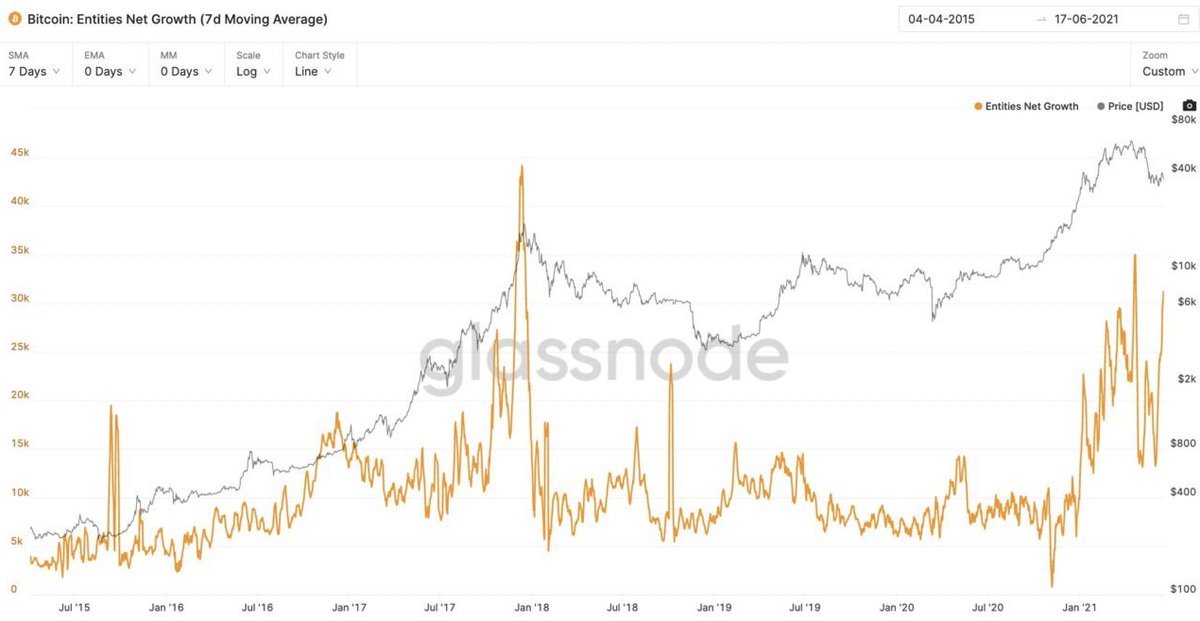

HUGE misunderstandings arising from Active Addresses vs Entities.

Entities: Estimates users via on-chain forensics

Active Addresses: Impacted by user growth, wallet activity (trade conditions), mempool congestion (drops in hash rate), fees spamming.

Entities: Estimates users via on-chain forensics

Active Addresses: Impacted by user growth, wallet activity (trade conditions), mempool congestion (drops in hash rate), fees spamming.

Chart: Unprecedented growth of users joining the network during this price dip while active addresses plummet.

-> It's a time of low volatility (less traders sending coins between exchanges to trade) and at a time when the network hash rate experienced The Great China Migration.

-> It's a time of low volatility (less traders sending coins between exchanges to trade) and at a time when the network hash rate experienced The Great China Migration.

Any analysis using active addresses in this time where China tripped the power cord in April (power outages) and a historic banning of miners in May/June will be stupidly flawed.

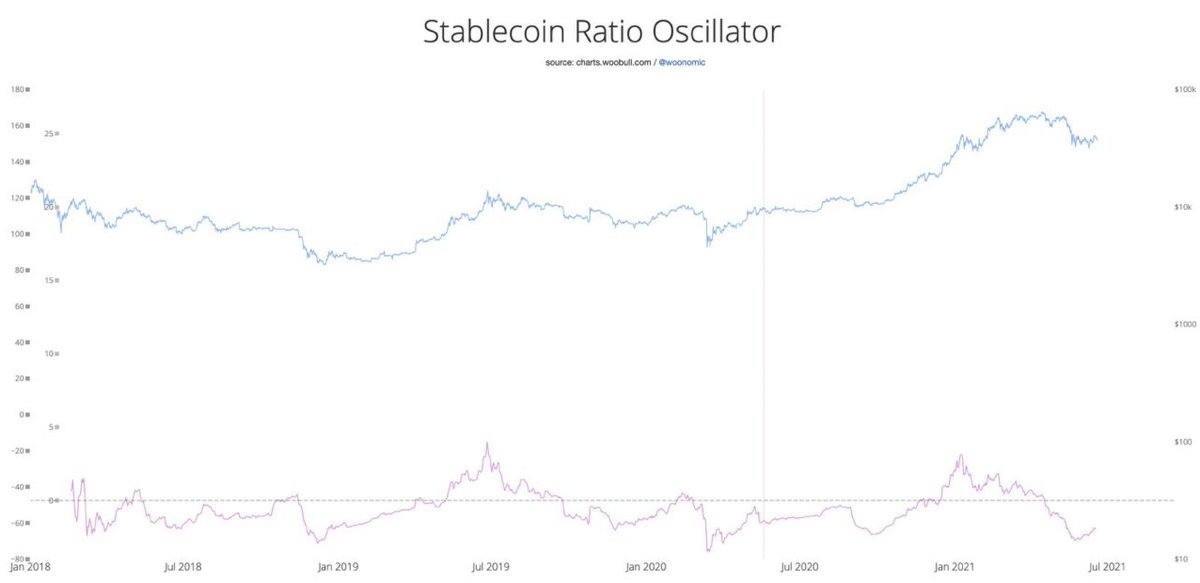

Another example of bad address analysis:

The "whales are dumping" meme.

No. It's just a count of addresses that contain more than 1000 BTC.

It could mean exchanges depleting inventory, or whale population is reducing, or just wallet consolidation. Nothing is definitive.

The "whales are dumping" meme.

No. It's just a count of addresses that contain more than 1000 BTC.

It could mean exchanges depleting inventory, or whale population is reducing, or just wallet consolidation. Nothing is definitive.

In reality, under entity analysis across ALL participants including exchanges... whales 10k+ are selling, while 1k-10k are buying what was sold. Everyone else is stacking. Speculative exchange inventory is depleting.

(It's bullish supply shock)

(It's bullish supply shock)

In all of these examples, address analysis is bearish based on unthoughtful "past correlation" as a flawed way to draw a conclusion. Address analysis fails to dissect exactly what's going on. Unprecedented times of change on the network is what's going on!

No single chart can be used as a holy grail, there's 100s of views into the network and it's detective work to figure out exactly what's happening.

@glassnode entities data is $600 per month. I'm not seeing any analyst posting bearish charts using this tier of data.

@glassnode entities data is $600 per month. I'm not seeing any analyst posting bearish charts using this tier of data.

• • •

Missing some Tweet in this thread? You can try to

force a refresh