What is #Litecoin

#LTC was created in Oct 2011 by computer scientist Charlie Lee, an ex-Googler.

$LTC is based on Bitcoin protocol but it has a different hashing algorithm, and the total supply is capped like Bitcoin, but a higher number of total tokens (84M vs 21M).

#LTC was created in Oct 2011 by computer scientist Charlie Lee, an ex-Googler.

$LTC is based on Bitcoin protocol but it has a different hashing algorithm, and the total supply is capped like Bitcoin, but a higher number of total tokens (84M vs 21M).

Gold vs Silver

#Litecoin is scarce in the same way #Bitcoin is, but it is cheaper and faster to transact in on the base chain (Layer 1). This leads to the narrative that #LTC is the "silver" currency to #BTC's "gold" store of value.

Its network is 10 years old with 100$ uptime.

#Litecoin is scarce in the same way #Bitcoin is, but it is cheaper and faster to transact in on the base chain (Layer 1). This leads to the narrative that #LTC is the "silver" currency to #BTC's "gold" store of value.

Its network is 10 years old with 100$ uptime.

Litecoin to Bitcoin Ratio

The LTC/BTC pair is a ratio of the value of LTC in terms of BTC value.

Litecoin's price has a demonstrated cycle range to Bitcoin price since 2011 - LTC acts as an oscillator on the LTC/BTC chart.

Its descending trend is close to a breakout (more ltr)

The LTC/BTC pair is a ratio of the value of LTC in terms of BTC value.

Litecoin's price has a demonstrated cycle range to Bitcoin price since 2011 - LTC acts as an oscillator on the LTC/BTC chart.

Its descending trend is close to a breakout (more ltr)

Litecoin has oscillated around 1.2% of bitcoin price, with cycle highs of 2.5% and cycle lows of .0042%.

This ratio is expressed in $LTCBTC pair. The pair cycles from 0.025 LTC/BTC to 0.004 LTC/BTC. Current value is 0.00366 LTC/BTC, significantly undervalued compared to BTC.

This ratio is expressed in $LTCBTC pair. The pair cycles from 0.025 LTC/BTC to 0.004 LTC/BTC. Current value is 0.00366 LTC/BTC, significantly undervalued compared to BTC.

Litecoin historically has grown 4x-6x more than Bitcoin from cycle lows.

I speculate that Litecoin will grow 4-5x more than Bitcoin (short-term) when it pumps, as it is currently reaching all-time lows on the LTC/BTC chart.

I speculate that Litecoin will grow 4-5x more than Bitcoin (short-term) when it pumps, as it is currently reaching all-time lows on the LTC/BTC chart.

Don't believe this is likely/possible?

I called the $DOGE breakout in January. I called a coming of break the long-term trend at 66 satoshis.

This sent #DOGE from $0.0080 to $0.08800 (10x) the following day.

I called the $DOGE breakout in January. I called a coming of break the long-term trend at 66 satoshis.

This sent #DOGE from $0.0080 to $0.08800 (10x) the following day.

https://twitter.com/misconfig_exe/status/1354814406278823943

Why is DOGE relevant? DOGE is merge-mined with Litecoin. But more importantly:

They both are "oscillators" on the Bitcoin chart.

They are both widely available.

In fact, Litecoin is much more available:

They both are "oscillators" on the Bitcoin chart.

They are both widely available.

In fact, Litecoin is much more available:

#Litecoin is available on @Venmo @CashApp @PayPal and of course on @RobinhoodApp and @coinbase and @Gemini. Pretty much all exchanges worldwide.

There are more $LTC ATMs than there are for ANY other altcoin. Only #BTC has more.

There are more $LTC ATMs than there are for ANY other altcoin. Only #BTC has more.

This means that when mania returns, Litecoin will be available to almost every newcomer -- especially those who already have an app from when they bought DOGE or SHIB or some poocoin and got burned.

They'll learn "Litecoin is like Bitcoin but cheaper"

They'll learn "Litecoin is like Bitcoin but cheaper"

Now, maybe you don't buy in to any of this nonsense, and you are a Bitcoin maximalist.

Maybe you're "too smart" for this.

Well, think like an average person. They can't figure out what DeFi project isn't going to rug them or which dog-token is not a scam.

Litecoin is 10 years old

Maybe you're "too smart" for this.

Well, think like an average person. They can't figure out what DeFi project isn't going to rug them or which dog-token is not a scam.

Litecoin is 10 years old

Unit Bias:

Unit bias is the psychological impulse to own "multiples of" something, rather than "fraction of" a thing.

This is part of the appeal of DOGE - you can have several thousand for cheap.

But everyone experiences this. #Litecoin is "cheaper" per unit than #Bitcoin --

Unit bias is the psychological impulse to own "multiples of" something, rather than "fraction of" a thing.

This is part of the appeal of DOGE - you can have several thousand for cheap.

But everyone experiences this. #Litecoin is "cheaper" per unit than #Bitcoin --

-- #Litecoin is not only cheaper per unit than Bitcoin, it's also cheaper than #ETH and #BCH, which are two other 'alts' offered on PayPal and Robinhood et al.

"The Price - Is Right"

"The Price - Is Right"

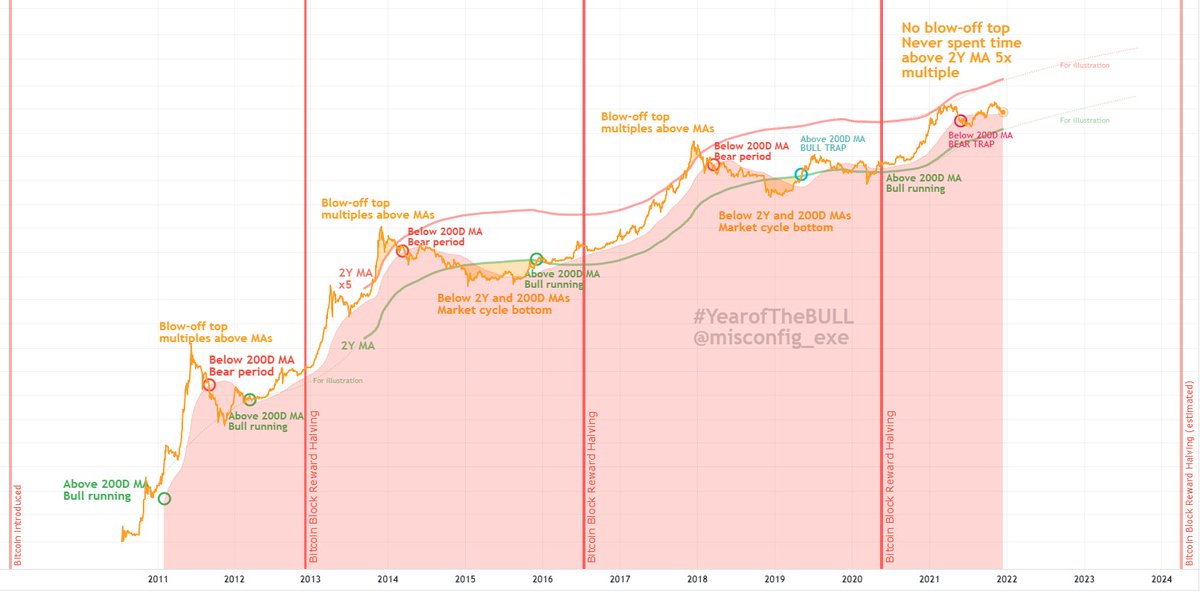

Note this is a logarithmic chart, the previous one was linear.

The log scale shows a more conservative approach to targets as it suggests a breakout may be further off.

The log scale shows a more conservative approach to targets as it suggests a breakout may be further off.

A new feature is in final stages of development (testing and refinement) for #Litecoin which will enable privacy of wallets and transactions: #MWEB or Mimble Wimble Extension Blocks

https://twitter.com/Benaskren/status/1417529934864556032

Oh I forgot to share this chart.

Compares LTC performance during BTC manias.

Compares LTC performance during BTC manias.

https://twitter.com/misconfig_exe/status/1388265753913303041

Remember, all investments and trades are risky. This is not financial advice.

Litecoin is my biggest holding at this time - "he's just shilling his bag".

DYOR and make your own decisions

Litecoin is my biggest holding at this time - "he's just shilling his bag".

DYOR and make your own decisions

Lol. *100% uptime not 100$

• • •

Missing some Tweet in this thread? You can try to

force a refresh