1/ Introducing percentage or market share views! 🚨

With a few simple clicks, users of Token Terminal can now switch between

- 7d, 30d, 90d, 365d, max

- cumulative / daily / monthly

- absolute / percentage views

Let’s work through a few examples! 👇🧵

With a few simple clicks, users of Token Terminal can now switch between

- 7d, 30d, 90d, 365d, max

- cumulative / daily / monthly

- absolute / percentage views

Let’s work through a few examples! 👇🧵

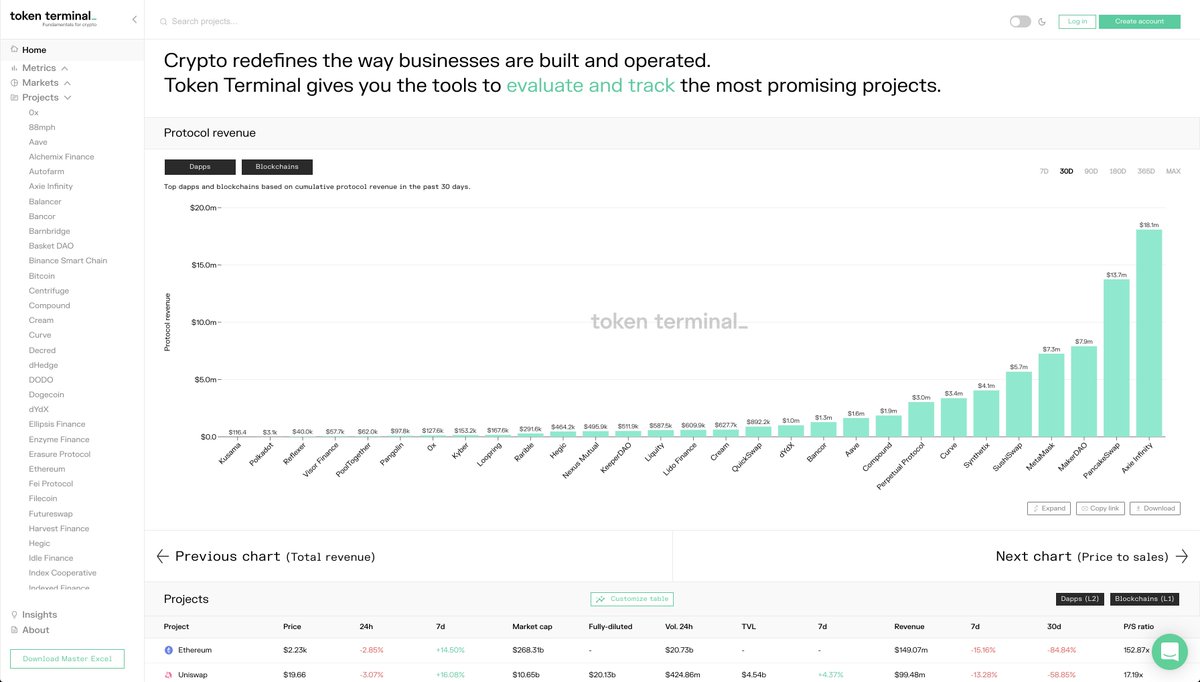

2/ Looking at the Protocol Revenue dashboard:

- The rise of @AxieInfinity is clearly visible

- Also the rapid emergence of @PancakeSwap

- @synthetix_io relative share has gone down (launch on Optimism might reverse this?)

- The rise of @AxieInfinity is clearly visible

- Also the rapid emergence of @PancakeSwap

- @synthetix_io relative share has gone down (launch on Optimism might reverse this?)

3/ Looking at the Total Revenue (supply-side + protocol) dashboard:

- @ethereum's share of total fees has gone down

- Even here, @AxieInfinity's recent growth is clearly visible

- We can also see that even @binance smart chain has to charge its users meaningful tx fees 😄

- @ethereum's share of total fees has gone down

- Even here, @AxieInfinity's recent growth is clearly visible

- We can also see that even @binance smart chain has to charge its users meaningful tx fees 😄

4/ Looking at the Lending dashboard:

Top lending protocols based on daily GMV (borrowing volume) in the past 365 days.

- We can see how @AaveAave has gained market share relative to @compoundfinance & @MakerDAO

- The launch of @LiquityProtocol is also clearly visible

Top lending protocols based on daily GMV (borrowing volume) in the past 365 days.

- We can see how @AaveAave has gained market share relative to @compoundfinance & @MakerDAO

- The launch of @LiquityProtocol is also clearly visible

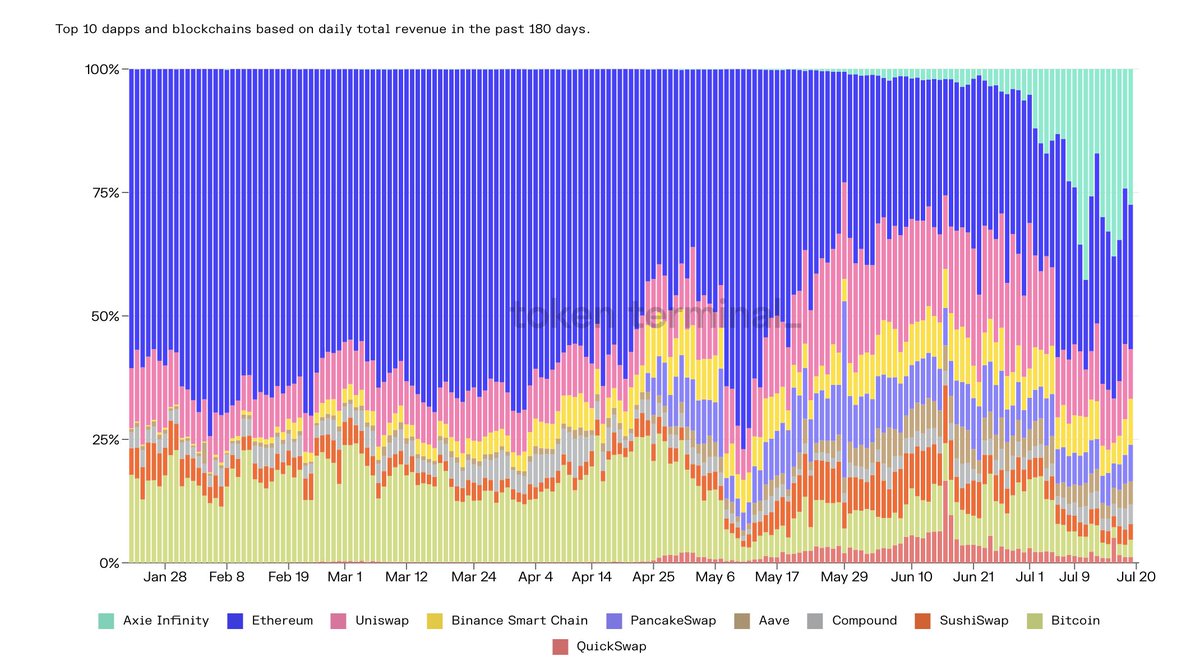

5/ Looking at the Exchange dashboard:

Top exchanges based on daily total revenue in the past 180 days.

- We can see how Uniswap still is the largest DEX in terms of total revenue (fees) paid

- It's also clear that AMMs have taken the lead in the DEX market (at least for now)

Top exchanges based on daily total revenue in the past 180 days.

- We can see how Uniswap still is the largest DEX in terms of total revenue (fees) paid

- It's also clear that AMMs have taken the lead in the DEX market (at least for now)

6/ Looking at the @Uniswap dashboard:

Daily trading vol. composition in the past 365 days:

- We can see that the growth of USDC/ETH pair has taken away share from the long-tail of assets (other category)

Daily trading vol. composition in the past 365 days:

- We can see that the growth of USDC/ETH pair has taken away share from the long-tail of assets (other category)

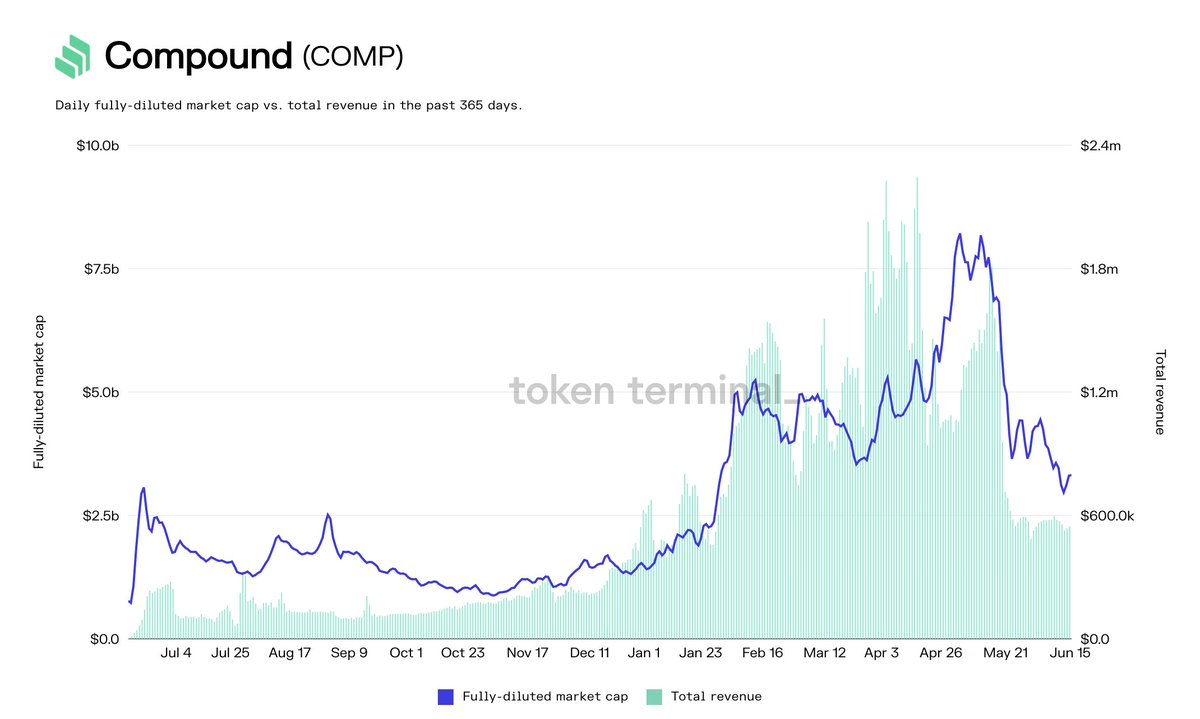

7/ Looking at the @compoundfinance dashboard:

Daily supply-side revenue and protocol revenue in the past 180 days.

- We can see the avg. revenue share % between $COMP holders & lenders and how it fluctuates over time (borrowing volumes & reserve factors change over time)

Daily supply-side revenue and protocol revenue in the past 180 days.

- We can see the avg. revenue share % between $COMP holders & lenders and how it fluctuates over time (borrowing volumes & reserve factors change over time)

8/ Looking at the @perpprotocol dashboard:

Daily trading vol. composition in the past 180 days.

- We can see the long-tail of assets (other category) having a sizeable share of total trading volume

- $ALPHA has also gained share of total trading volume recently

Daily trading vol. composition in the past 180 days.

- We can see the long-tail of assets (other category) having a sizeable share of total trading volume

- $ALPHA has also gained share of total trading volume recently

9/ Looking at the @SushiSwap dashboard:

Daily supply-side revenue and protocol revenue in the past 180 days.

- We can clearly see that the protocol activated the fixed revenue share that was implemented in the Uniswap v2 contracts

Daily supply-side revenue and protocol revenue in the past 180 days.

- We can clearly see that the protocol activated the fixed revenue share that was implemented in the Uniswap v2 contracts

fin/ What interesting insights can you find from the 📊?

Go ahead and check out the new charts on tokenterminal.com & share them with us on Twitter!

P.S. We're also launching a Token Terminal @discord next week to boost community engagement, stay tuned for that! 😎

Go ahead and check out the new charts on tokenterminal.com & share them with us on Twitter!

P.S. We're also launching a Token Terminal @discord next week to boost community engagement, stay tuned for that! 😎

• • •

Missing some Tweet in this thread? You can try to

force a refresh