TAX FREE SAVINGS ACCOUNT

The anatomy of my holdings

• GLODIV

• STXPRO

• SYG4IR

Find out what % of my capital I allocate to each one and why.

(Thread)👇🏽

The anatomy of my holdings

• GLODIV

• STXPRO

• SYG4IR

Find out what % of my capital I allocate to each one and why.

(Thread)👇🏽

• Introduction

The TFSA was introduced in SA in 2015. The aim is to encourage savings, in which all growth and income are tax free.

For example:

• No Capital gains tax

• No Dividends withholding tax

• No Tax on interest

Let’s quickly learn👇🏽

The TFSA was introduced in SA in 2015. The aim is to encourage savings, in which all growth and income are tax free.

For example:

• No Capital gains tax

• No Dividends withholding tax

• No Tax on interest

Let’s quickly learn👇🏽

• Dividends

It’s important to capitalize on the structure of a TFSA.

What do I mean by this?

The point is to pay no tax, right? However, offshore dividends are taxed accordingly to the laws of that specific sovereign state.

So your dividends from abroad aren’t exempt.

It’s important to capitalize on the structure of a TFSA.

What do I mean by this?

The point is to pay no tax, right? However, offshore dividends are taxed accordingly to the laws of that specific sovereign state.

So your dividends from abroad aren’t exempt.

• What’s inside and Why?

Remember, these ETF’s are all still denominated in Rand, so although they provide offshore exposure, I must still sell to Rands to be able to withdraw my funds.

So, there is no offshore like real offshore.

Let’s breakdown my holdings 👇🏽

Remember, these ETF’s are all still denominated in Rand, so although they provide offshore exposure, I must still sell to Rands to be able to withdraw my funds.

So, there is no offshore like real offshore.

Let’s breakdown my holdings 👇🏽

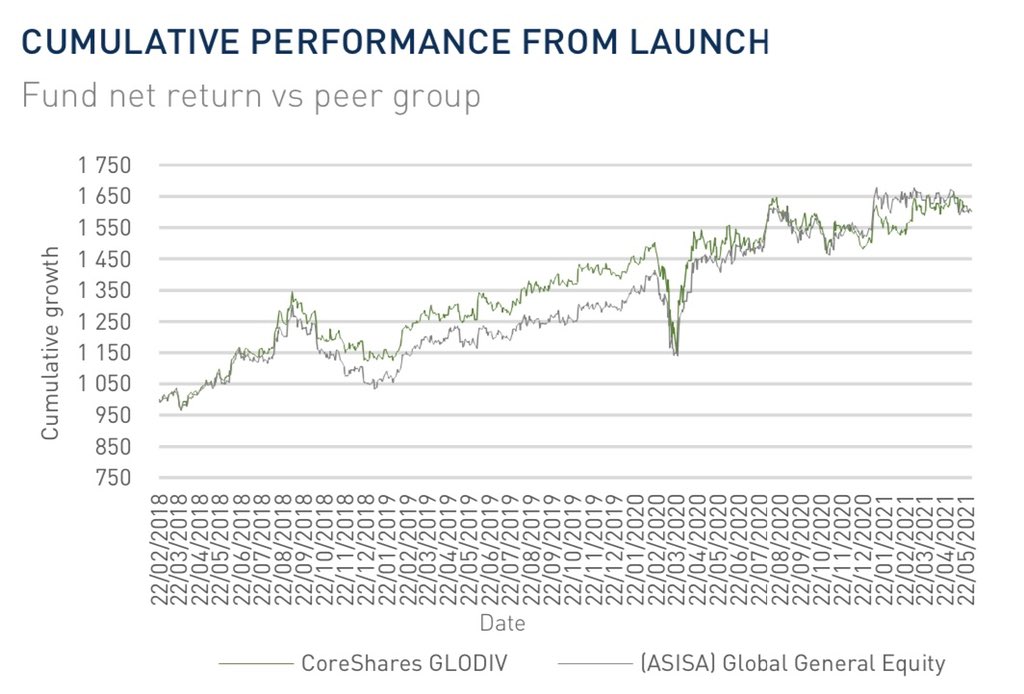

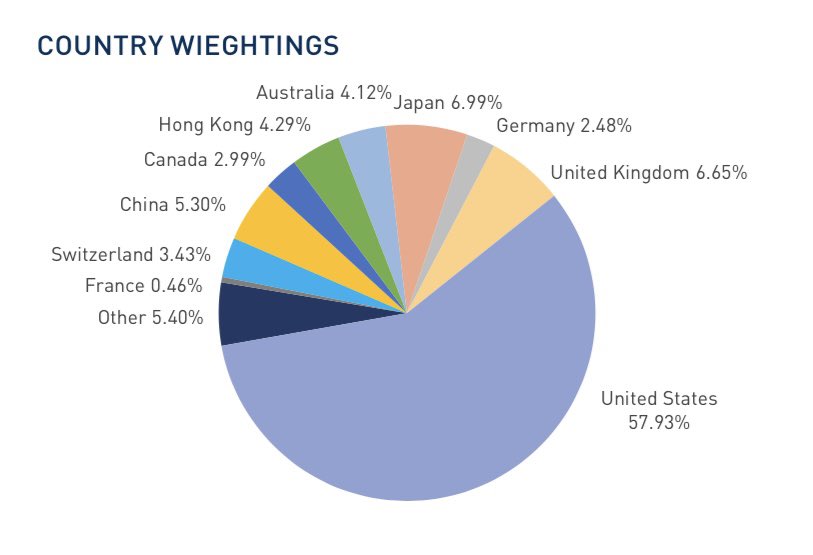

(1) GLODIV

Offered by: @CoreShares

Launched: 2018 (February)

Fund size : R724million

Benchmark: S&P Global Dividend Aristocrats Blend Index (Custom

Why this fund?

• Offshore Exposure

• Constant Dividends

• Rand hedge

(although still denominated in ZAR)

Countries👇🏽

Offered by: @CoreShares

Launched: 2018 (February)

Fund size : R724million

Benchmark: S&P Global Dividend Aristocrats Blend Index (Custom

Why this fund?

• Offshore Exposure

• Constant Dividends

• Rand hedge

(although still denominated in ZAR)

Countries👇🏽

• Composition

Many of these companies have been increasing dividend payments year after year.

Although it contains other ETF’s, which isn’t always ideal, it offers low volatility and constant income growth.

Making it a strong contender to form the core of your portfolio.

Many of these companies have been increasing dividend payments year after year.

Although it contains other ETF’s, which isn’t always ideal, it offers low volatility and constant income growth.

Making it a strong contender to form the core of your portfolio.

• Risks

- Operating costs bring ⬇️ returns

- Strengthening Rand

- Foreign securities

- Liquidity issues

Check out the fact sheet here ⬇️

drive.google.com/file/d/1epunfj…

- Operating costs bring ⬇️ returns

- Strengthening Rand

- Foreign securities

- Liquidity issues

Check out the fact sheet here ⬇️

drive.google.com/file/d/1epunfj…

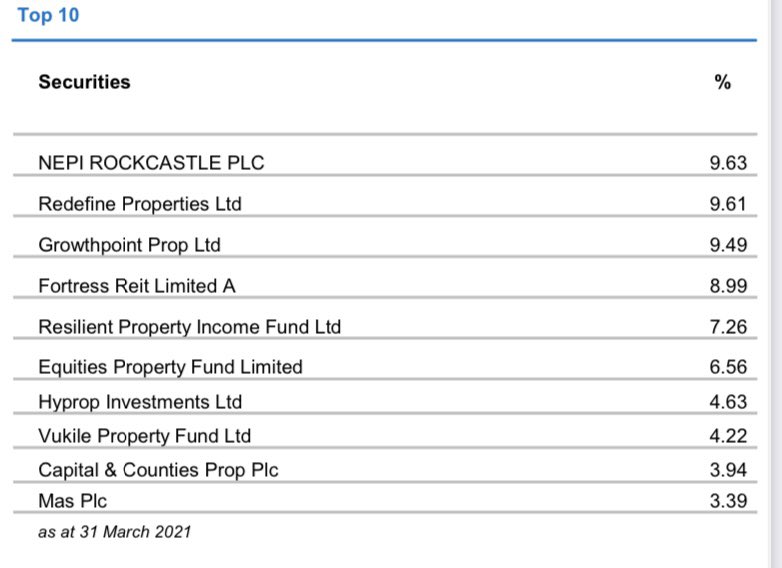

(2) STXPRO

Offered by: @SATRIX_SA

Launched: 2017 (February)

Fund size : R298million

Benchmark: SA composite Property capped index

Why this fund?

• Less stress of owning property

• Truly Benefit from Tax Free

• Constant Dividends

Sector exposure 👇🏽

Offered by: @SATRIX_SA

Launched: 2017 (February)

Fund size : R298million

Benchmark: SA composite Property capped index

Why this fund?

• Less stress of owning property

• Truly Benefit from Tax Free

• Constant Dividends

Sector exposure 👇🏽

• Composition

If you are as worried as me about the property market, then a REIT is a good viable option.

You also benefit fully from the tax free aspect of this account because it is a local exposure ETF.

If you are as worried as me about the property market, then a REIT is a good viable option.

You also benefit fully from the tax free aspect of this account because it is a local exposure ETF.

Returns

Current price : R9.13

Return : -13%

You’ve lost capital if you have been a bag holder (unrealized)

Current price : R9.13

Return : -13%

You’ve lost capital if you have been a bag holder (unrealized)

• Risks

- Securities lending

- Local economy

- Weakening ZAR

Check out the fact sheet here 👇🏽

drive.google.com/file/d/1yI7ge1…

- Securities lending

- Local economy

- Weakening ZAR

Check out the fact sheet here 👇🏽

drive.google.com/file/d/1yI7ge1…

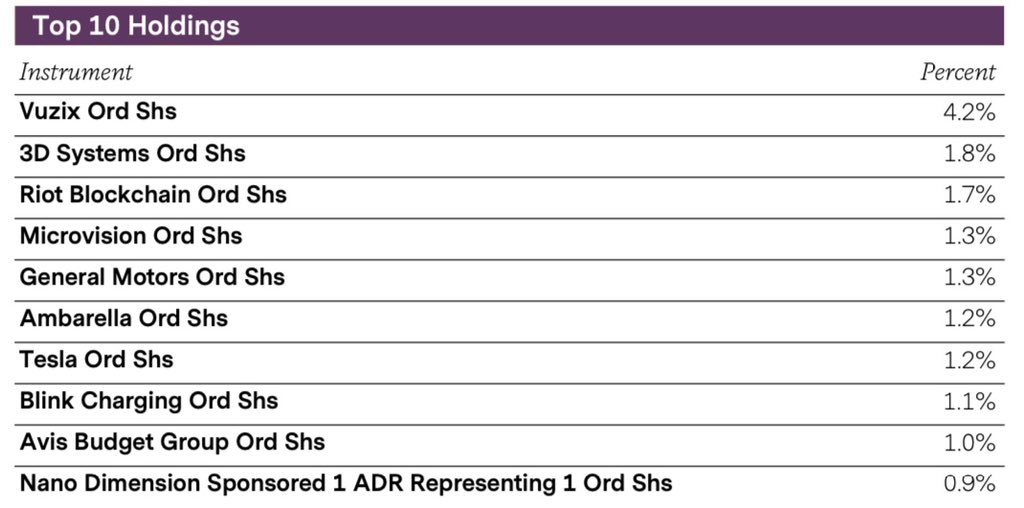

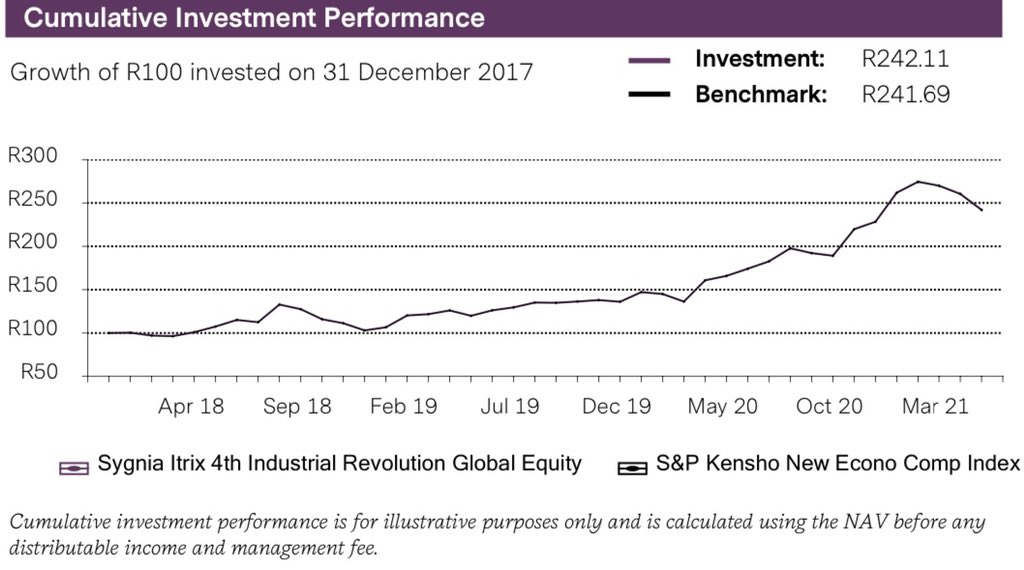

• SYG4IR

Offered by: @sygnia

Launched: 2017 (December)

Fund size : R2.1billion

Benchmark: S&P Kensho New Economies Composite Index

Why this fund?

• Offshore exposure

• Growth sectors

• Dividends

•Rand hedge (although still denominated in ZAR)

Asset allocation 👇🏽

Offered by: @sygnia

Launched: 2017 (December)

Fund size : R2.1billion

Benchmark: S&P Kensho New Economies Composite Index

Why this fund?

• Offshore exposure

• Growth sectors

• Dividends

•Rand hedge (although still denominated in ZAR)

Asset allocation 👇🏽

•Composition

100% offshore exposure (equities)

Making it a perfect ETF’s to protect against Rand devaluation, albeit higher risk.

More risk = more reward = SYG4IR

Less risk = less reward = GLODIV

100% offshore exposure (equities)

Making it a perfect ETF’s to protect against Rand devaluation, albeit higher risk.

More risk = more reward = SYG4IR

Less risk = less reward = GLODIV

• Returns

Current price: R51.85

Return: 142%

Since December 2017, the fund has performed exceptionally well.

The question now is how high did you buy and are you prepared to swallow significant drawdowns? Because they will come.

You can see the trend could be ⬇️

#ETFs

Current price: R51.85

Return: 142%

Since December 2017, the fund has performed exceptionally well.

The question now is how high did you buy and are you prepared to swallow significant drawdowns? Because they will come.

You can see the trend could be ⬇️

#ETFs

• Risks

- 100% offshore exposure

- Strengthening Rand

- Failing companies

- Overbought

- Overvalued constituents

Check the fact sheet below 👇🏽

drive.google.com/file/d/10Um9Mm…

- 100% offshore exposure

- Strengthening Rand

- Failing companies

- Overbought

- Overvalued constituents

Check the fact sheet below 👇🏽

drive.google.com/file/d/10Um9Mm…

• Why these 3 ETF’s

* GLODIV

- Stability + income

- Core of my retirement portfolio

* STXPRO

- Maximize Tax free account

* SYG4IR

- High growth exposure

Sidenote:

I trade property ETF’s within my TFSA. I buy in weakness- sell in euphoria.

Find out why in the video 👇🏽

* GLODIV

- Stability + income

- Core of my retirement portfolio

* STXPRO

- Maximize Tax free account

* SYG4IR

- High growth exposure

Sidenote:

I trade property ETF’s within my TFSA. I buy in weakness- sell in euphoria.

Find out why in the video 👇🏽

• YouTube

You definitely want to check out the video below to find out what percentage of my capital I allocate to each ETF👇🏽

I also explain what happens in drawdowns when you have no liquidity in your Tax Free Account.

You definitely want to check out the video below to find out what percentage of my capital I allocate to each ETF👇🏽

I also explain what happens in drawdowns when you have no liquidity in your Tax Free Account.

Shout-out 🔊

Thanks for having an inside look into my TFSA account.

What are you holding and why?

Thanks for having an inside look into my TFSA account.

What are you holding and why?

• • •

Missing some Tweet in this thread? You can try to

force a refresh