Yesterday I shared an observation on Oriental Carbon & Chemicals (OCCL), regarding their investments into VC funds and pre-IPO opportunities. A lot many wrote in with their views, so here are mine, with some international insights. (1/15)

OCCL is a very boring business - making insoluble sulphur, which is essential for vulcanizing rubber to make primarily tyres. Their latest annual report is very informative with respect to their strengths and market positioning, no need to re-invent the wheel here. (2/15)

Back when I first looked at OCCL several years ago, a colleague and I talked to some industry people to understand the indiustry structure. As anyone following OCCL will know, the market is mature and slow growing. The industry is capital intensive too. (3/15)

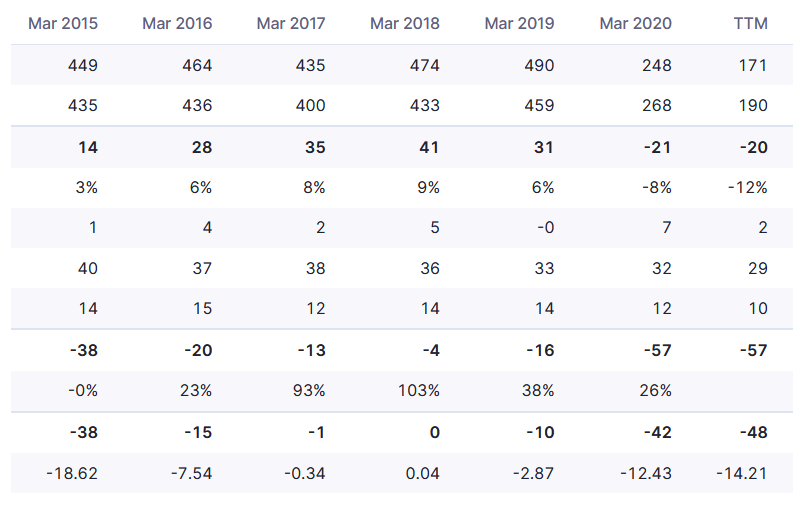

Global capacity is around ~400,000 MTPA and suffered from overcapacity over the last few years. Further, it is capital intensive, with every rupee invested into manufacturing only yielding sales of an additional rupee. Asset turnover is low. (4/15)

It also takes ages to set up new capacity. OCCL takes 1-2 years to operationalize expansions, and a global look suggests it is the same across the industry. It takes years to get approvals from tyre manufacturers too. No fast and furious here. (5/15)

An interesting insight into OCCL gleaned from distributors was that Eastman Chemicals, commanding 60% of global market share, is the price-setter in this industry and everyone essentially follows them. Eastman sells in India, but OCCL has 60% market share (probably taxes). (6/15)

Exports is where OCCL makes most of its money, though, as confirmed by annual reports and by management on investor calls. So it makes sense to see what Eastman is up to in the world markets and the USA, where OCCL targets more share. (7/15)

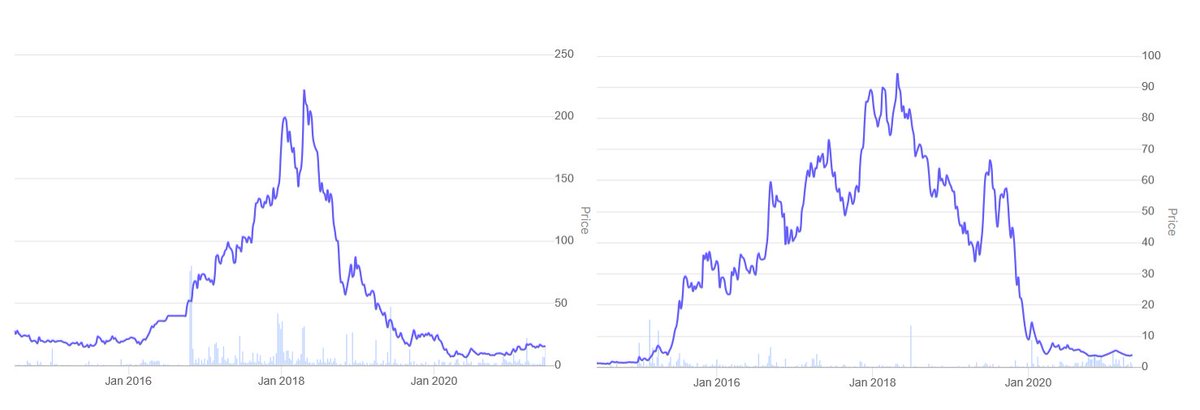

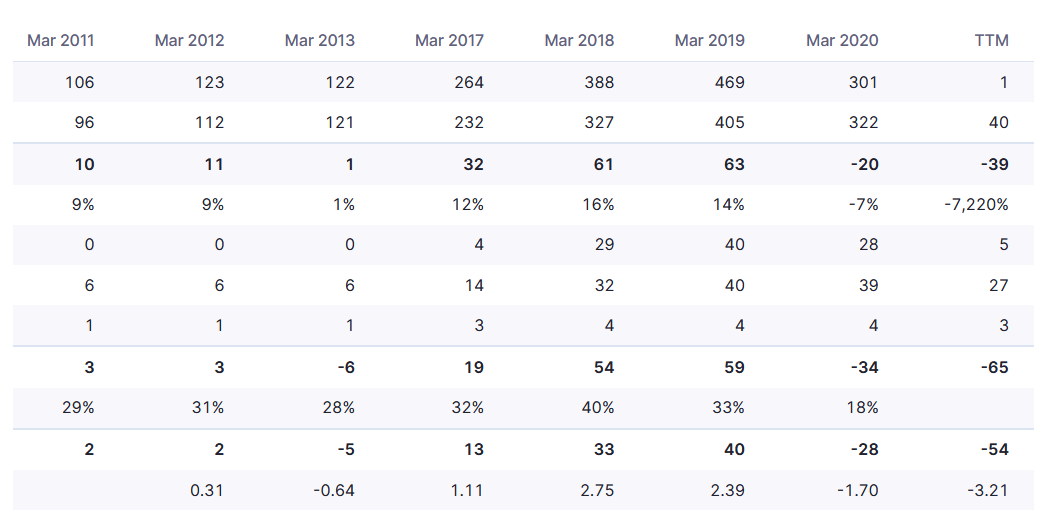

Insoluble sulfur is a small division for Eastman, which it got as part of a larger acquisition of Solutia Inc almost a decade ago. The brand is called 'Crystex' and Eastman has promoted it aggressively till 2018-ish. It hasn't been doing all that well since. (8/15)

Eastman concalls and annual reports reveal that the insoluble sulfur division was suffering cost pressures. They shutdown a Singapore plant for tire additives (insoluble sulphir) permanently in 2020. Com mentary suggests it wasn't doing all that well due to cost pressure. (9/15)

In June 2021, Eastman announced it is selling (inter alia) its tire additives division, which includes insoluble sulphur, to a PE fund called One Rock Capital. From management commentary, they speak of this division as something that did not "work out". (10/15)

Other indications are that insoluble sulphur capacity in Japan may also be shutting down, as referenced by management in concalls, with only capacity additions by OCCL and Sunsine Chemicals (chinese competitor). Overall, the industry structure is seeing supply reduction. (11/15)

Now you can contextualize OCCL - a player increasing capacity at a time when the industry is seeing reduced supply. However, that by itself may not necessarily lead to supernormal profits. Here, we go back to Eastman Chemicals. (12/15)

One Rock PE fund owns a lot of disparate businesses, this is another. If the division was not performing well at Eastman due to cost pressures (as stated), the PE fund will (a) shut down more capacities and/or (b) jack up prices. (13/15)

The competitors will benefit in these scenarios. Factors that will play out in this scenario - increasing demand, reducing capacity, increased prices by largest player - all of them can interplay among themselves for a substantial period of time. (14/15)

I have written and documented this extensively for personal use but thought a brief summary here can give insights to other people too. This should not be construed as investment advise or basis for investment decision. (15/15)

• • •

Missing some Tweet in this thread? You can try to

force a refresh