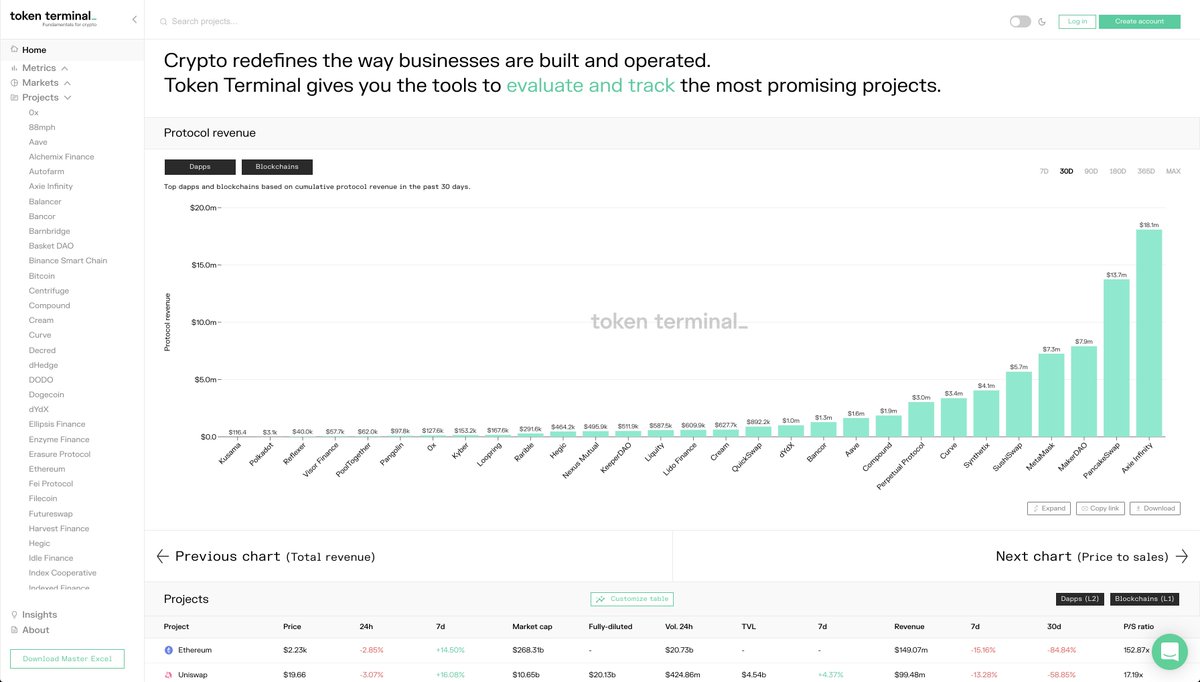

While the P/E ratio is a great starting point for cryptoasset valuation, it should not be used in isolation.

- What's driving 'E'? Token incentives / organic adoption?

- What does the rev. composition look like? One or multiple sources?

- Is the revenue share % sustainable?

- What's driving 'E'? Token incentives / organic adoption?

- What does the rev. composition look like? One or multiple sources?

- Is the revenue share % sustainable?

https://twitter.com/0xAppodial/status/1418158319680770051

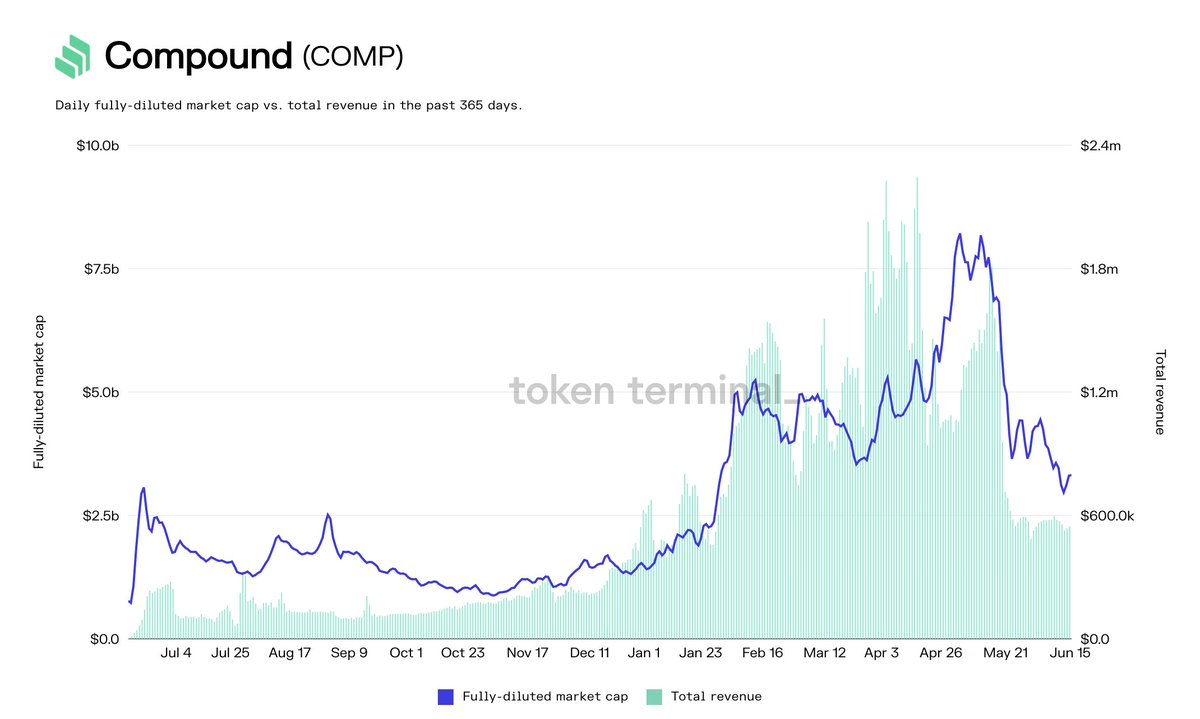

- What's driving 'E'? Token incentives / organic adoption?

Example: @compoundfinance

Currently, there's more $ paid out in token incentives vs. what's coming in as protocol revenue.

Nothing unusual for an early-stage startup, but worth being aware of.

Example: @compoundfinance

Currently, there's more $ paid out in token incentives vs. what's coming in as protocol revenue.

Nothing unusual for an early-stage startup, but worth being aware of.

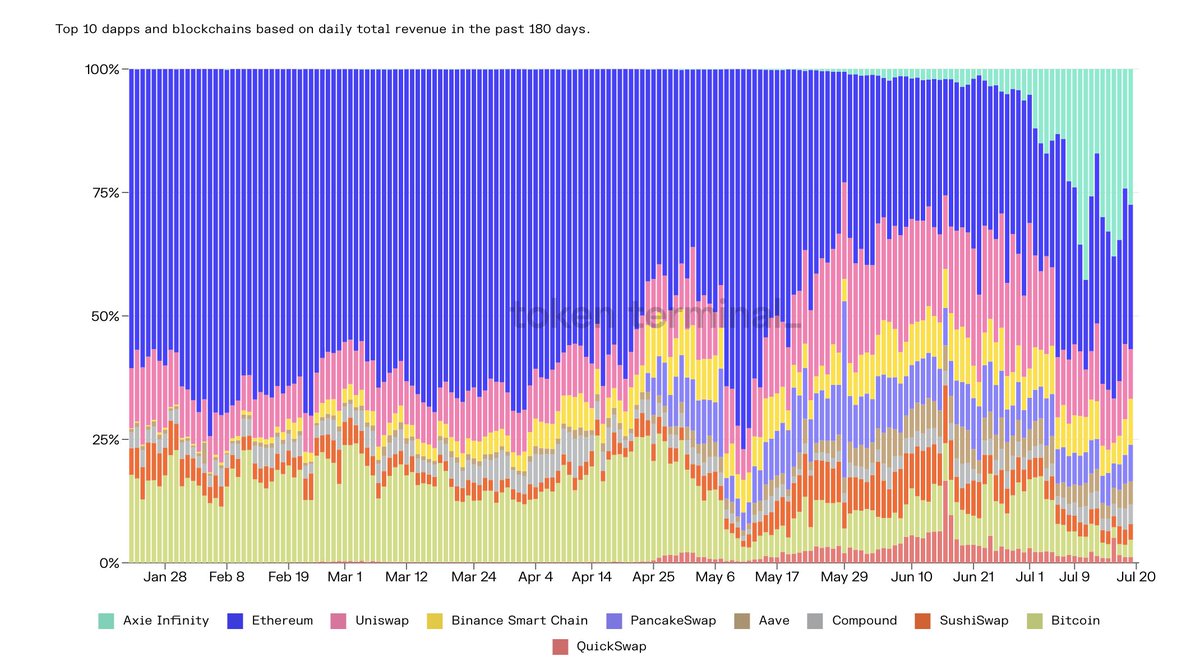

- What does the rev. composition look like? One or multiple sources?

Example: @Uniswap

The long-tail of assets (other category) is driving the majority of Uniswap's (LP) revenue.

Diversity > concentration

Example: @Uniswap

The long-tail of assets (other category) is driving the majority of Uniswap's (LP) revenue.

Diversity > concentration

- Is the revenue share % sustainable?

Example: @MakerDAO

Currently, all interest payments go to the protocol (MKR holders).

Will Maker eventually have to share this revenue with CDP creators / depositors?

Example: @MakerDAO

Currently, all interest payments go to the protocol (MKR holders).

Will Maker eventually have to share this revenue with CDP creators / depositors?

• • •

Missing some Tweet in this thread? You can try to

force a refresh