JP Morgan is bearish on the GBTC unlock coming up.

Here I'll go through the inner workings so you can make up your own mind.

There's 2 impacts, one bullish, one bearish. The key is in how they interact. IMO it'll be immediately bullish.

coindesk.com/grayscale-unlo…

Here I'll go through the inner workings so you can make up your own mind.

There's 2 impacts, one bullish, one bearish. The key is in how they interact. IMO it'll be immediately bullish.

coindesk.com/grayscale-unlo…

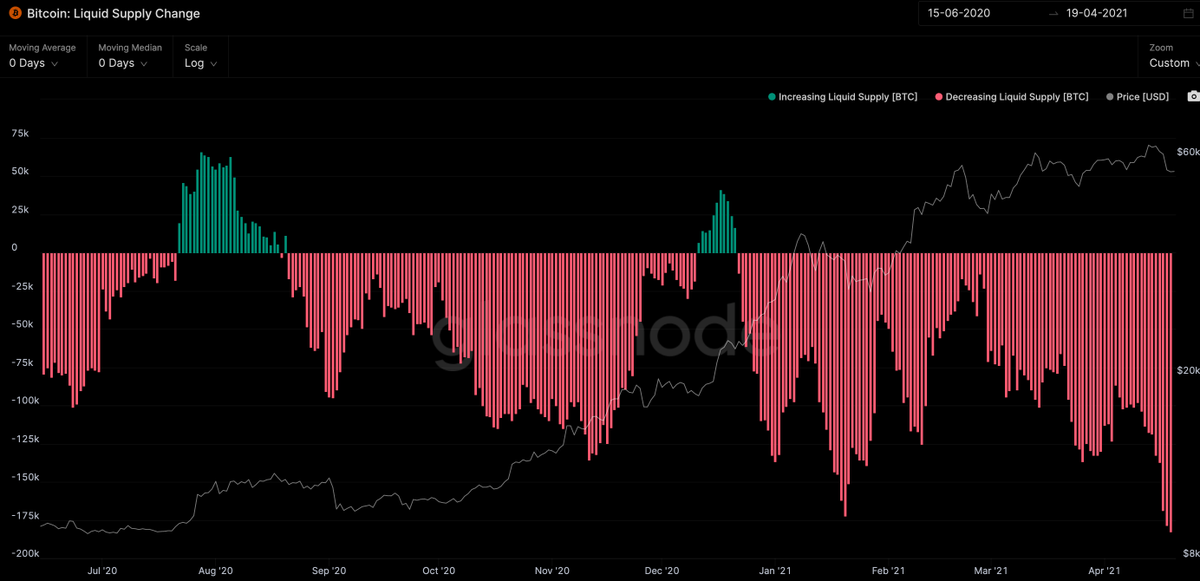

Grayscale is a unique product. It's designed as a black hole that sucks in BTC.

No BTC ever leaves the trust, apart from Grayscale taking its 2% management fees from the holdings, this is the only way to reduce the GBTC inventory.

No BTC ever leaves the trust, apart from Grayscale taking its 2% management fees from the holdings, this is the only way to reduce the GBTC inventory.

How does GBTC increase its holdings?

They allow accredited investors to add BTC into the trusts holdings in return for receiving shares in the trust (which normally trades at a premium to BTC).

This is the so-called "carry trade".

They allow accredited investors to add BTC into the trusts holdings in return for receiving shares in the trust (which normally trades at a premium to BTC).

This is the so-called "carry trade".

It's historically been a lucrative trade. At times the premium has traded at over 100% to the underlying BTC in the trust.

The only catch is you have to hold your shares for 6 months before you can sell them.

The upcoming GBTC unlock we are referring to are these shares unlocking and being available to be sold for cash.

There are 2 impacts on the market:

The upcoming GBTC unlock we are referring to are these shares unlocking and being available to be sold for cash.

There are 2 impacts on the market:

1) Derivatives

Playing the carry trade:

a) buy BTC spot, put it into Grayscale

b) receive GBTC shares

c) short BTC futures (to hedge risk)

d) earn yield from shorting BTC

e) earn the GBTC premium

Unlocking:

f) sell GBTC shares for USD

g) unhedge shorts

(g) is BULLISH

Playing the carry trade:

a) buy BTC spot, put it into Grayscale

b) receive GBTC shares

c) short BTC futures (to hedge risk)

d) earn yield from shorting BTC

e) earn the GBTC premium

Unlocking:

f) sell GBTC shares for USD

g) unhedge shorts

(g) is BULLISH

2) Spot markets

When GBTC shares unlock and get sold, the GBTC Premium drops (share price drops relative to the BTC in the trust)

Investors now have more incentive to by GBTC shares rather than BTC, it diverts some of the buying pressure on BTC spot markets. This is bearish.

When GBTC shares unlock and get sold, the GBTC Premium drops (share price drops relative to the BTC in the trust)

Investors now have more incentive to by GBTC shares rather than BTC, it diverts some of the buying pressure on BTC spot markets. This is bearish.

(1) is sudden and directly impactful than while (2) acts very slowly. Thus it's a bullish.

The over all impact over the long term is neutral as it's all arbitrage which balances out in time. What we are analysing is the short term demand/supply imbalances which may impact price.

The over all impact over the long term is neutral as it's all arbitrage which balances out in time. What we are analysing is the short term demand/supply imbalances which may impact price.

• • •

Missing some Tweet in this thread? You can try to

force a refresh