Arista Networks $ANET 2Q21 Earnings 👍🏻

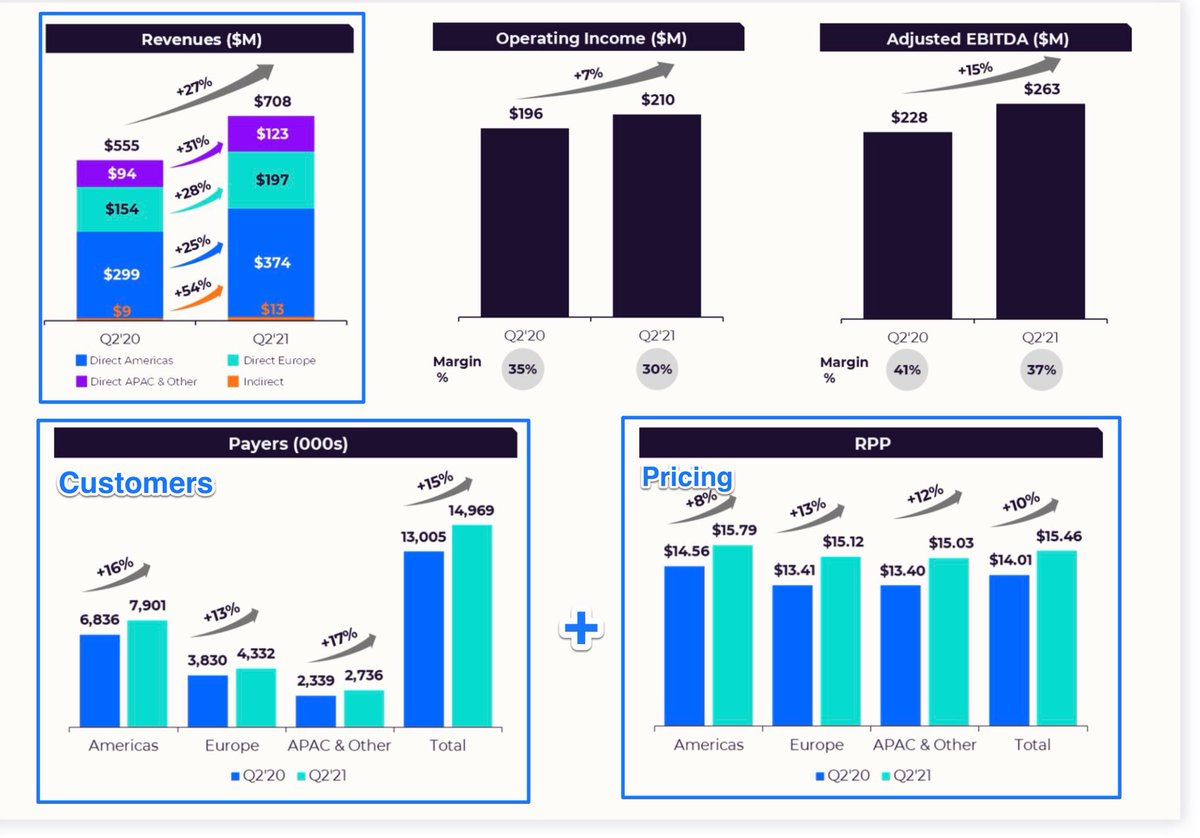

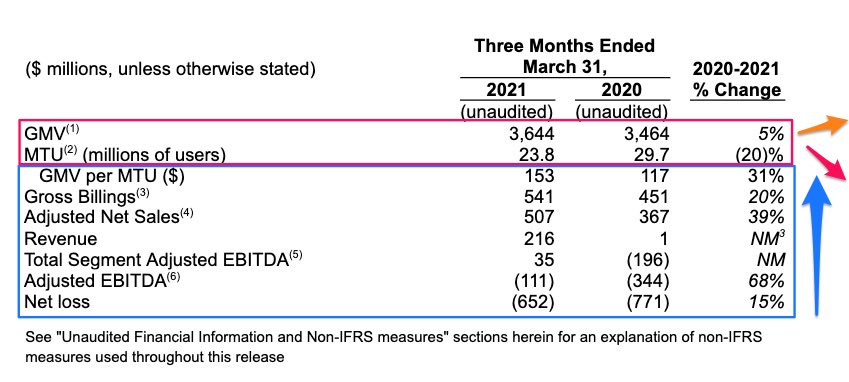

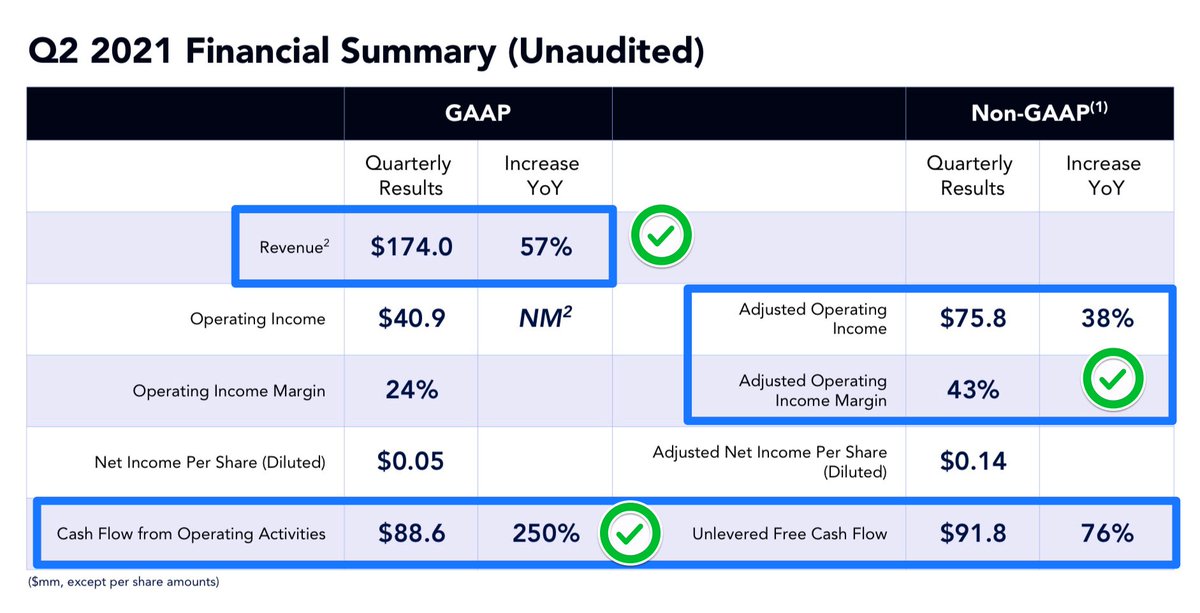

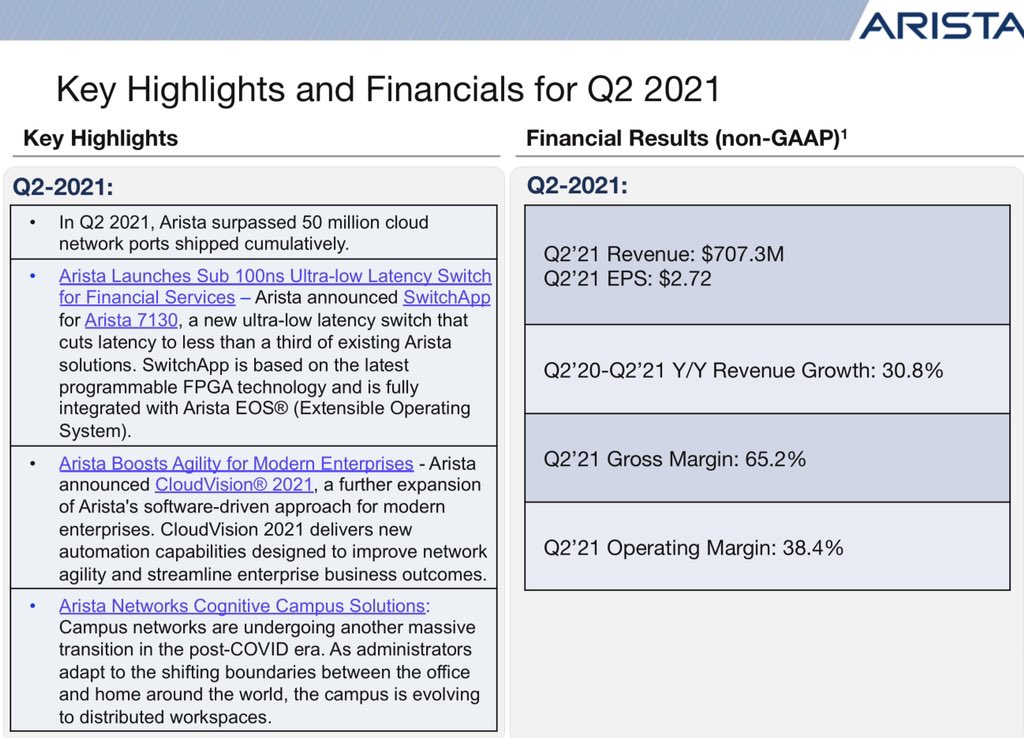

- Rev $707m +31% ↗️

- NG Gross Profit $461m +32% ↗️ margin - 65.2% +52bps ✅

- NG EBIT $272m +32%↗️ margin 38.4% +35bps ✅

- NG Net Income $217m +30% ↗️ margin 30.7% -24bps ↘️

- 6M OCF $518m +56% ↗️

- Rev $707m +31% ↗️

- NG Gross Profit $461m +32% ↗️ margin - 65.2% +52bps ✅

- NG EBIT $272m +32%↗️ margin 38.4% +35bps ✅

- NG Net Income $217m +30% ↗️ margin 30.7% -24bps ↘️

- 6M OCF $518m +56% ↗️

➡️ "Our record second quarter reflects continued momentum and diversification across our top verticals and product-lines."

➡️ “We are on the cusp of network software and data driven transformation and look forward to delighting many more customers."

➡️ “We are on the cusp of network software and data driven transformation and look forward to delighting many more customers."

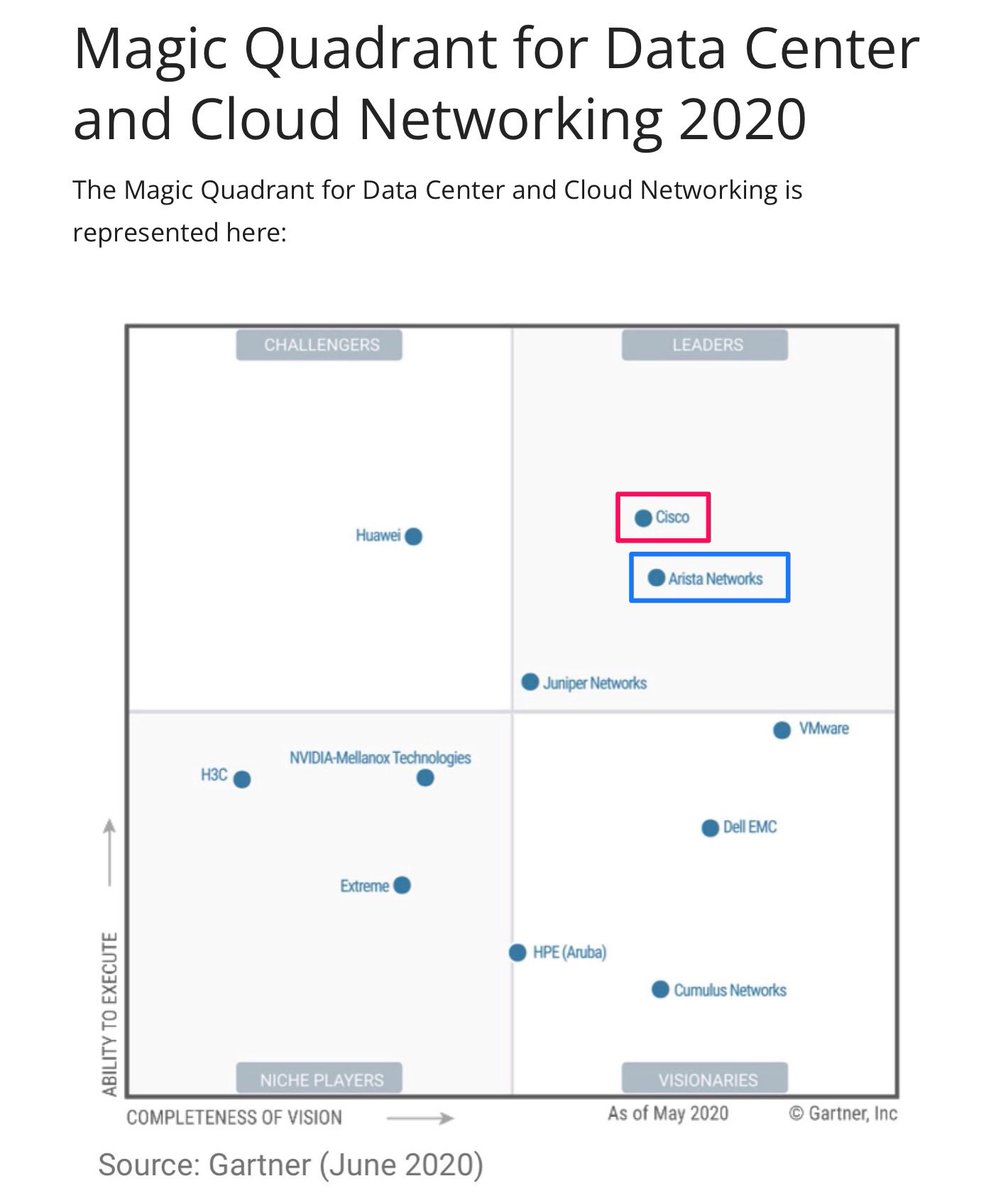

⭐️ Arista Networks $ANET - Gartner Leader 2020 Magic Quadrant for Data Center and Cloud Networking alongside Cisco $CSCO.

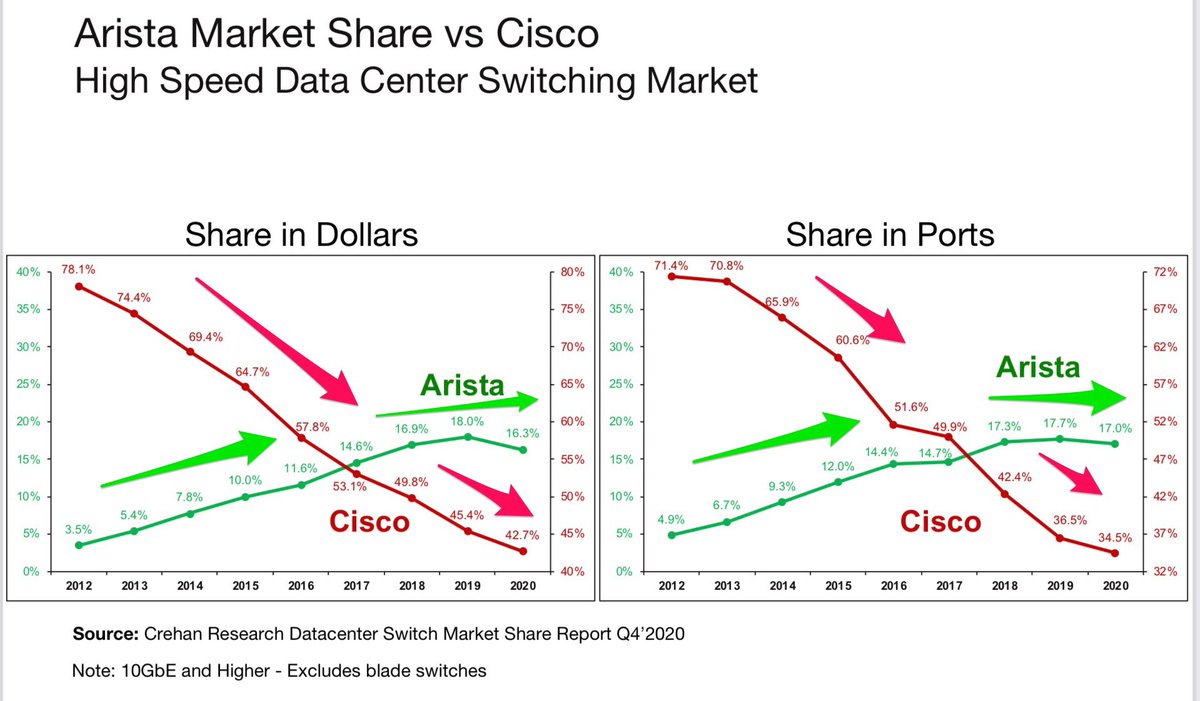

Cisco $CSCO continues to lose market share 📉 in high speed data centre switching and Arista Networks $ANET had been gaining market share 📈.

Final Thoughts on Arista Networks:

➡️ Steady growth, profitable, long-term innovator and compounder supported by very long-term secular tailwinds, led by solid management. Thesis remains unchanged.

➡️ Steady growth, profitable, long-term innovator and compounder supported by very long-term secular tailwinds, led by solid management. Thesis remains unchanged.

• • •

Missing some Tweet in this thread? You can try to

force a refresh