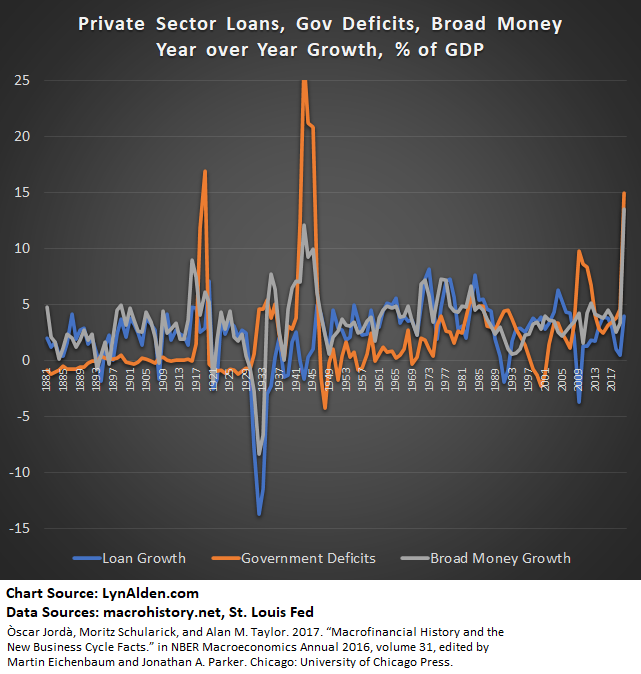

However, if you add bank holdings of Treasuries to their loans, the gap fills by quite a bit. The rest is mainly excess reserves.

This is because, as @LukeGromen has elegantly pointed out a number of times, banks *are* lending, albeit mainly to the federal government.

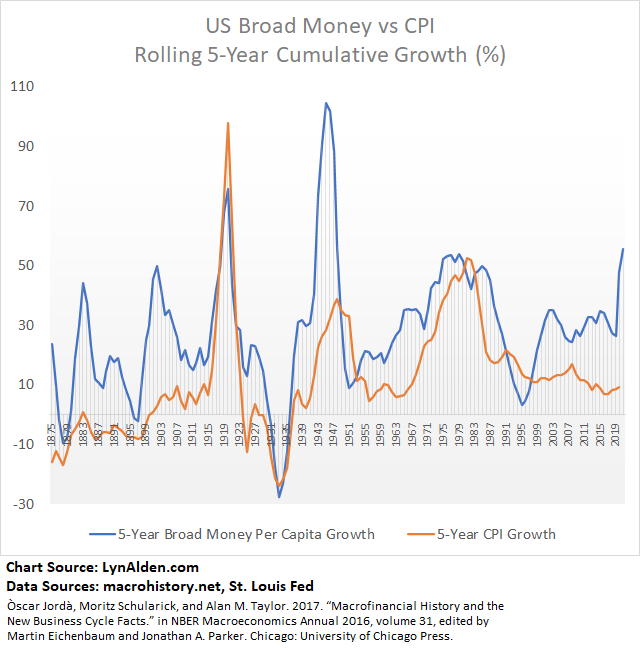

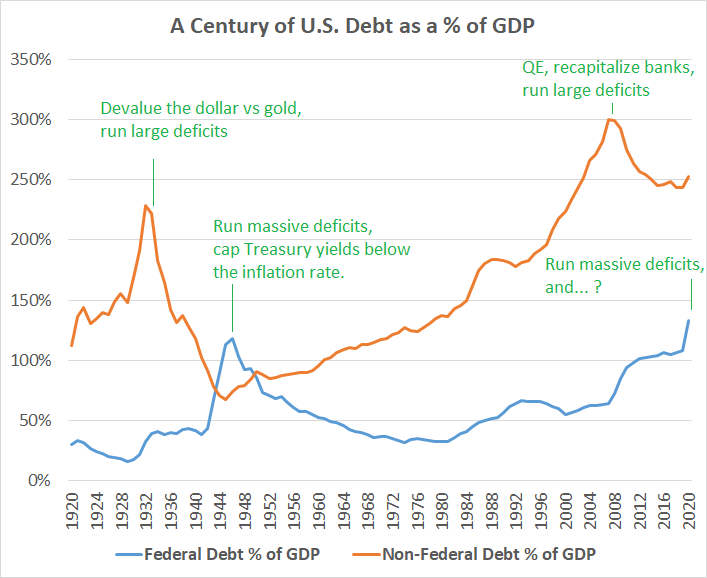

It's like the 1940s more-so than the 1970s.

It's like the 1940s more-so than the 1970s.

Treasuries and agencies, to be specific.

• • •

Missing some Tweet in this thread? You can try to

force a refresh