#Bitcoin mining punches above its weight class wrt renewables adoption

It's also better able to transition to low carbon vs traditional industry

👇🏼🧵 will dive into:

🔸️how miners are decarbonizing

🔸️what's carbon negative vs neutral

🔸️context wrt trad industry

1/

It's also better able to transition to low carbon vs traditional industry

👇🏼🧵 will dive into:

🔸️how miners are decarbonizing

🔸️what's carbon negative vs neutral

🔸️context wrt trad industry

1/

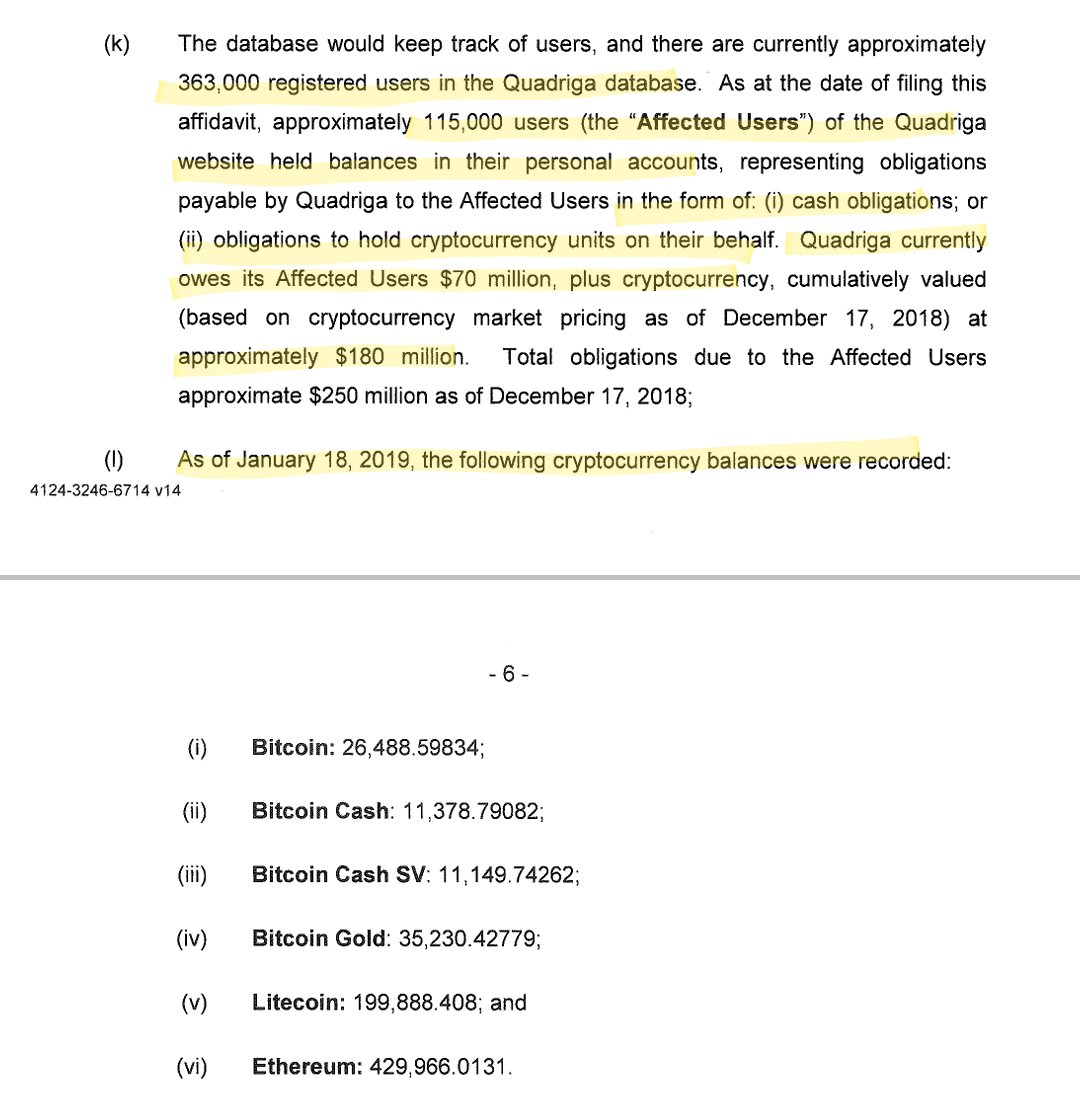

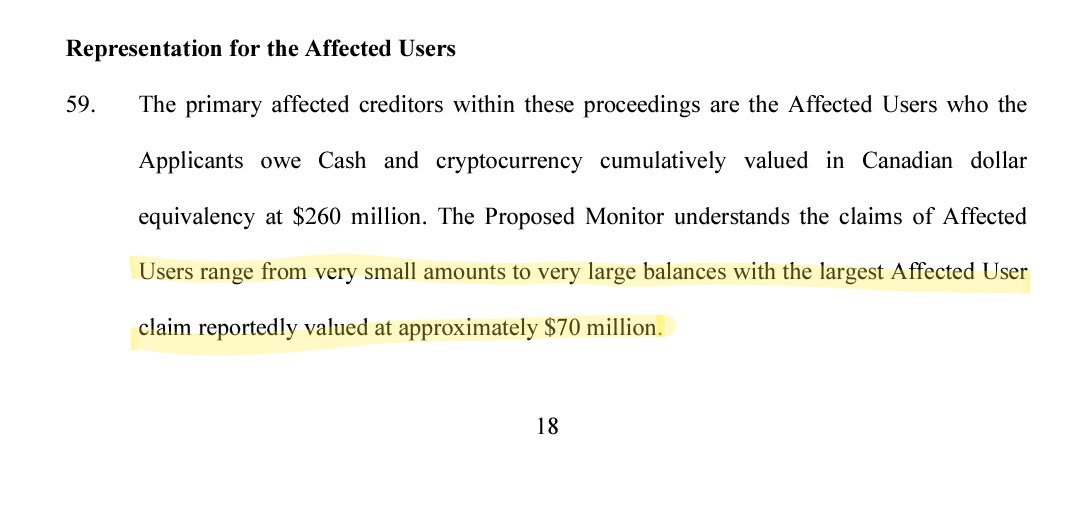

#Bitcoin mining is unique: it's the only industry w/ an industrial footprint that produces a digital good. Further, production cost cannot be passed to consumers

As such, mining is an energy intense trade exposed industry like steel or cement, & locates where most competitive

2/

As such, mining is an energy intense trade exposed industry like steel or cement, & locates where most competitive

2/

Green makes economic sense: energy & carbon emissions are cost centers

Green mining is accelerating b/c it has a competitive edge

✅ Lower marginal cost of power

✅ Added revenue streams (heat, byproducts)

❌ No carbon costs

Similar to trad industry, mining is decarbonizing

3/

Green mining is accelerating b/c it has a competitive edge

✅ Lower marginal cost of power

✅ Added revenue streams (heat, byproducts)

❌ No carbon costs

Similar to trad industry, mining is decarbonizing

3/

"Carbon neutral" (or net zero) emissions are what we hear about most

Neutral means to eliminate or offset all fossil based emissions

Many countries or companies target "0" by 2050 or 2060

4/

Neutral means to eliminate or offset all fossil based emissions

Many countries or companies target "0" by 2050 or 2060

4/

Carbon negative takes neutral a step further - it's removing more carbon than is emitted

Carbon negative reverses the carbon positive state most economies operate on (except Bhutan & Suriname 🏆); usually we're emitting more than removals (ie CO2e emissions > sequestration)

5/

Carbon negative reverses the carbon positive state most economies operate on (except Bhutan & Suriname 🏆); usually we're emitting more than removals (ie CO2e emissions > sequestration)

5/

Industries (or economies), can work towards carbon neutrality by:

🔸️fuel switching (to less carbon intensive fuels)

🔸️process switching (diff process w/ lower emissions)

🔸️carbon capture & storage/sequestration (CCS)

🔸️offsets

Trad industry examples for context 👇🏼

6/

🔸️fuel switching (to less carbon intensive fuels)

🔸️process switching (diff process w/ lower emissions)

🔸️carbon capture & storage/sequestration (CCS)

🔸️offsets

Trad industry examples for context 👇🏼

6/

Big emitters in trad industries like steel & cement can switch to bio-based coke/charcoal to lower process (chemistry) or fuel (combustion) emissions

Or they can switch manufacturing processes, eg coke ovens vs DRI 4 steel

(Note there are limits, changes can affect quality)

7

Or they can switch manufacturing processes, eg coke ovens vs DRI 4 steel

(Note there are limits, changes can affect quality)

7

Alternatively 🏭 can buy offsets; ie ⬇️ emissions elsewhere to offset combustion or process emissions at the site (eg 🌳 planting, lowering landfill methane emissions)

(Compliance offsets can be capped at a % of emissions reductions to meet regs. Voluntary may not be capped)

8/

(Compliance offsets can be capped at a % of emissions reductions to meet regs. Voluntary may not be capped)

8/

CCS is capturing carbon & storing it permanently & long term (centuries+)

It's for heavy industry (steel, cement, O&G, power gen) as they're large point sources of emissions (vs transportation or households)

But CCS is 💰 & needs a lot of energy, so it's uncommon in the wild

9/

It's for heavy industry (steel, cement, O&G, power gen) as they're large point sources of emissions (vs transportation or households)

But CCS is 💰 & needs a lot of energy, so it's uncommon in the wild

9/

Diff types of CCS:

Geological: inject CO2 into geo formations like oil & gas fields, saline aquifers. CO2 injection can even enhance oil recovery

Mineral: CO2 can be converted chemically to stable carbonates (rocks)

Biogenic: CO2 is taken up by alage or bacteria & destroyed

10

Geological: inject CO2 into geo formations like oil & gas fields, saline aquifers. CO2 injection can even enhance oil recovery

Mineral: CO2 can be converted chemically to stable carbonates (rocks)

Biogenic: CO2 is taken up by alage or bacteria & destroyed

10

Trad industries have choices to lower carbon. Depending on the combo of tech, they can hit neutral or even negative

Cost is usually the biggest factor, but others incl lifetime of equipment (won't change process/equipment until end of life due to sunk costs)

11/

Cost is usually the biggest factor, but others incl lifetime of equipment (won't change process/equipment until end of life due to sunk costs)

11/

#Bitcoin miners have an advantage over trad industry

🔸️mobile: can locate to renewables (can't move steel plant)

🔸️short upgrade cycles to more productive & energy efficient equipment (kilns & coke ovens last decades)

🔸️high margins: $ to innovate, deploy lowcarbon tech

12/

🔸️mobile: can locate to renewables (can't move steel plant)

🔸️short upgrade cycles to more productive & energy efficient equipment (kilns & coke ovens last decades)

🔸️high margins: $ to innovate, deploy lowcarbon tech

12/

#Bitcoin miners can lower carbon footprint several ways

🔸️renewables & nuclear

🔸️fuel switching from fossil to biomass (biomethane from landfills, anaerobic digesters)

🔸️more efficient or productive miners (less ⚡)

🔸️offsets

🔸️carbon capture & storage/sequestration

13/

🔸️renewables & nuclear

🔸️fuel switching from fossil to biomass (biomethane from landfills, anaerobic digesters)

🔸️more efficient or productive miners (less ⚡)

🔸️offsets

🔸️carbon capture & storage/sequestration

13/

Carbon neutral #Bitcoin mining is possible

💯 renewable: 🌊 @GryphonMining @CCU_BTC

Renewables☀️💨 + storage🔋

cc: @sqcrypto @ARKInvest

Nuclear: @compass_mining @StandardPower1 to run on ☢

Biomethane: @easycryptohunt is working w/ 👨🌾🐄💩

Biomass pellets & biochar 🔥➡️⚡

/14

💯 renewable: 🌊 @GryphonMining @CCU_BTC

Renewables☀️💨 + storage🔋

cc: @sqcrypto @ARKInvest

Nuclear: @compass_mining @StandardPower1 to run on ☢

Biomethane: @easycryptohunt is working w/ 👨🌾🐄💩

Biomass pellets & biochar 🔥➡️⚡

/14

#Bitcoin miners have already achieved carbon neutral operations. Many operate at higher renewables % than existing grids

Industry data shows we're already overdelivering vs traditional heavy industries!

@CambridgeAltFin @CoinSharesCo #BitcoinMiningCouncil cc: @michael_saylor

15

Industry data shows we're already overdelivering vs traditional heavy industries!

@CambridgeAltFin @CoinSharesCo #BitcoinMiningCouncil cc: @michael_saylor

15

But we're a baddass industry & push the envelope :)

Miners can go above & beyond #NetZero

This week, forever immortalized on the #Bitcoin blockchain: a carbon negative block

👇🏼 Let's explore ways a miner could hit carbon negative (some options more likely than others)

16/

Miners can go above & beyond #NetZero

This week, forever immortalized on the #Bitcoin blockchain: a carbon negative block

👇🏼 Let's explore ways a miner could hit carbon negative (some options more likely than others)

16/

Example 1: Renewable or ☢ miners sell heat offtake to heat load 🏭🏘

Heat is recovered & used in an application that otherwise burns coal or natural gas, offsetting fossil emissions

👆🏼 very plausible. @MintGreenHQ & @GenesisMining already piloting industrial heat recovery

17/

Heat is recovered & used in an application that otherwise burns coal or natural gas, offsetting fossil emissions

👆🏼 very plausible. @MintGreenHQ & @GenesisMining already piloting industrial heat recovery

17/

Eg 2: Combust biofuel (biomethane, biomass) + capture & sequester CO2

🔸️CO2 could be captured by alage & made into neutraceuticals, animal/fish feed, biomaterials

🔸️CO2 could be injected into greenhouses

Plausible due to addnl revenue streams & byproducts; exists outside ⛏

🔸️CO2 could be captured by alage & made into neutraceuticals, animal/fish feed, biomaterials

🔸️CO2 could be injected into greenhouses

Plausible due to addnl revenue streams & byproducts; exists outside ⛏

Example 2: Renewable or ☢ miners sell heat offtake to heat load

Heat is recovered & used in an application that would otherwise burn coal or natural gas, offsetting fossil emissions

👆🏼 very plausible. @GenesisMining & @MintGreenHQ already piloting industrial heat recovery

18/

Heat is recovered & used in an application that would otherwise burn coal or natural gas, offsetting fossil emissions

👆🏼 very plausible. @GenesisMining & @MintGreenHQ already piloting industrial heat recovery

18/

Ex3. Biofuels 🔥 + deploying carbon capture & storage

Imo, this is expensive & would only be used in a *high* carbon price jurisdiction. Miners would relocate first

(Note, I can see O&G using CCS for enhanced oil recovery; but since oil is burned, it's not carbon negative)

19/

Imo, this is expensive & would only be used in a *high* carbon price jurisdiction. Miners would relocate first

(Note, I can see O&G using CCS for enhanced oil recovery; but since oil is burned, it's not carbon negative)

19/

Example 4: Theoretically, renewable or nuclear ⚡ could be coupled w/ offsets to achieve carbon negative operations

I question *why* due to unnecessary cost, but it's doable

Regardless, there are several pathways to carbon negative; & there will be miners that pursue them

/20

I question *why* due to unnecessary cost, but it's doable

Regardless, there are several pathways to carbon negative; & there will be miners that pursue them

/20

That sums up how #Bitcoin mining is decarbonizing. Hopefully, you learned something new

Further analysis that could build on this 🧵: adding CO2 reduction estimates for green mining options; timelines for adoption to get to net zero

As for sustainability more broadly...

21/

Further analysis that could build on this 🧵: adding CO2 reduction estimates for green mining options; timelines for adoption to get to net zero

As for sustainability more broadly...

21/

The future of #Bitcoin mining is green:

⬆️ integration w/ clean, modern power grids: provide ancillary services & subsidize renewable infra

⬇️ waste: plastics & tires (PRTI @GoingParabolic) for energy

⬆️ industrial synergies: heat offtake, flare gas use, & saleable byproducts

22/

⬆️ integration w/ clean, modern power grids: provide ancillary services & subsidize renewable infra

⬇️ waste: plastics & tires (PRTI @GoingParabolic) for energy

⬆️ industrial synergies: heat offtake, flare gas use, & saleable byproducts

22/

Considering we overachieve vs trad industry, #Bitcoin is unfairly held to impossible ESG standards

Esp when we deliver on the "S" (@gladstein 👇🏼 illustrates why energy used by network is not wasted

bitcoinmagazine.com/authors/alexgl…) & "G" (@nlw covers full ESG coindesk.com/podcasts/coind…)

23/

Esp when we deliver on the "S" (@gladstein 👇🏼 illustrates why energy used by network is not wasted

bitcoinmagazine.com/authors/alexgl…) & "G" (@nlw covers full ESG coindesk.com/podcasts/coind…)

23/

The headlines don't cover our success stories w/ the same fanfare, but the #Bitcoin mining industry is BUIDLing a better future in the background & I'm proud to be a part of it!

We're a 💎 in the rough rn, but don't count us out!

24/ fin

We're a 💎 in the rough rn, but don't count us out!

24/ fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh