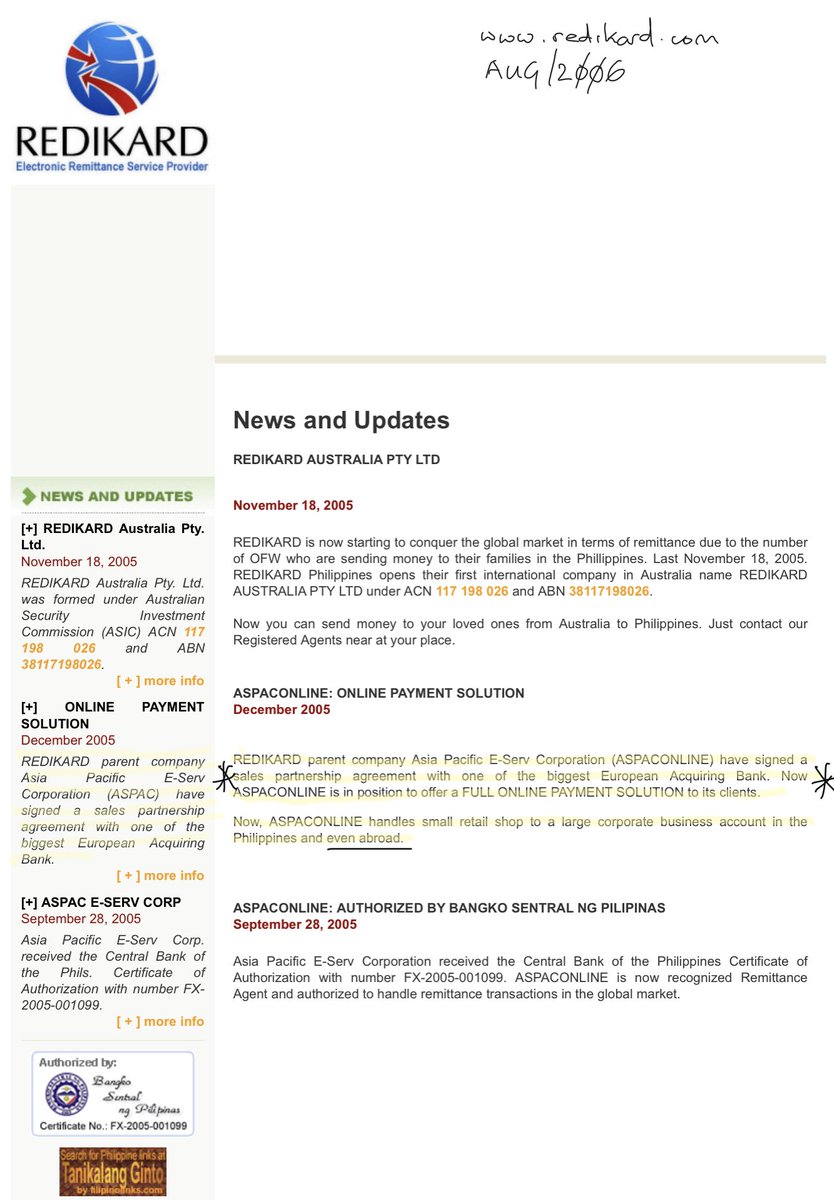

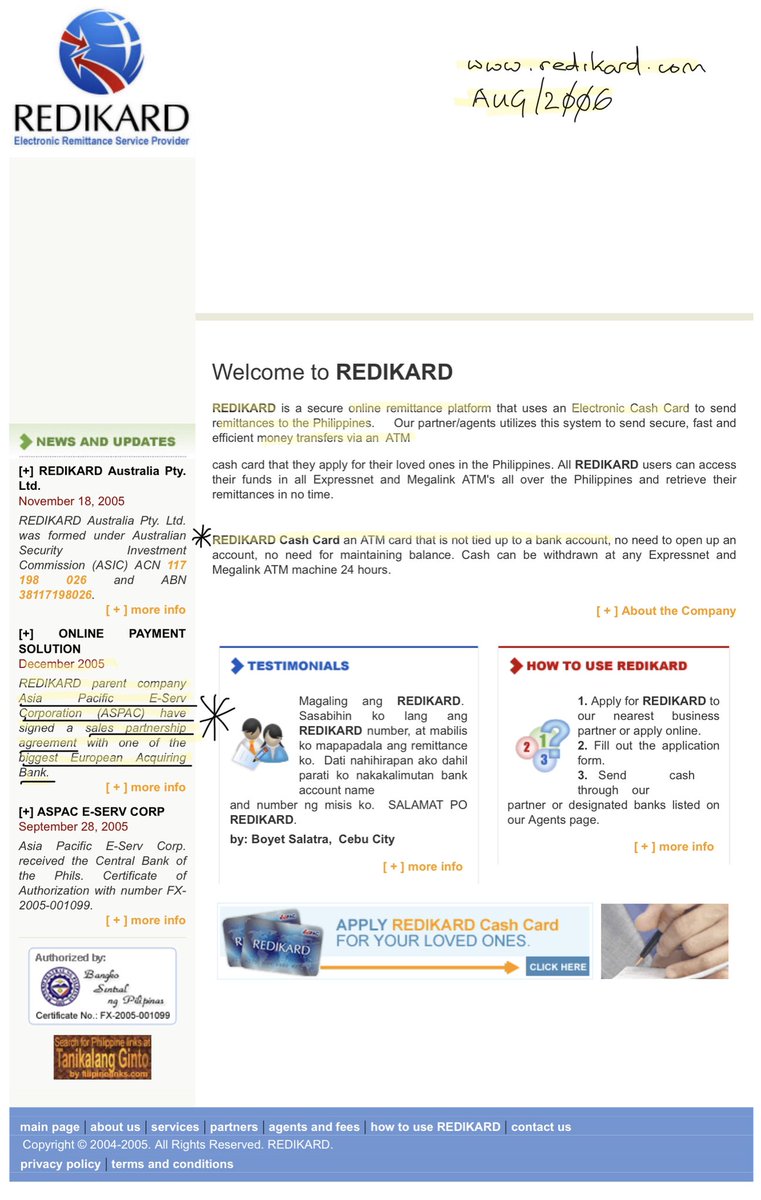

3/ international money transfer op come prepaid card op #RediKard was ‘fully integrated’ in to #Earthport’s systems at >30,000 transactions/month(seemingly the standing start!). RediKard’s Managing Director was allegedly none other than Christopher Bauer who would later …

4/ become notorious as “Jan Marsalek’s man in Manilla” in the #Wirecard scandal - ‘his’ Philippines PSP was reported responsible for 15% of Wirecard’s T/o & 20% of profits + it’s reported he employed as COO the former #Earthport CEO James Bergman (

https://twitter.com/ianbeckett/status/1403096446702915591), …

5/ small world!. #RediKard’s parent company was Philippines PSP Asia Pacific E-Serv Corporation “#ASPACONLINE” whose founders allegedly included the ‘well connected’ Esther Magleo &/or son Ronald Magleo. Unsurprisingly RediKard had a ‘dummy’ UK SPV (RedikardDOTcom UK Ltd) …

6/ with directors Arnold Marcellana (allegedly ASPACONLINE’s compliance officer), Rafael Lagaspi (allegedly ASPACONLINE’s President & CEO), Ray Espinosa (‘well connected’ in the Philippines) + finally Nicola Sparks’ (as UK company secretary). Ronald Magleo is reported as …

7/ stating that #Wirecard acquired ASPACONLINE’s ops in 2007 (#Wirecard reported a ‘Phillipines branch’ in 12/2007) as a means of Asia Pacific market entry + that ASPACONLINE had been setup just 2 yrs before. ASPACONLINE’s M.O. was stated brazenly on their website …

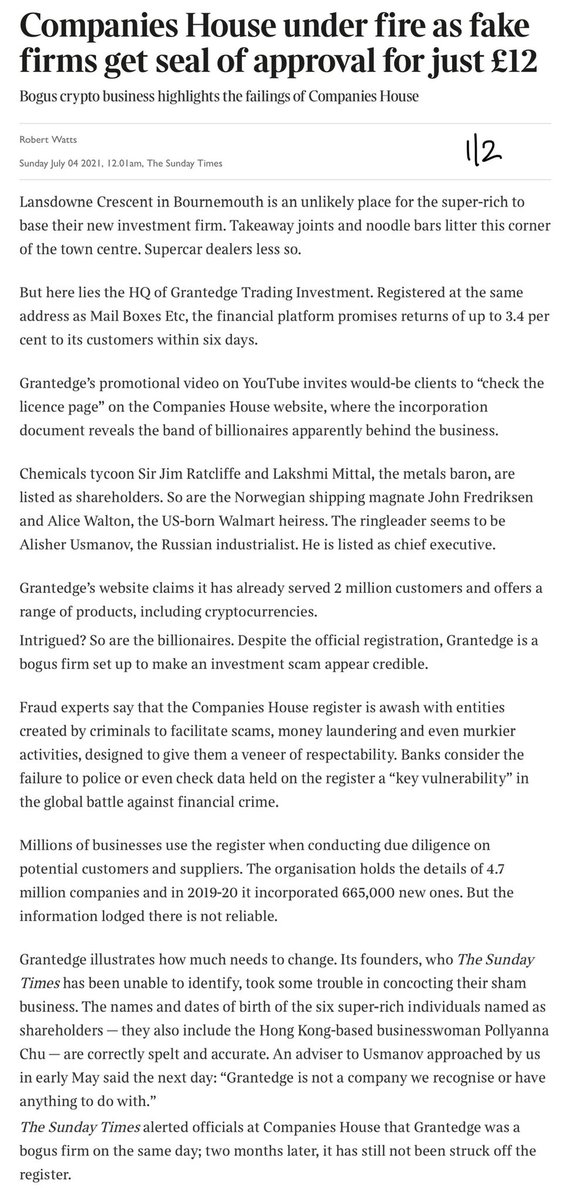

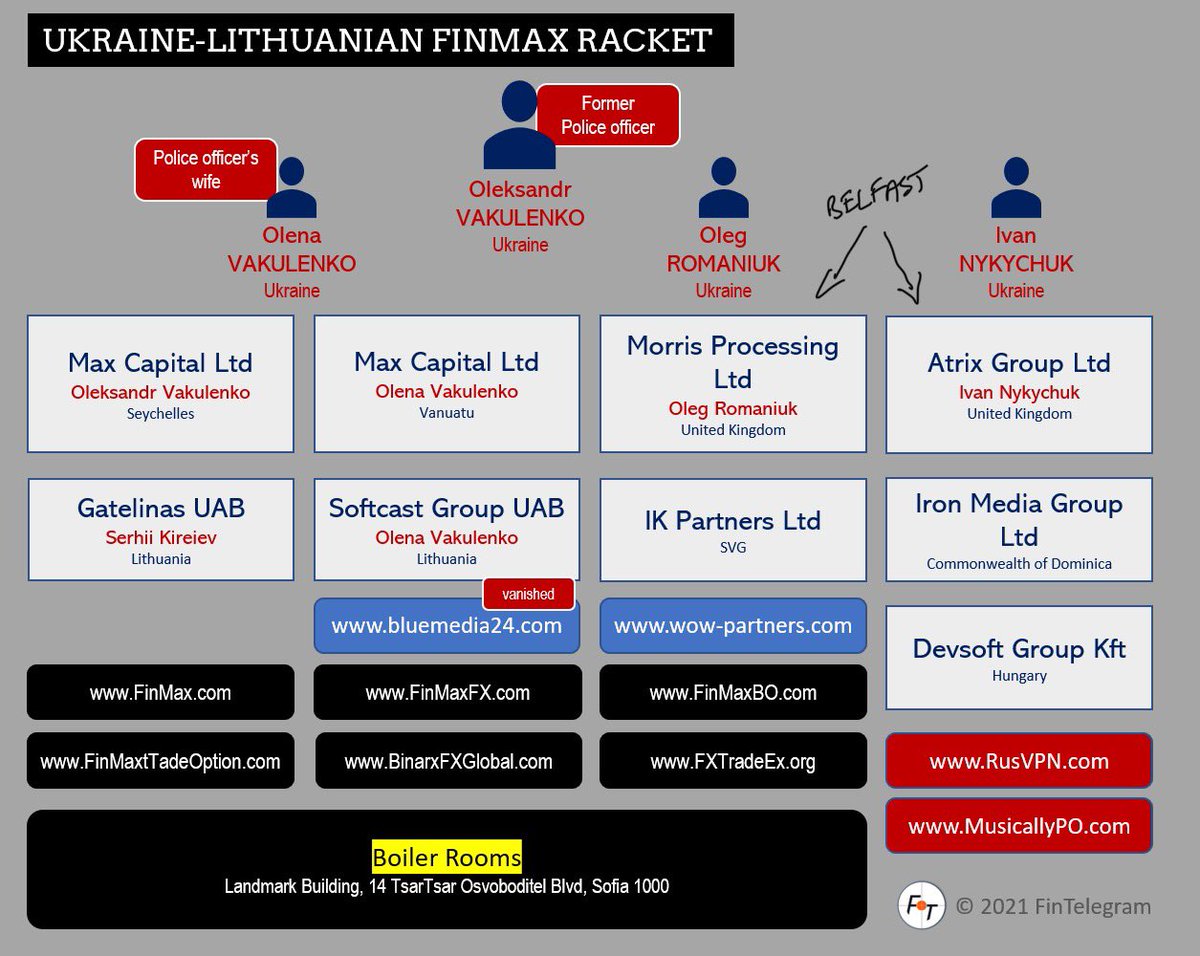

8/ ‘in the day’ (2006) including : 1. accommodating high risk Merchant ops (eg online gambling/pornography, tele-marketing) + unlawful (in many countries) Merchant ops (eg online pharma dispensaries). 2. a ‘requirement’ that the Merchant setup a ‘dummy’ EU SPV, something …

9/ ASPACONLINE could apparently facilitate. 3. ASPACONLINE used a key ‘EU Merchant Acquirer’ for which a ‘dummy’ EU SPV was mandatory. 4. #Wirecard’s notorious #ClicktoPay ewallet (+ associated prepaid debit card) was up front + centre. …

10/ 5. #RediKard ‘outsourced remittance delivery’ provided a ‘one stop shop’ for Merchants to receive international payments from EU SPV’s. #Wirecard’s #ClicktoPay wallet was reportedly notorious for its use in online gambling & pornography ops, particularly when coupled …

11/ with the Click2Pay prepaid debit card which reportedly facilitated online gambling ‘payout’ via global ATM’s. It’s been alleged ASPACONLINE also ran with #Wirecard a ‘manual’ op to charge Click2Pay ewallets from local Philippines bank accounts (+ purportedly had access to …

12/ #Wirecard’s systems to update user accounts). Key ASPACONLINE figures allegedly seamlessly morphed in to Wirecard Asia Pacific “Wirecard AP” honchos. Ronald Magleo is reported as stating that he was Wirecard AP’s Operations Director, his mother (Esther Magleo) …

13/ Wirecard AP’s CFO & his wife Wirecard AP’s ‘Wirecard DE trained’ Business Development officer. LinkedIn bio’s purportedly showed Arnold Marcellana morph in to Wirecard AP’s Risk & Compliance Officer + John Pickering morph in to Wirecard AP’s Marketing …

14/ Director. In addition to being reported ASPACONLINE’s President & CEO + a director of ‘dummy’ UK SPV ‘Redikard.com UK Ltd’, Rafael Lagaspi was also reported as former Chairman of Wirecard AP’s supervisory board & (along with Wirecard’s Jan Marsalek & …

15/ Frank Boettger) a director of Singapore op ‘Wirecard Asia Pte Ltd’. Rafael Lagaspi is also a director of Philippines money transfer/PSP/prepaid card op #Omnipay which ASPACONLINE was reported as having an 16% interest in - noteworthy is Omnipay’s President/CEO Simoun Ung.

16/ Rafael Lagaspi was also a director of UK/Phillipines #FCA authorised remittance processing op #Cashsense Ltd (

https://twitter.com/ianbeckett/status/1395379699627474945), unsurprisingly Sean Forward (associate of Dietmar & Ayalet Knöchelmann, Rüdiger Trautmann & chums -

https://twitter.com/ianbeckett/status/1403095967407165443) was also …

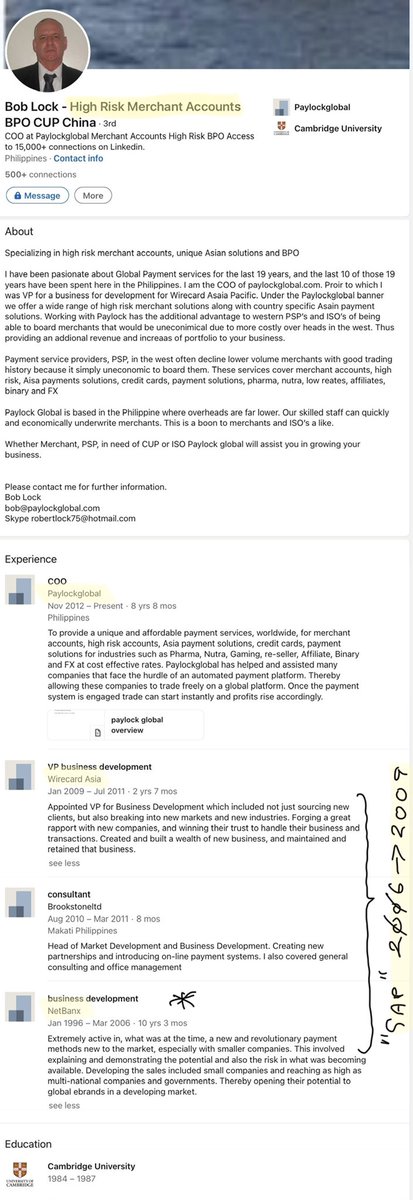

17/ a Director of Cashsense Ltd alongside shadowy figure “Bob Lock” (aka the infamous ‘Robert Lock’). Unsurprisingly the only remaining purported ‘Bob Lock’ Linkedin bio shows no work history before 1996 + kicks off by teaming up with Cambridge chums at online payment …

18/ processor #Netbanx (#TransactGroup Ltd) before another gap (coincidently ASPACONLINE’s/Wirecard AP’s ‘formative years’), before purportedly a stint as Wirecard AP’s VP (Business Development) finally finishing with his ‘own’ PSP - “PayLockGlobal” (With a remarkable …

19/ similarity to ASPACONLINE’s offering with ‘dummy EU SPV’s’ + likewise purportedly powered by #Earthport). Netbanx (Transact Group Ltd) were allegedly ‘not too fussy’ about their Merchants, it’s honchos were however more infamous for their penalised ‘activities’ in the …

20/ #PhonePaidServices’ premium rate sex call/WAP-Push/SMS cesspit (scribd.com/document/51300… AND scribd.com/document/51300… AND scribd.com/document/51303…) including ‘listen & jerk off’ & ‘cheap filth’. Netbanx was sold in late 2005 to the notorious AIM listed #Neteller Plc, …

21/ one of a number in the FSA’s ‘small caps cesspit’ that would turn out to be facilitators of illegal USA online gambling transactions. Mere months later the USA cracked down hard on these online gambling e-wallets/payment processors, ~70% of Neteller’s revenue …

22/ disappeared overnight + it (+ it’s honchos) would later enter deferred prosecution agreements with USA authorities. Pornographers alleged that the fallout also led to Neteller’s Netbanx removing pornography related Merchants. Back to Bob Lock, who in addition to being …

23/ a director (as was Sean Forward & Rafael Lagaspi) of FCA authorised money transfer op #Cashsense was also a director of UK SPV ‘E-Credence UK Ltd’(aka E-Credit Plus UK Ltd) along with Yoshio Tomiie. Yoshio Tomiie was a key figure in #SenjoGroup (

https://twitter.com/ianbeckett/status/1395379556073279491) …

24/ + ‘the strange case of #Ashazi: #Wirecard in Bahrain, via Singapore’. Unsurprisingly a long term ‘Walpay’ (

https://twitter.com/ianbeckett/status/1403086868875522054) director (South African, Roy Harding) was also allegedly a director of Senjo Payments Europe SA as well as Bijlipay Asia Pte. Ltd (aka …

25/ Waltech Asia Pte. Ltd). In 2008 Bob Lock became a director/company secretary of 7 UK SPV’s on the same day, all 7 already had Redikard.com UK Ltd’s company secretary Nicola Sparks as a director/company secretary. The remaining UK SPV that Bob Lock became …

26/ a director/company secretary of in 2008 was NauConn UK Ltd. Although Bob Lock’s purported Linkedin bio shows no role at ASPACONLINE + an official role at Wirecard AP starting only in 2009, It’s been alleged however that Bob Lock was promoting both ASPACONLINE + …

27/ Wirecard AP in 2008. NauConn UK Ltd was allegedly linked to the “Naughty Connections” UKR spun adult dating op. Sampling the other 7 UK SPV’s , ‘Webnovas UK Technologies Ltd’ appears in the OpenCorporates corporate grouping for the Mindgeek Group aka the Canadian online …

28/ pornography giant better known as PornHub, YouPorn, Redtube etc(brownrudnick.com/press_release/…). Unsurprisingly another UK SPV ‘LB JuggCash Ltd’ also appears in the OpenCorporates Mindgeek corporate grouping - it was part of the notorious ‘Consett formation factory’ coincidently …

29/ that the #Wirecard crew allegedly operated through. Focus Care London Limited was allegedly linked to a Philippines tele-marketer + their alleged USA partners (Divine Communications) who were allegedly notorious for their pre-paid calling card ops. Entertek Online Ltd by …

30/ coincidence shared the same name as the infamous Andy Alvarez’s Entertek Online Inc’s affiliate pornography ops (incl. YourPaySite & WebmasterCentral). An excerpt from ‘epimp-the rise & fall of an adult site webmaster’ gives an insight in to Andy Alvarez’s affiliate …

31/ pornography ops + notes the notorious Andy Alvarez linked #Electracash USA cheque payment processor. Electracash would crash in to bankruptcy in 2010 as the USA authorities cracked down hard a second time on the schemes used to covertly illegally process …

32/ online gambling payments. Electracash’s bankruptcy creditors list makes fascinating reading (scribd.com/document/51313…) as amongst the top 20 unsecured creditors peppered with pornographers & covert online gambling payment processors is ‘Maze Investments Ltd’ from the …

33/ notorious ‘Consett formation factory’. Bob Lock & Christopher Bauer were far from the only ex Wirecard AP exec’s to go on to run purportedly their ‘own’ PSP’s with a striking similarity to ASPACONLINE’s M.O. + it’s EU SPV requirement for Merchants. One ponders if …

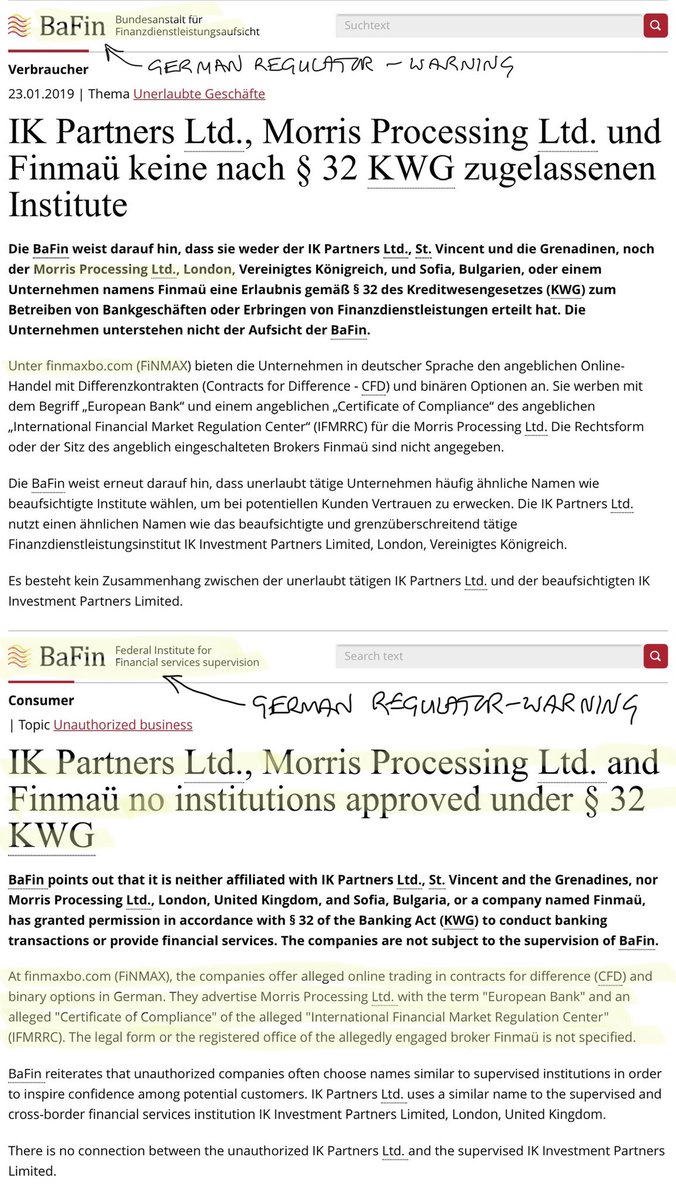

34/ as well as #Wirecard they were all linked to #Earthport as well?. While @TheFCA(FSA) has slept at the wheel for decades, one of the major reasons why thousands of seemingly inactive UK SPV’s have been created/maintained (no doubt with UK bank +/or Merchant acquirer a/c’s) …

35/35 is becoming increasingly clear for the rest of us (as is the ‘real use’ of notorious prepaid card ops) … perhaps it’s time for the #HMRC to have an epiphany as the #FCA & #BaFin show no signs of waking up anytime soon. Plenty more to come !

• • •

Missing some Tweet in this thread? You can try to

force a refresh