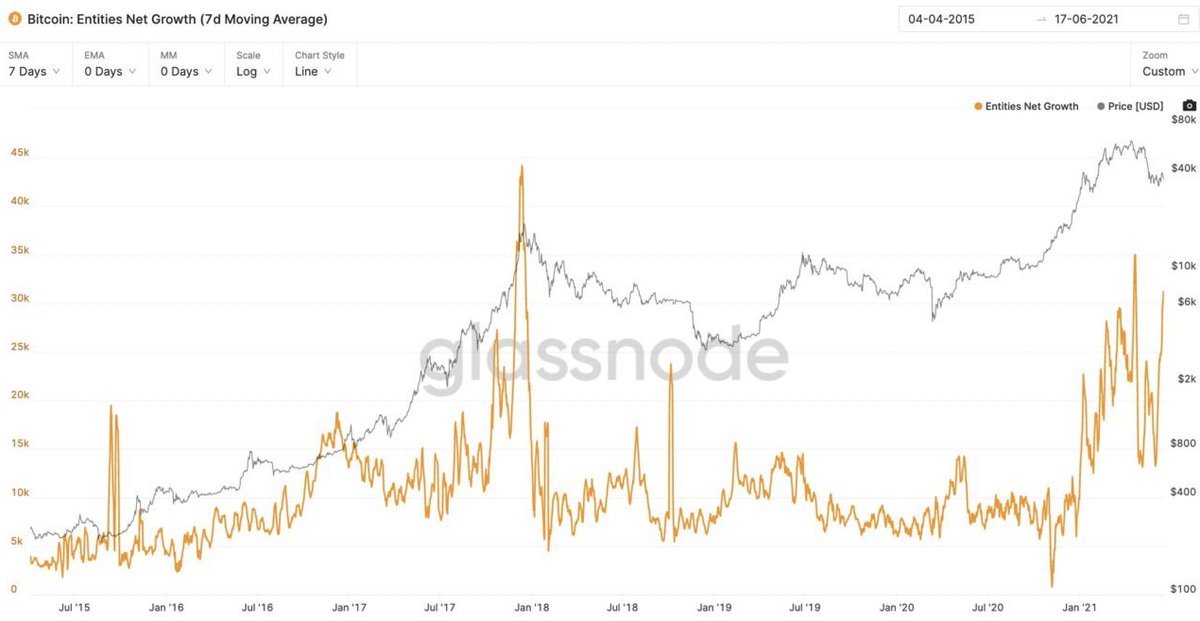

As price grinds sideways-bearish, coins are being scooped off the exchanges at a very bullish rate.

PS. The latest sizing of withdrawals vs deposits are at local highs at levels that signal a bottom, whales are scooping.

PS. The latest sizing of withdrawals vs deposits are at local highs at levels that signal a bottom, whales are scooping.

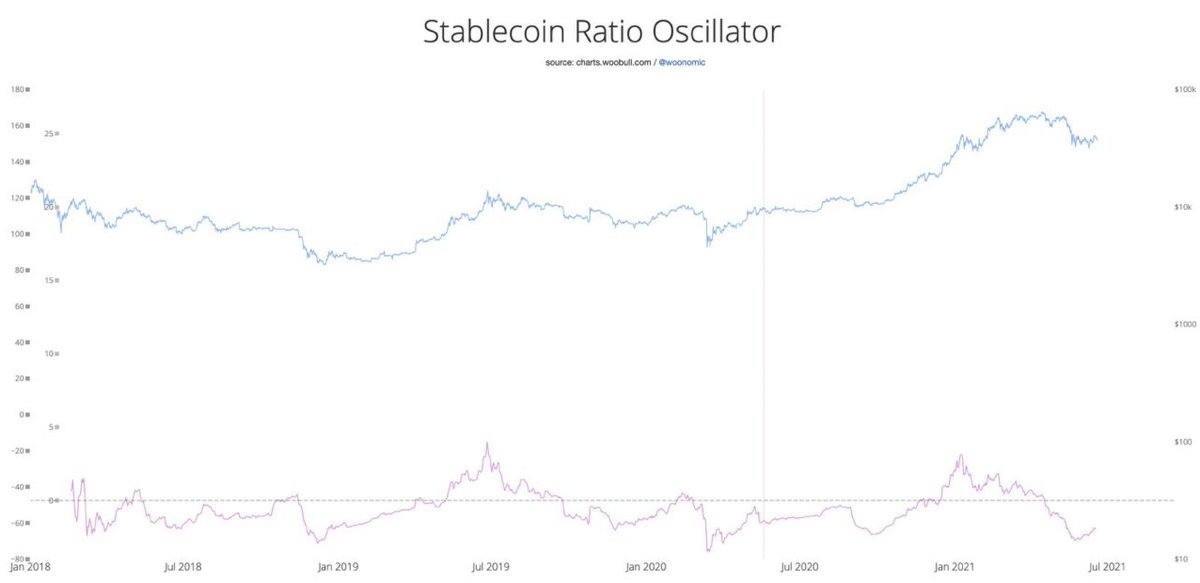

Here's another view of it, in terms of supply shock... the ratio of coins available on exchanges vs total supply (inverted so it tracks price).

Quantitative supply shock underway.

Last time I saw this, it took some time before price bounced (Oct 2020); it bounced hard.

Quantitative supply shock underway.

Last time I saw this, it took some time before price bounced (Oct 2020); it bounced hard.

A qualitative view of supply shock. Measured in holders who ain't likely to sell vs the ones that do.

IMO anyone short this market will get rekt given enough time. It's just a waiting game until the fundamentals prevail.

• • •

Missing some Tweet in this thread? You can try to

force a refresh