The global monetary system built around the dollar currently relies on the US running persistent trade deficits with the rest of the world, and benefits the US corporate class over the US worker class, which is part of why it's gradually losing steam.

lynalden.com/fraying-petrod…

lynalden.com/fraying-petrod…

https://twitter.com/philbak1/status/1413484242974167041

The other reason it's losing steam is that the US is becoming a smaller share of global GDP over time, and with sanctions it is starting to incentivize strategically important countries (ie those with oil and nukes) to de-dollarize and diversify their currency usage.

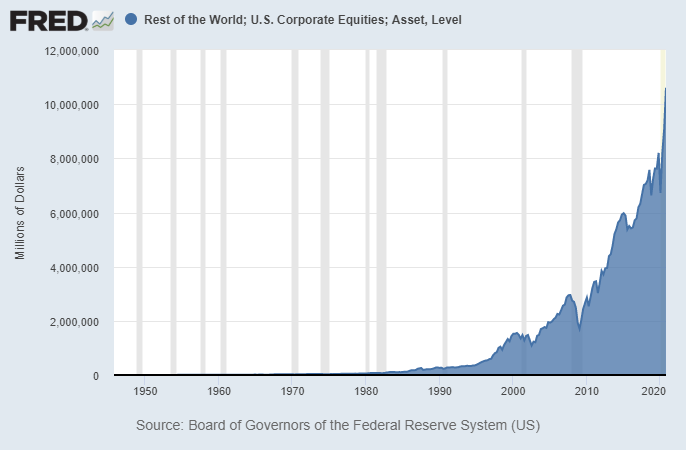

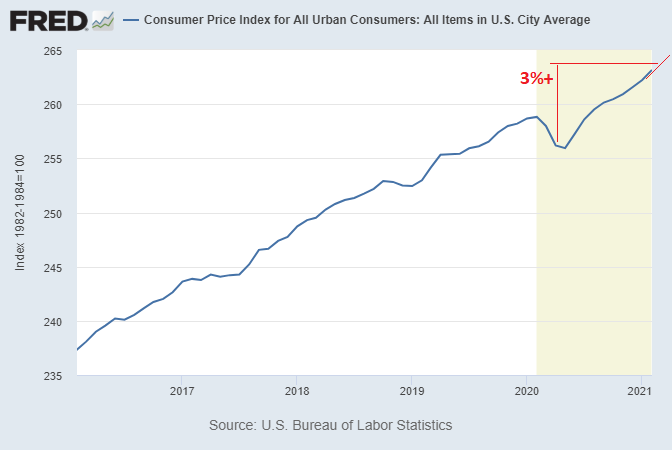

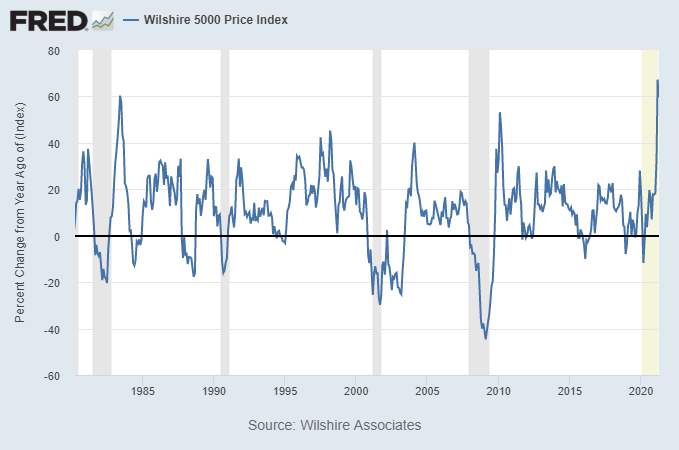

The numbers speak for themselves as to how the current monetary system is not working for 90% of the US anymore:

https://twitter.com/LynAldenContact/status/1349855393376313344

The natural end state of this gradual shift is for international usage of the global reserve currency to diversify into usage of regional reserve currencies instead, and for countries to use more neutral bearer assets in their FX reserves.

• • •

Missing some Tweet in this thread? You can try to

force a refresh