4/ A useful analogy for thinking about crypto:

Blockchains are global computers that host Internet-scale applications.

Blockchains are global computers that host Internet-scale applications.

5/ Key takeaway:

Crypto makes it possible to build organisations that operate at global scale from day one.

Crypto makes it possible to build organisations that operate at global scale from day one.

7/ Traditional companies are a set of pen & paper contracts.

These contracts are enforced by local jurisdictions --> limited scale.

These contracts are enforced by local jurisdictions --> limited scale.

8/ Blockchain-based applications consist of a set of open-source (smart) contracts.

These contracts are enforced by a blockchain (global computer) --> Internet scale.

These contracts are enforced by a blockchain (global computer) --> Internet scale.

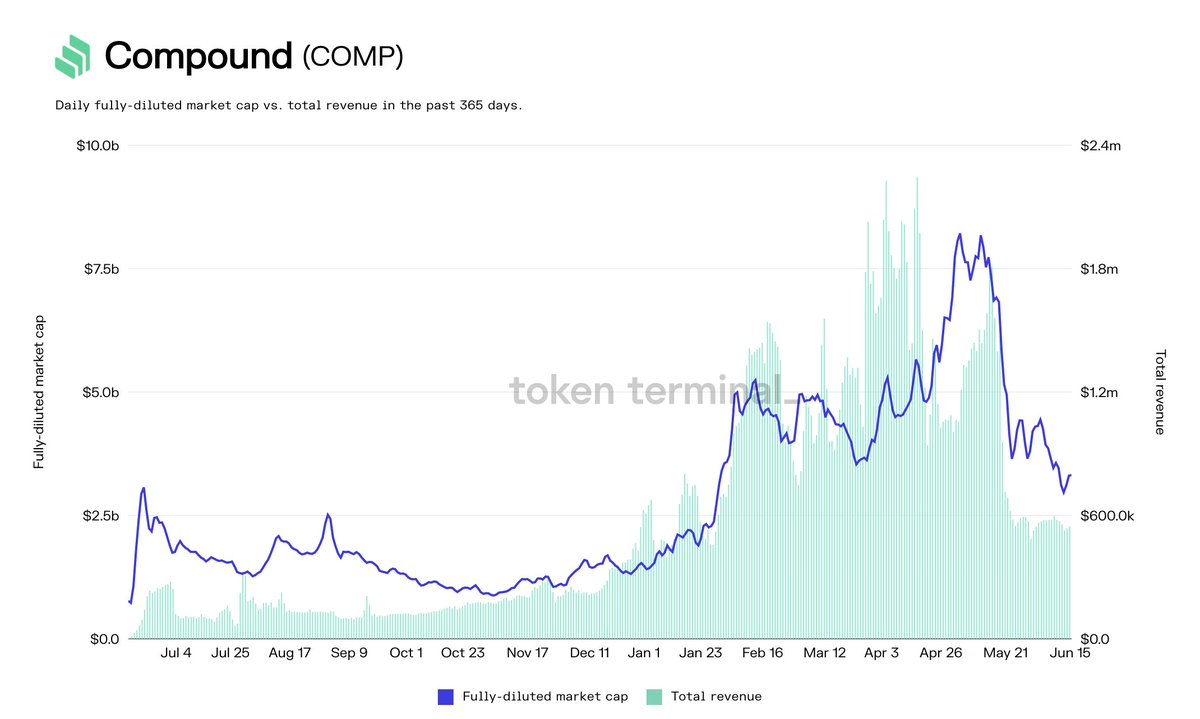

9/ For example, Compound can be thought of as a bank built on the Ethereum blockchain.

Compound's open-source contracts contain the business logic for lending & borrowing.

Compound's open-source contracts contain the business logic for lending & borrowing.

10/ Key takeaway:

By modifying the business logic of an application's open-source contracts, we can build all kinds of businesses in a highly scalable manner directly on the Internet.

By modifying the business logic of an application's open-source contracts, we can build all kinds of businesses in a highly scalable manner directly on the Internet.

11/ This opportunity has not gone unnoticed by entrepreneurs.

A parallel financial system (and beyond) is being built on top of Ethereum and other blockchains.

A parallel financial system (and beyond) is being built on top of Ethereum and other blockchains.

13/ Key takeaway:

While still a fringe technology, blockchains and the applications built on top of them are starting to operate at significant scale.

While still a fringe technology, blockchains and the applications built on top of them are starting to operate at significant scale.

14/ Blockchains like Bitcoin & Ethereum are Internet-native economies:

Currently, they’re both settling transactions for over $10 billion each day.

Currently, they’re both settling transactions for over $10 billion each day.

15/ Uniswap is an exchange built on Ethereum:

Launched only a few years ago, the daily trading volumes on Uniswap already exceed $1 billion.

Launched only a few years ago, the daily trading volumes on Uniswap already exceed $1 billion.

16/ Compound is a lending market built on Ethereum:

Launched only a few years ago, there’s currently over $6 billion worth of loans outstanding on Compound.

Launched only a few years ago, there’s currently over $6 billion worth of loans outstanding on Compound.

17/ MakerDAO is a central bank built on Ethereum:

Launched only a few years ago, there’s currently over $2 billion worth of DAI (stablecoin) in circulation.

Launched only a few years ago, there’s currently over $2 billion worth of DAI (stablecoin) in circulation.

18/ Increasingly, the only way to participate in the upside of these organisations is to own tokens:

Tokens represent ownership in these Internet-native organisations or DAOs.

Tokens represent ownership in these Internet-native organisations or DAOs.

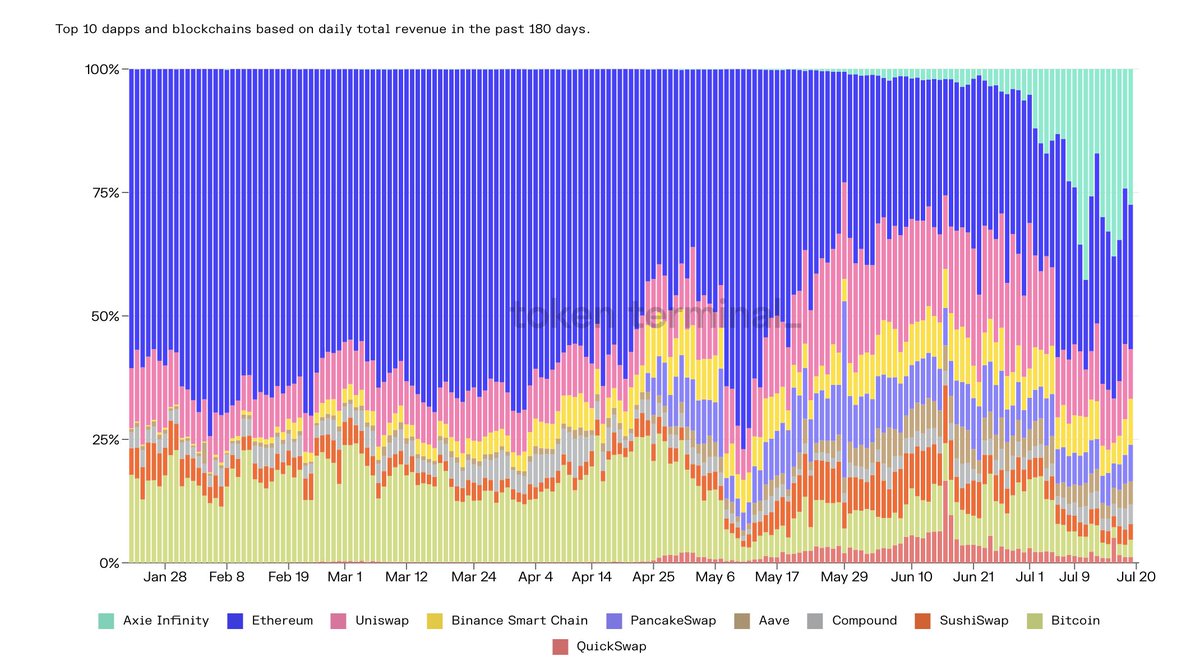

20/ The above apps are primarily built on Ethereum.

In the next phase, we’ll see apps expand to multiple different blockchains, each with its own unique set of features.

These novel features, like scalability, file storage & privacy, will enable new kinds of apps to be built.

In the next phase, we’ll see apps expand to multiple different blockchains, each with its own unique set of features.

These novel features, like scalability, file storage & privacy, will enable new kinds of apps to be built.

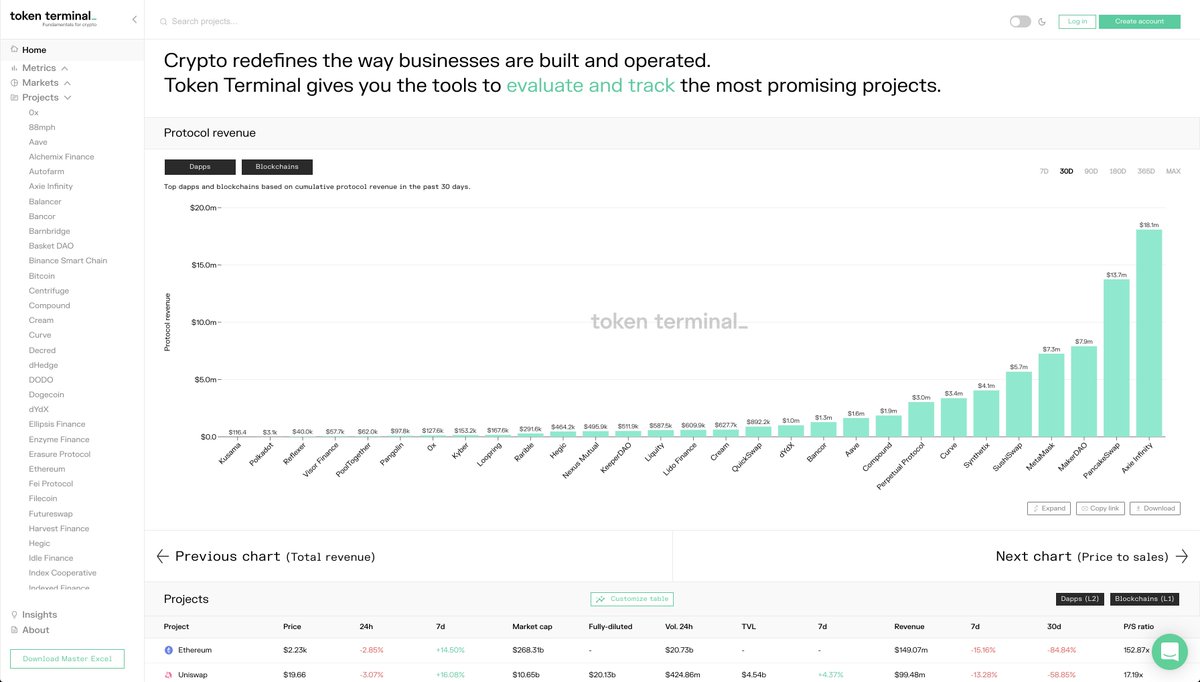

21/ The problem is how to separate signal from noise?

In crypto, anyone anywhere can build a blockchain-based application.

The only thing you need is an Internet connection.

In crypto, anyone anywhere can build a blockchain-based application.

The only thing you need is an Internet connection.

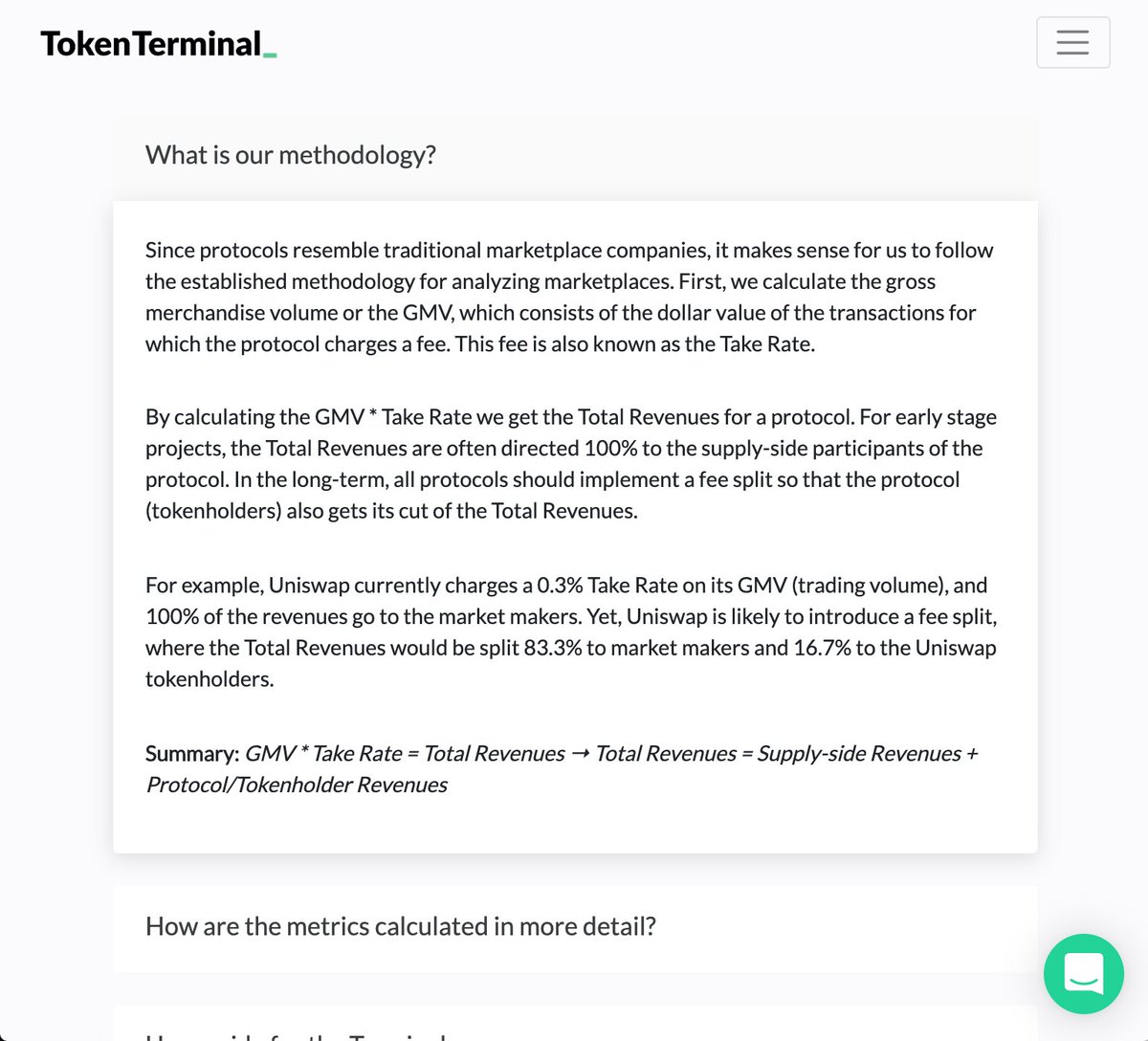

22/ Focus on blockchains & applications that are widely used:

In crypto, users can track the performance of DAOs from day one.

In crypto, users can track the performance of DAOs from day one.

fin/ Thus, The Token Terminal community is

well-positioned to capture the upside of this opportunity.

Join

- the community: tokenterminal.com/signup

- our team: docs.tokenterminal.com/careers

well-positioned to capture the upside of this opportunity.

Join

- the community: tokenterminal.com/signup

- our team: docs.tokenterminal.com/careers

• • •

Missing some Tweet in this thread? You can try to

force a refresh